Sustainable Health funding critical

Roselyne Sachiti Features Editor

Roselyne Sachiti Features Editor

Zimbabwe’s health delivery system has been consistently financed by a mixture of funding sources ranging from Government, aid agencies and multilateral organisations, private companies, non-governmental organisations and households (through out-of-pocket payments).

At the recent Association of Health Funders of Zimbabwe (AHFoZ) 2017 Annual Stakeholders Conference in Victoria Falls, several players in the health sector shared thoughts on different topics which covered key issues like health funding, cost crisis, medical aid fraud among others. They also discussed at length how Zimbabwe can achieve universal health coverage — a key development indicator.

Deputy Minister of Health and Child Care, Mr Aldrin Musiiwa said to achieve universal health coverage, Government had committed itself to introducing the National Health Insurance scheme to ensure that all members of society have access to affordable health services.

“It is our hope that such a scheme will be established soon. It is important that such a scheme should benefit not only those who are employed and so able to contribute but those in the informal sector and those who are unemployed. As Government, our priority is to protect vulnerable members of society in line with ZimAsset. This includes protecting children, the elderly, pregnant women and people living with disabilities,” he said.

Mr Musiiwa added that the quality of life from a health perspective would only be satisfactory when all Zimbabweans had equal access to affordable healthcare.

“That is our goal. It is a goal that is also in line with our commitment, as a member of the UN and WHO, to universal health coverage and the Sustainable Development Goals (SDGs).

“We are aware, however, that achieving this goal will be a process rather than an event. We also realise that we cannot achieve universal healthcare alone. We need the private sector and partners within the health ecosystem to play their part. In that regard, the opening of clinics and other health institutions by medical aid societies to complement existing public and private healthcare services is appreciated, particularly where fee levels are affordable,” he said.

He admitted that the public health sector was struggling with inadequate resources, due to general budgetary constraints. “Any additional provision of health services is welcome, as we work towards improving the quality of life, from a health perspective, of our people. Our funds, as a Ministry, are inadequate and stretched. The Budget allocation from the fiscus is always below the 15 percent set out in the Abuja Declaration,” he added.

He said currently, public institutions provide a safety net for all — hence the over-stretching of all resources, including human, financial and infrastructural. Mpilo, Harare and Parirenyatwa Central Hospitals, he added, were particularly overstretched, as too many people go directly to these hospitals instead of recognising their status as referral hospitals. “People need to know that they should not use central hospitals as the entry point for healthcare services. They should be treated at their local clinics and then be referred to the next level if necessary.”

National Social Security Authority (NSSA) Acting Chief Social Security Officer, Mr Shepherd Muperi told delegates that it was now time for Zimbabwe and Africa to find their own solutions to emerging health challenges.

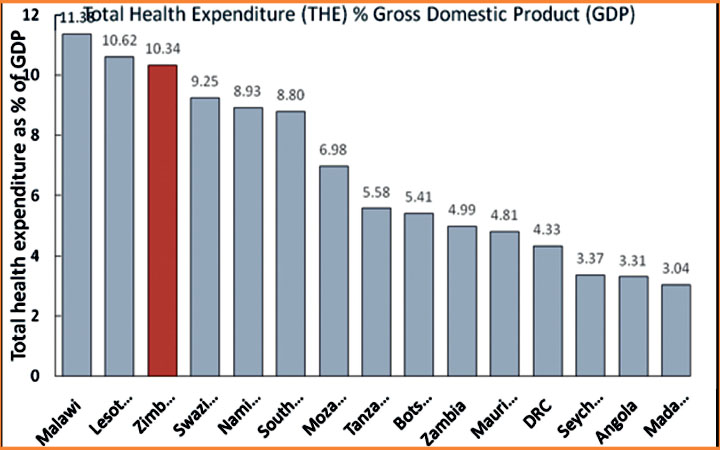

“President Mugabe while officially opening the 67th Edition of the WHO Regional Committee for Africa here in the Vic Falls recently, said few countries are investing the recommended 15 percent of national budget towards health.

