LIVE BLOG: 2018 NATIONAL BUDGET

UPDATES by Costa Mano

Download National Budget Statement For 2018 Here

1421: Minister Chinamasa has ended his budget statement presentation and that concludes our updates. Thank you for joining us.

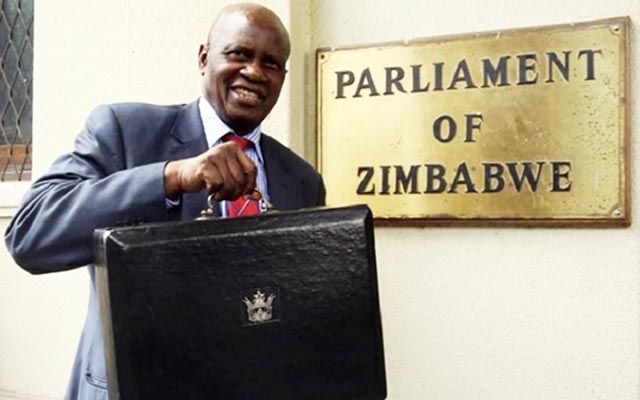

Finance and Economic Planning Minister Patrick Chinamasa flanked by his wife Monica pose for pictures on arrival for the 2018 budget presentation at parliament building in Harare today – Picture by Kudakwashe Hunda

1618: The Government entered into Special Mining Lease Agreements with some platinum group mining companies which provide for a specific royalty rate of 2.5%. However, platinum produced by mining companies that do not have a Special Mining Lease Agreement remained liable to a royalty rate of 10%, as provided for in the Finance Act. In line with the principles of equity and fairness in the taxation system, Government committed, in April 2017, to align the royalty rates to 2.5% as part of the 2018 Budget measures. The 2018 Budget, therefore, proposes to regularise royalty rates for platinum on all platinum group mining companies with effect from 1 April 2017, until August 2019.

1613: In order to eliminate inefficiencies due to congestion arising from activities of unauthorised persons operating at Beitbridge Border Post, and also drawing from the new dispensation, as enunciated by His Excellency, the President, Government proposes an extension of Operation Restore Legacy by the Zimbabwe Defence Forces, to Beitbridge Border Post, in order to restore order.

The Zimbabwe Defence Forces command structures will, therefore, with immediate effect, coordinate with other security agencies removal of touts, vendors and beggars from the Customs Controlled Area.

Furthermore, in order to ensure that only authorised persons enter the Customs Controlled Area, thereby eradicating loitering, it is proposed to demarcate the pathway for pedestrians entering and exiting the Customs Controlled Area, in line with best practice in the region.

1608: Sport betting has rapidly grown as a recreational activity, generating in excess of US$30 million per annum. In order to mobilise resources to upgrade community recreational centres, the 2018 Budget proposes to levy 5% of gross takings by bookmakers, with effect from 1 January 2018.

1607: Lithium, which is used in the manufacture of automotive batteries and the bulk of dimensional stones such as Black Granite and Marble, are exported with minimum value addition, depriving the country of potential foreign currency receipts and opportunities to create employment.

For example, lithium concentrate with a grading of 5 to 6% lithium oxide is exported through off-take agreements at prices of about US$600 per tonne. Upon beneficiation, the resultant lithium carbonate is sold at prices ranging from US$15 000 to US$20 000 per tonne.

The 2018 Budget, therefore, proposes to impose an export tax of 5% on the gross value of exported lithium.

President Emmerson Mnangagwa arrives for the 2018 budget presentation at Parliament Building in Harare today- Picture by Kudakwashe Hunda

1554: $132 million for 2018 general elections has been allocated in the budget. The Government has also fully the current voter registration drive.

1552: Government has adopted a zero tolerance on land barons. Civil servants bonuses will be paid in 2018 but will be staggered as usual.

1546: In line with the envisaged growth in the economy, total revenue[1] collections in support of Government operations, programmes and projects, excluding Statutory Funds, are estimated at $5.071 billion for the coming 2018 fiscal year.

1543: Economic growth rate expected to be 4.5% in 218

1541: On indigenisation, Government is, through the Finance Bill being submitted to this August House for the 2018 financial year, amending the Indigenisation and Empowerment Act, to bring the following into effect from April 2018:

Extractive Sector

Diamonds and platinum are the only sub-sectors designated as ‘extractive.’

