Masimba expects improved performance in Q2

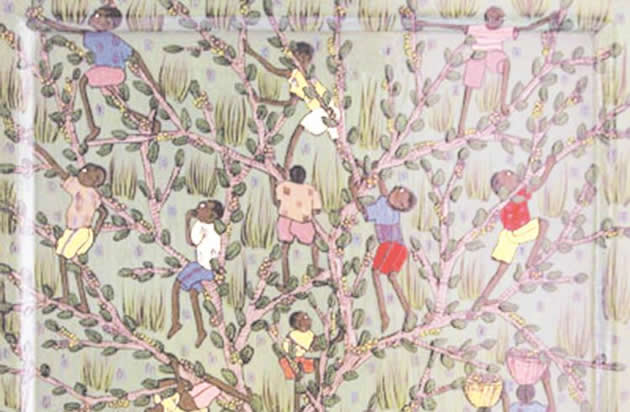

Masimba CEO Mr Canada Malunga presents the company’s half year to June results. Mr Malunga believes the company is poised for growth in the second half.

Conrad Mwanawashe Business Reporter

LISTED construction and contracting group, Masimba Holdings expects an improved performance in the second half of the year leveraging on the anticipated boom in residential housing construction and on Government’s focus on infrastructure development.

Masimba Holdings chief executive officer Mr Canada Malunga said the prospects will be leveraged on infrastructure rehabilitation and development in the medium term while developments in the energy sector will present revenue growth opportunities.

The company is currently involved in some of the new energy projects.

The group, which weaned off its plastic manufacturing company Proplastics this year, will intensify regional and local alliances so as to unlock access to capital which is key for infrastructure projects.

Alliances will also enhance capacity, key for the execution of anticipated infrastructure projects. The company is also looking to housing infrastructure development in Harare in partnership with local developers in the third quarter of 2015 for further growth.

“Looking ahead, we expected construction revenue to grow marginally in the second half of this year,” said Mr Malunga.

To position itself for the resurgence in the construction sector, Masimba is undertaking a number of initiatives including costs realignment.

“The process started in 2014 and the second phase will be executed in the third quarter of 2015. Sustainable overheads declined by 17 percent in 2015 and are expected to come off another 15 percent in 2016,” said Mr Malunga.

He said the full benefit of the cost realignment will be realised in the first quarter of the next financial year.

In the first six months to June, the group reduced borrowings to $555 667 from $1,58 million as at December last year.

Government debt has declined to $1,69 million from $2,99 million in December 2014.

The group boasts of a stable and strong financial position supported by readily available facilities to fund viable projects.

Masimba has entered into a joint venture with Mauritius-incorporated Kosto Holdings, which resulted in the establishment of a new reinforcement steel cutting and bending business.

Kosto Holdings is part of the Reinforced Steel Contractors (RSC) group of South Africa and the new business venture started trading in May trading under RSCZ flagship. Masimba holds 50 percent equity in the new operation.

“The RSCZ certainly has made a mark on the market. When you look at the profile of the clients, we have customers that previously we were not able to reach out to. We have informal type of clients, other contractors that we compete with and we have also now started dealing with other big contractors that are working on the country’s infrastructure projects at the moment. So we are excited about the prospects of the business and we certainly believe that our decision to venture into that business is vindicated,” said Mr Malunga.

Mr Malunga said the brand was well received in the market and its performance and operating margins compare favourably with peers.

Masimba decided to shelve the Monavale housing projects having refocused from putting up housing units in favour of servicing stands. Currently the company is servicing one thousand stands in blocks of 250 to ensure that it does not unnecessarily take credit risk.

Revenue for the group in the six months to June retreated to $4,145 million from $7,71 million in the same period last year excluding Proplastics contribution.

Comments