“Donor funding is fast disappearing from the scene and a yawning health funding gap has been left,” he said. He called on all stakeholders to put heads together for practical solutions to this funding gap to save lives.

Mr Muperi said the NHIS proffered one such practical solution. He added that NHIS lessons for Zimbabwe from other countries include voluntary coverage of the informal sector (majority of countries studied), mandatory coverage of the formally employed (all countries studied), co-existence with private and existing medical aid societies.

He added that according to what they saw in other countries, members of medical aid societies can also be members of the National Health Insurance Scheme, providing a two tier system which ensures complementarity between social health insurance and private health insurance.

Outlining suggestions for Health-care Financing NHIS in Zimbabwe, Mr Muperi said member contributions based scheme or general taxation financing or a combination of both were options as found in other countries. “This depends on what a country can afford. General taxation financing depends on economic performance and national budget adequacy,” he said.

He suggested mandatory coverage of the formally employed, with coverage of the informal sector on a voluntary basis is a realistic option. NHIS Scheme principles were approved by Cabinet in 2016.

In his presentation, Health Economist: Planning and Donor Coordination in the Ministry of Health and Child Care, Technical team leader National Health Accounts, Mr Gwati Gwati said Zimbabwe’s health system has been consistently financed by a mixture of funding sources with the major ones being Government through central budget allocation and sub national Governments ie local authorities, aid agencies and multilateral organisations, private companies, non-governmental organisations and households (through out-of-pocket payments).

Mr Gwati said Government for example funds $309,70 million (21,39 percent) of the health budget, corporations and employers $411,54 (28,43 percent), households plus private contribution to health insurance $362,46 (25,04 percent), non-profit institutions serving households stand at $3,24 million (0,22 percent) while the rest of the world donors are at $360 million (24,92 percent).

“Public (Government and health insurance from public employers is pegged at $584,51, private (OOP plus health insurance from private employers of HH) $584,51 external donors $360,85,” he said.

Giving a summary of health policy directions within the ministry of health and child care, he said the goal of the Health Financing Policy was to guide Zimbabwe’s health system to move towards Universal Health Coverage including financial risk protection, access to quality essential health care services, and access to safe, effective, quality, and affordable essential medicines and vaccines for all by 2030.

Mr Gwati said the National Health Financing Policy will be focused on reaching objectives that include mobilising adequate resources for predictable sustainable funding of the health sector and ensuring effective, equitable, and efficient and evidence based allocation and utilisation of health resources.

He also said the policy hopes to enhance the adequacy of health financing and financial protection of households and ensure that no-one is impoverished through spending on health by promoting risk pooling and income cross subsidies in the health sector.

“It also seeks to ensure that purchasing arrangements and provider payment methods emphasize incentivising provision of quality, equitable and efficient health care services and strengthen institutional framework and administrative arrangements to ensure effective, efficient and accountable links between revenue generation and collection, pooling and purchasing of health services,” he explained.

According to Mr Gwati, Government seeks to strengthen domestic health financing and abide by the Abuja Declaration on Health where not less than 15 percent of budget shall be allocated to health.

“Government will spend not less than $60 per capita per year to ensure the minimum comprehensive benefit package is financed. “Government will explore options for progressive earmarked taxes and levies to raise additional resources for health,” he told delegates.

He added that the current mechanism to raise additional revenue to the health sector that has been successful and sustainable will be maintained and expanded where feasible.

Examples include the National AIDS Levy, Health Services Fund, Workman’s Compensation Fund, Assisted Medical Treatment Order, and Accident Victims Compensation Fund on Motor Vehicle Insurance.

“The Government will encourage various forms of mandatory prepayment mechanisms such as social health insurance (SHI), community based health insurance (CBHI), national health insurance (NHI) especially for the informal sector and rural areas as a means of achieving universal health coverage,” explained Mr Gwati.