Accordingly, the proposed Amendments will confine the 51/49 Indigenisation threshold to only the two minerals, namely diamonds and platinum, in the extractive sector.

The 51/49 threshold will not apply to the rest of the extractive sector, nor will it apply to the other sectors of the economy, which will be open to any investor regardless of nationality.

Reserved Sector

The Reserved sector is only for Zimbabwean citizens, and for non-Zimbabweans, entry into the Reserved sector will only be by special dispensation granted by Government, if the proposed business:

Creates employment; Affords the opportunity for the transfers of skills and technology for the benefit of the people of Zimbabwe; promotes the creation of sustainable value chains; and meets the prescribed socially and economically desirable objectives.

As we seek to attract both local and foreign investments, existing and potential investors become fully guided by the Amendments we seek to effect through the Finance Bill that is being brought to this August House.

Those already in the Reserved sector, except gold panning, will be required to register and comply with our laws.

Buhera South legislator Cde Joseph Chinotimba shares a lighter moment with Minister of Lands, Agriculture and Rural Resettlement Air Marshal Perrance Shiri before budget presentation in parliament today. Picture by John Manzongo

1531: State Enterprises that exhibit potential will be reformed, while those which cannot be rehabilitated will be privatised or face outright closure.

The Government had received requests for 6000 ECD teachers but has shifted this obligation to schools and parents since nine primary school grades are considered onerous.

1528: Measures to contain Budget expenditures, and conserve scarce foreign currency, will extend to review of foreign business travel practices. Experience has shown that Zimbabwe delegations to regional and international fora being among the largest from the region at such gatherings.

In this regard, the following requirements now apply:

Strict reduction in the size of delegations to levels that are absolutely necessary; and where there is Diplomatic presence, taking advantage of this to realise representation in outside meetings.

1526: The Cabinet decision to abolish the Youth Officer posts under the Ministry of Youth, Indigenisation & Empowerment and transfer the roles and function to the Ward Development Coordinators in the Ministry of Women, Gender and Community Development is being implemented with immediate effect. Currently, too many grades in the Public Services are provided with vehicles as a Condition of Service every five years, with the vehicles being licenced, insured, serviced and repaired at Government expense. The total outstanding request for Condition of Service vehicles is now close to US$140 million, which the economy in its state cannot afford.

Government, therefore, has reviewed the vehicle Scheme as follows:

Permanent Secretaries and equivalent grades, one personal issue vehicle;

Commissioners and equivalent grades, one vehicle;

and Principal Directors, Directors and Deputy Directors and their equivalents, vehicle loan scheme.

1521: A number of public officials continue to be engaged in the public service well beyond their retirement age. In this regard, from January 2018 Government will, through the Service Commissions, retire staff above the age of 65. The staff that retire will be assisted with access to capital, to facilitate their meaningful contribution towards economic development, including taking advantage of allocated land, for those who are beneficiaries of the land reform programme. Furthermore, Government will also introduce a voluntary retirement scheme that serves to rationalise the public service wage bill, whilst providing financial incentives to beneficiaries to engage in economic activities in such areas as farming, and start-up of small business enterprises.

1519: It is paramount that the ‘New Economic Order’ judiciously adopts Fiscal Anchors, in order to instil and strengthen fiscal discipline for effectively improving Budget management and enhancing coordination of fiscal and monetary policies.

The Fiscal Anchors for the Budget relate to:

Fiscal Deficit Targeting, under which the Budget deficit for 2018 is halved to below 4% of GDP, and subsequently capping Budget deficits below 3%, in line with best practices and financing capacity of the economy;

Sustainable level of Public Debt to GDP, consistent with the Section 11(2) of the Public Debt Management Act [Chapter 22:21] which requires that the total outstanding Public and Publicly Guaranteed Debt as a ratio of GDP should not exceed 70% at the end of any fiscal year;

Ceiling of Government Borrowing from the Central Bank, in line with Section 11(1) of the Reserve Bank Act [Chapter 22:15], which requires that Reserve Bank lending to the State at any time shall not exceed 20% of the previous year’s Government revenues; and

Minimum Spending on Infrastructure, by re-directing substantial resources towards capital development priorities, through increasing the capital Budget thresholds from the current 11% to 15% in 2018 and 25% by 2020.

