Farmers paid $17,5bn for grain deliveries

Golden Sibanda Senior Business Reporter

Government has so far paid about $17,5 billion to farmers across the country for grain deliveries to the Grain Marketing Board (GMB), Finance and Economic Development Minister Professor Mthuli Ncube has said, after a stellar farming season that saw record grain output.

Minister Ncube revealed this yesterday during a mid-term budget and economic performance review panel discussion, during which he also said all key economic indicators were looking up, as the economic recovery programme, enters overdrive.

The discussion was organised by Business Weekly and Zimpapers Television Network (ZTN) in conjunction with industrial lobby group, Confederation of Zimbabwe Industries (CZI).

“If you look at agriculture, all manners of the commodity have performed well . . . we are seeing positive growth everywhere and we are quite confident about our prediction of 34 percent record growth,” he said.

“As Government ,we have spent about $15 billion paying out farmers, in fact as of yesterday (Tuesday), we probably did another $2,5 billion, so already we are closer to about $17 billion

“So far there is very strong delivery activity at GMB, but also whenever we pay farmers, we are putting money into the economy, because farmers spend in the main, even if they save it is still income to farmers. All of that can only support economic growth by pushing up aggregate demand,” he said.

Strong agricultural performance and significant growth in other sectors would drive recovery and overall economic growth, projected to reach 7,8 percent, which is a revision from the initial forecast of 7,4 percent.

The minister said commodities that have recorded remarkable growth this season, included maize, tobacco, beef, cotton, sugar cane, horticulture, poultry, ground nuts and soya beans among others.

Other key growth nodes include mining, which is seen expanding by 2 percent, manufacturing 7 percent, power 4 percent, construction 8 percent, wholesale and retail 5 percent, transport and retail, 5 percent, accommodation and food 6,4 percent.

Similarly, notable growth is seen in ICTs (6 percent) and financial services (4.5 percent), real estate just over 1 percent, public administration (2 percent), health and social services sector (5 percent), cumulatively giving an average of 7,8 percent.

Minister Ncube said Government remained confident that growth this year will remain strong, in the face of the pandemic, riding on the leverage from the low base effect, after two consecutive years of recession.

The Treasury chief said the right economic policies put in place by Government had started to bear fruit, which has reflected in falling inflation, on the back of a coterie of effective policy interventions including the foreign currency auction system, fiscal and monetary policy discipline.

The annual rate of inflation fell to 50,37 percent last month, the first time it has dropped to two digit levels since 2019, from 106,6 percent in June 2021. It is projected to decline further to between 22 and 35 percent by December.

Minister Ncube also pointed out that the 2021 budget had performed well after a near balanced budget, which saw revenues almost matching expenditure for the six months to June 2021.

He said although at 198 billion, Treasury spent slightly above budget, Government was able to meet all its expenditure from mainly tax revenue collections, which outperformed targets.

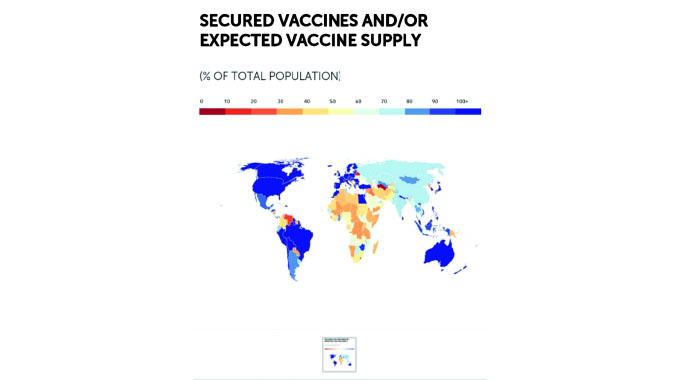

The minister said successful implementation of the Covid-19 vaccination programme, which has seen Government spend US$93 million from the budgeted US$100 million to procure vaccines, would not only save lives but the economy as well.

Thus far, he said, the Government has paid for 12 million Sinovac vaccines while an additional 6,5 million jabs were due from the African Union, under the Covax programme.

Put together, this should see Zimbabwe inoculate more than the 60 percent of the total population the country needs to administer jabs on in order to attain national herd immunity.

Minister Ncube said there was optimism all around the globe that economies would recover, supported by the injection of US$650 billion worth of International Monetary Fund (IMF) special drawing rights (SDRs).

Minister Ncube said Zimbabwe, as part of the 190 members of the IMF, would also benefit from the financial bailout, with about US$1 billion due to Harare, to support recovery efforts from shocks of the pandemic.

Further, he said mass vaccinations going on around the world will reduce the compelling need for further restrictions that have led to national economic shutdown and negatively impacted the global economy.

Southern Africa, said the Finance Minister, was expected to register somewhat muted growth of approximately 4 percent, largely led by the continent’s heavy weight economies; South Africa and Nigeria.

In his opening remarks during the panel discussion, CZI President Henry Ruzvidzo, said the industrial lobby group noted with appreciation that the contribution they made into the national budget and midterm review, had been considered.

“We thank you and your team for the policies that are helping to steady the ship during this difficult time. The macro-economic stability achieved so far in this budget helps businesses to plan and to reinvest.

“Protecting the stability is important for the growth of the economy and indications from the second half of last year and first half of this year, from the surveys that we have done would indicate that industry is on the rebound; capacity utilisation has actually been improving.

Mr Ruzvidzo said average capacity utilisation was projected to continue improving in spite of challenges posed by Covid-19 related restrictions, aimed at containing spreading of the respiratory disease.

“Some concerns have however, been raised by business with respect to the auction system, which has been a game-changer for our sector; much more work remains, to make the auction more efficient and generally accepted by both generators and users of foreign currency.

“The reasons for the widening disparity between the official exchange rate and the parallel exchange rate needs to be established and urgent action taken to resolve the issues to avoid the current distortions that are undermining confidence in our financial services sector,” Mr Ruzvidzo said.

He said efforts by the Government on the health front, particularly with respect to Covid-19 vaccinations were commendable and business was hopeful this would prevent new upsurges that require national lockdowns.

Mr Ruzvidzo said they also appreciated the amount of investment the Government has directed towards infrastructure, but urged more attention into the power sector, with many projects coming up.

Investments in ICTs were also critical given the rapid changes and adoption of new technologies that are going on everywhere, which should drive productivity and efficiency across the economic sectors.

The competitiveness of industry was critical to grow exports and reduce imports, Mr Ruzvidzo said, as well as for deepening of local value chains. He said the doing business environment had to improve rapidly, which requires “an all hands on deck approach”.

“I suggest the next frontier be about simplifying the economic model; simplifying taxation; simplifying regulations; simplifying currency; simplifying investment rules; all in all simplifying how business is conducted in the country,” he said.

CZI also appreciated ongoing efforts by the Government to re-establish external lines of credit but noted it was paramount to completely resolve the issue of blocked funds, as this was critical for growth and development of industry.

Comments