Private health insurance, he said, would continue to be available as a voluntary prepayment mechanism for services not covered in the minimum benefits package.

“Special revenue generation provisions will be made for diseases of high national public health concern/significance as and when they emerge. “All external aid for health will be harmonised, coordinated, monitored and evaluated in line with health priorities and plans of the Government of Zimbabwe,” he pointed out.

Mr Gwati said they would continue to encourage and expand involvement of local philanthropy and charities for special health initiatives at all levels of care. He also revealed that Government would explore, ensuring consistency with its key policy principles and goals, innovative partnership mechanism with the private sector to increase resources to health such as Public Private Partnerships, joint ventures and outsourcing guided by a strong regulatory framework.

Further explaining the policy direction, Mr Gwati said Government would explore new and strengthen existing mechanisms for promoting equity, risk equalisation and reduce fragmentation with a special emphasis on ensuring that health spending does not lead to or deepen impoverishment especially in the poor and indigent population.

“A national mandatory prepayment scheme will be introduced and expanded as a key form of pooling risk to reduce out of pocket payments. “There will be clear separation of functions and roles between pooling and purchasing of healthcare services,” he said.

AHFoZ chief executive officer Ms Shylet Sanyanga said Health Funders’ have been making huge contributions to health in Zimbabwe yet operations have been constrained by operational environment, characterised by company closures/downsizing, high unemployment levels / informal economy, liquidity challenges and cash shortages.

She said based on a response rate of 54 percent, statistics show that in 2016 medical aid societies collectively paid $324 365 937 to various healthcare service providers compared to $437 228 600 in 2015.

“A total of $324 365 937 was collectively paid by medical aid societies in 2016 compared to the 2016 Ministry of Health budget allocation of $330million from the National treasury ( it is not clear how much was disbursed) “The 2017 budget shows that $59,1 million was allocated to the Ministry of Health and Child Care,” she said.

Ms Sanyanga added that in 2016 a total of 157 cases of fraud were collectively investigated compared to 50 cases in 2015 and 32 in 2014. A total of $1 971 435 was collectively recovered in 2016 compared to $159 278 in 2015, according to Ms Sanyanga.

Competition and Tarrif Commission’s Mr Earnest Manjengwa said as a competition authority, they called for unrestricted access to any market at any level and at any timeline with the notion of inclusive growth which calls for equal opportunities for everyone, everywhere.

“We believe the upcoming Medical Aid Societies Bill will go a long way in regulating the conduct of firms in the healthcare sector through promoting a level playing field. An efficient healthcare ecosystem is made possible when all economic agents play on a level playing field hence, competition policy is one of the key mechanisms to consider towards achieving a efficient healthcare ecosystem,” he said.

He said as a competition authority, they recommended a competitive health care system encompassing competing delivery systems, each priced according to its costs and chosen by consumers on the basis of quality, cost, and any other welfare enhancing factors; or a mechanism which, by engendering a healthy rivalry in the sector, may drive down costs and/or improves the quality of goods and services delivered to patients.

Divisional Director of Member Care and Liberty Health, Dr Numaan Muhamood, said funding healthcare and establishing quality systems required sharing insights, perspectives and protocols.

“While regulators and funders can play an oversight role in terms of value delivery and sustainability, healthcare providers are the stewards of patient health and must be active in the conversation,” he said.

He added that a key concern for medical professions on the African continent was income security. “The International Finance Corporation reports that 72 percent of African healthcare services are paid for out of pocket, which puts healthcare practitioners at huge financial risk, especially in times of economic downturn.

“Our core concerns as funders are sustainability and value — not just for patients, but for healthcare professionals too,” he added. Mr Muhamood said insurers should gain the trust of provider networks.

“In the past, small insurers have gone to market with selective membership products. Due to their less comprehensive product offering, these providers are unable to accommodate funding for secondary and tertiary services. This results in limited hospital coverage and reduced access to tertiary care,” he added.

- Feedback: [email protected], [email protected]

Comments