Progressive reduction of the share of Employment Costs in the Budget to initially 70% in 2018, 65% in 2019, and below 60% of total revenue by 2020, to create fiscal space to accommodate financing of the development Budget and operations of Government.

Central to adherence to the above Fiscal Anchors will be discipline and the political will to implement the necessary measures, avoiding arbitrary reversals to agreed Cabinet policy positions that entail pain and sacrifice.

Minister of Information Communication Technology and Cyber Security Cde Supa Mandiwanzira(R) arrives at the Parliament Building alongside Foreign Affairs and International Trade Minister Major General Dr Sibusiso Moyo-Picture by Wilson Kakurira

1516: Money creation, through domestic money market instruments which do not match with available foreign currency, only serves to weaken the value of the same instruments, translating into rapid build-up in inflationary pressures, to the detriment of financial and macro-economic stability. This has seen growing mis-matches between electronic money balances and the stock of real foreign exchange balances, as reflected by cash holdings and nostro balances of banks. The mis-match between the supply and demand for foreign exchange, has also led to the emergence of foreign exchange premiums in the market.

1514: The ‘New Economic Order’, therefore, gears towards restoring discipline, fostering a stronger culture of implementation, supported by political will in dealing with the following: correcting the Fiscal Imbalances and Financial Sector Vulnerabilities; Public Enterprises and Local Authorities Reform; Improving the unconducive Investment Environment; Dealing with Corruption in the Economy; Re-engagement with the International Community; Stimulating Production, and Exporting; Creation of Jobs, as well as a credible 2018 election

1510: The challenges facing the economy demand well thought-out, and focused, Government interventions for a much more rapid and sustained recovery path that delivers on jobs as envisaged and outlined in His Excellency President E.D. Mnangagwa’s Inaugural Address. The Recovery Measures towards a ‘New Economic Order’ usher a break away from policy inconsistencies, reversals and hesitations of the past, and signal a strong Business Unusual Approach.

1509: Revenue for the year will be $3.9 billion up from 3.5 billion realised last year. Expenditure will be $5.6 billion against the budgeted $4.1 billion. $2.9 billion are the borrowings for this year.

1506: Inflation will average 3% in 2017 and is expected to remain as such into 2018.

“Our economy has not been performing to its potential and to the expectations of the citizenry, as demonstrated by low production and export levels, and the resultant prevailing high levels of unemployment, and a continuing deterioration in macro-economic stability. This is notwithstanding our various economic blueprints for the economy to realise sustainable growth, development and poverty eradication. The unsatisfactory performance of the economy is being underpinned by declining domestic and foreign investor confidence levels, against the background of policy inconsistencies in an uncertain and uncompetitive business environment,”

1501: Minister Patrick Chinamasa now addressing the gathering.

1458: President Mnangagwa and Minister Chinamasa have entered the August House.

1441: Minister Chinamasa has arrived.

1436: The Speaker of Parliament, Advocate Jacob Mudenda, has read the Prayer as well as announcing that the Minister of Finance and Economic Planning Patrick Chinamasa will present the Budget at 3pm and suspends business.

1428: President Emmerson Mnangagwa has arrived at Parliament Building and will either proceed to his Office or into the Chamber.

1405: Cabinet ministers have started arriving and these include Major General SB Moyo, Supa Mandiwanzira and Kazembe Kazembe. Members of Parliament have already taken their seats.

The media are waiting patiently to capture the Minister of Finance and Economic Planning Patrick Chinamasa and his briefcase that the nation hopes will carry some good news for them. Picture by Wilson Kakurira

1355: We will be giving you live updates from Parliament Building. Please stay with us.

1354: Zimbabweans wait with bated breath for Finance Minister Patrick Chinamasa’s 2018 National Budget Statement, which he is expected to present this afternoon; outlining macro-economic and fiscal objectives, targets and other projections, taking into account several underlying macro-economic and fiscal assumptions.

The 2018 Budget is hugely anticipated to provide solid indications on key economic parameters and underlying macro and micro-economic assumptions to drive economic performance, and the anticipated revenue out turns, critical for providing guidance on the expenditure capacity of the Government for the coming year.

Comments