OK Zim well-funded for capex projects

Business Reporter

Retail giant OK Zimbabwe has put in place measures to cover its working capital needs as well as funding requirements for planned capital expenditure projects in line with its growth strategy.

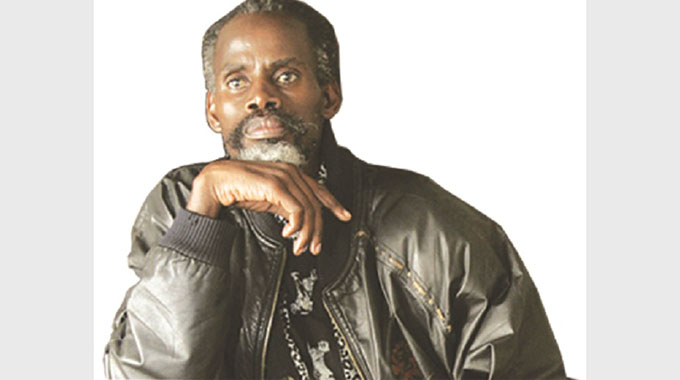

Chief executive officer Maxen Karombo told shareholders at the firm’s annual general meeting that despite the market’s wide liquidity challenges, the business remains on a sound footing.

Some of the challenges are the pricing of goods and services in local currency based on the official exchange rate, suspension of bank lending; increase in the bank policy rate from 80 to 200 percent; increase in the medium term accommodation interest rate from 60-100 percent and high inflation rate. The Reserve Bank of Zimbabwe (RBZ) raised the main interest rate to 200 percent from 80 percent citing high inflation and negative impact of excessive liquidity on the exchange rate.

“This includes all prior debt arrangements entered into before this particular date, and now this excessive borrowing results in liquidity pressure not just on us but across the entire supply chain,” he said.

“We feel that our supply partners are going through exactly the same issues, which is impacting the way we do business together.”

While the foreign exchange market is very volatile, the Government introduced the willing buyer, willing seller interbank exchange rate system, which formal businesses are required to comply with.

“It is not as attractive to the market compared to the rest that is offered in the alternative and hugely unregulated market,” he said.

“So this continues to impact on our competitiveness of US dollar prices in our stores and ultimately impacts on the capacity for us to generate our own foreign currency for local sales.”

On the parallel market, one US dollar is trading around or $900. Officially, the Zimbabwean dollar is trading at $416.28 against the greenback.

“The market is desperately waiting for a foreign exchange market system that is market determined and stable. This will allow everyone in the supply chain easier planning scope for easier planning and businesses that can be largely predetermined in line with company strategies.”.

Mr Karombo talked about the need to review the intermediated money transfer tax (IMTT). The IMTT is collected on a range of financial transactions such as direct debits, online and mobile money transfers, payments to suppliers, loans, interbank transfers, and any other fund transfers.

“It is worth noting that when this tax was introduced it was meant to mop up the unbanked and informal sector, but it has had an unwanted and unexpected impact on the formal sector.

“So, we made representations to the treasury and to all authorities about the impact of this tax on business operations and how it is limiting us. We hope this tax will be reviewed and allow for business growth. “

For the first quarter ended June 30, 2022, the group’s sales volumes grew by 1 percent over the prior year. In the same vein, sales value increased by 237 percent from the prior year in historical terms and 40 percent in inflation-adjusted terms.

“Our stores were reasonably stocked during the quarter, although we continued to experience temporary supply gaps on some key volume drivers. Profit margins were consistent with the prior year and in line with the group’s plans for the current year,” he said.

In terms of the outlook, the group expects inflation headwinds to dominate the trading environment in the short term.

At the AGM, directors’ fees were approved at $48,5 million and auditors’ fees at $30 million

Comments