ZSE remains pivotal

Anyway Taruvinga

Empirical evidence indicates that for sustainable growth and development, funds must be effectively mobilised and allocated to enable businesses and the economy to harness human, material and management resources for optimal output. Financial markets perform the key role of facilitating the mobilisation of financial resources from surplus units to deficit units either in the money or capital markets. The money market is where short term instruments such as Treasury Bills (TBs), term deposits and currencies are traded whilst the capital market is that segment that deals with longer term instruments such as shares and bonds.

In Zimbabwe the ZSE has played a dominant role in the capital market through providing a trading platform for investors and issuers of long dated instruments, particularly shares. Between February 2009 and November 2014 the ZSE has handled $2,64 billion worth of equity turnover with foreign shareholder purchases totalling $1,22 billion. The amount of foreign participation on the bourse rivals the $1,6 billion worth of FDI into the country over the same period.

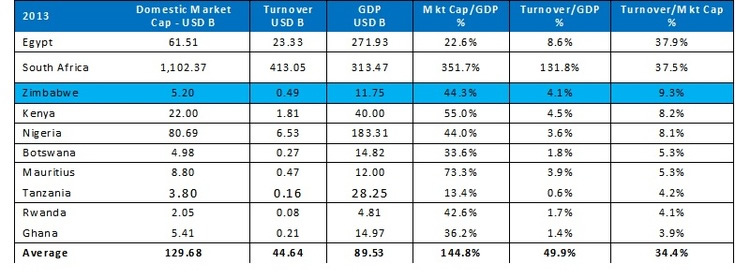

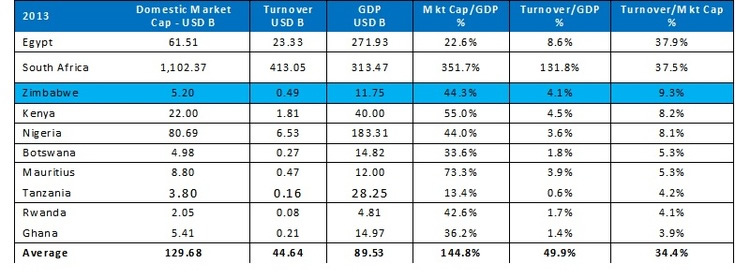

A comparison of the ZSE with other African stock exchanges indicates that it is holding its own in market development indicators. In terms of liquidity, a comparison of the 2013 turnover ratios (turnover to market capitalization) shows that the ZSE fared better than other established markets such as the Nairobi and the Nigeria Stock Exchanges. This is despite the well documented liquidity challenges affecting the economy at large.

One of the core functions of the stock market is to enable deserving corporations to harness long term funding from surplus units. Corporations have an option to secure such long term funding from creditors (usually banks) by way of borrowing or from shareholders by way of equity funding.

The local banking sector has been unable to cope with the demand for long term funding given the deposit structure that is largely skewed towards demand and short term deposits. More listed companies have chosen to move away from the expensive short term debt to equity funding over the years as a result. In 2009 there were four capital raising exercises which included three rights issues and one private placement.

The number of rights issues doubled in 2010 to eight whilst in 2012 there were seven rights issues of which two included an additional private placement and in 2013 there were two private placements and three rights issues. In 2014 there has been one rights issue with another one having been recently announced. All in all there have been twenty five capital raising initiatives over the past six years which raised about $268 million.

The ZSE has therefore enabled companies to restructure their balance sheets by reducing gearing levels and the average cost of capital. In some instances companies escaped judicial management and liquidation after creditors were paid off by the proceeds of the capital raising initiatives or alternatively having had their debt converted to equity.

Company closures, loss of production and loss of employment has thus been, to a certain extent, reduced.

In addition to facilitating capital raising, the ZSE also promotes best practise corporate governance practices for listed companies. Through the listings requirements, listed companies are required to make timely disclosure of financial performance and also to hold regular shareholder meetings. Board appointees and board compositions have to meet set criteria.

All these measures lead to a culture of transparency and efficiency within listed companies which benefits more than the company shareholders, but the economy at large. The ZSE also promotes improvements in the business environment by lobbying policy makers for concessions. Over the years this has resulted in most of the capital controls on foreign investments being removed thereby leading to a more open economy.

In line with the ZIM-ASSET vision of economic empowerment and economic growth the ZSE is also planning to launch the Zimbabwe Emerging Enterprises Market (ZEEM) in the coming year. ZEEM will be a second tier bourse for SMEs with growth potential needing capital to expand their business or consolidate their operations.

The board will have less stringent requirements for listing compared to the main board and will also afford SMEs lower listing fees. SMEs have been identified as the major contributors to the GDP and employment in the country but they continue facing funding and skills challenges.

Enabling them to list will remove some of the credit and reputation risk attached to small corporations which make them unable to attract right priced capital or the relevant human capital skills. Listing will also improve their corporate governance practices, which have often led to high failure rates when left unchecked.

ZIM-ASSET also seeks to support infrastructure development in the country, given the fact that infrastructure is a key enabler to economic growth. Given the limited government resources, capital expenditure has lagged and the private sector has lacked the capacity to support meaningful capital expenditure on infrastructure.

The ZSE is therefore planning to launch the Debt Securities Market next year meant to afford the government, quasi government and the private sector an alternative avenue for raising long term funding.

Lessons drawn from other countries such as Kenya and South Africa indicate that the debt market is a significant contributor to long term funding for infrastructure development.

By providing a regulated platform for the trading of debt instruments, the ZSE hopes to improve the liquidity of the instruments as well as improve transparency in their pricing.

This will go a long way in attracting long term funding at optimal cost and result in improved infrastructure funding for areas such as energy, transport and housing.

For further information please email [email protected]

Comments