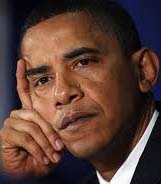

Obama unrolls US debt deal

a disastrous debt default that would have sown chaos in the world economy.

“I want to announce that the leaders of both parties in both chambers have reached an agreement that will reduce the deficit and avoid default, a default that would have had a devastating effect on our economy,” Obama said in hastily announced remarks at the White House.

In the US Congress, leaders of the Democratic-held Senate and the Republican-led House of Representatives were expected to present the framework to their rank-and-file yesterday ahead of final votes to approve the deal.

“We’re not done yet: I want to urge members of both parties to do the right thing and support this deal with your votes over the next few days,” Obama said, with time running short before a midnight Tuesday deadline.

The US government hit its debt limit on May 16 and has used spending and accounting adjustments, as well as higher-than-expected tax receipts, to continue operating normally – but can only do so through today.

Business and finance leaders have warned default would send crippling aftershocks through the fragile US economy, still wrestling with stubbornly high unemployment of 9,2 percent in the wake of the 2008 global meltdown. Without a deal, the US government would have to cut an estimated 40 cents out of every dollar it spends, forcing grim choices between defaulting or cutting back programmes like those that help the poor, disabled and elderly.

Meanwhile, investors boosted stocks and sold safe-haven assets yesterday, betting that a last-minute deal in Washington meant the US economy would avoid default. There remained a widespread assumption, however, that credit ratings agencies could downgrade US Treasuries from their vaunted triple-A status, a move that would impact the valuation of numerous other assets.

After a tense weekend spent in search of a compromise to allow the US borrowing limit to be lifted, Obama said leaders from both parties reached a deal to cut the budget deficit by US$1 trillion over

10 years, with additional savings of US$1,4 trillion possible.

The plan must be passed by both Houses of Congress and will still face some opposition. But it is expected to allow the debt ceiling to be raised, avoiding the prospect of Washington not being able to pay its bills and defaulting.

World stocks as measured by MSCI climbed 0,6 percent with emerging market shares up 1,2 percent. There were large gains in Japan, where the Nikkei rose 1,3 percent.

In Europe, the FTSEurofirst 300 rose 0,7 percent with banking shares enjoying a big boost. But there remained a degree of scepticism about how long the rise in risk sentiment would last, given the likely US downgrade, which some believed could come this week.

“It is a relief rally on the back of the parties coming together, but it could only last for a couple of days as the United States could now face a ratings downgrade,” Manoj Ladwa, senior trader at ETX Capital, said.

“That would impact every part of the United States.”

It would also raise issues for assets elsewhere. Some large pension funds, for example, will only hold triple-A debt, meaning they may have to sell Treasuries and buy elsewhere, crowding trades into

German Bunds, for example. The relative valuations of a number of assets, meanwhile, are based on their difference from supposedly risk-free Treasuries.

The flip side of yesterday’s stock rally was the unwinding of investors positions taken to protect against US default.

Gold fell more than 1 percent before recovering slightly. It was at US$1 614 an ounce after hitting all-time nominal highs last week.

The dollar rose against the Swiss franc, which has seen intense interest from investors as the dual euro zone and US debt crises have stirred markets this year. – AFP.

Comments