Mwana bosses agree to pay cut

Business Reporter

Business Reporter

MWANA Africa Plc executives have agreed to a 50 percent pay cut as the pan-African multi-commodity mining company bids for US$5 million in annual savings. The mining and development company announced in June its plans to save US$5 million from budgeted corporate costs.

Mwana has suffered from lower commodity prices in 2013 and said in June it was hoping to save US$5 million a year and considering its options in relation to its assets and projects including Bindura Nickel Corporation and Zani Kodo.

To that end, Mwana Africa said on Friday that the firm’s non-executive directors had all agreed to the 50 percent reduction in their fees with immediate effect.

Mwana chief executive Mr Kalaa Mpinga has since agreed to reduce his salary by 25 percent and waived his US$510 000 bonus awarded to him in March.

“Senior management have agreed to salary cuts ranging from 15 percent to 20 percent, effective from 1 September 2013. The company has also decided to significantly scale down its London presence,” Mwana said in a statement.

The expected annualised savings from these cost cutting measures is US$2,6 million.

Mwana said the remainder of the cost savings will primarily be achieved through a review of suppliers’ contracts, reducing advisory costs and benefiting from ancillary savings associated with the scaling down of the London office.

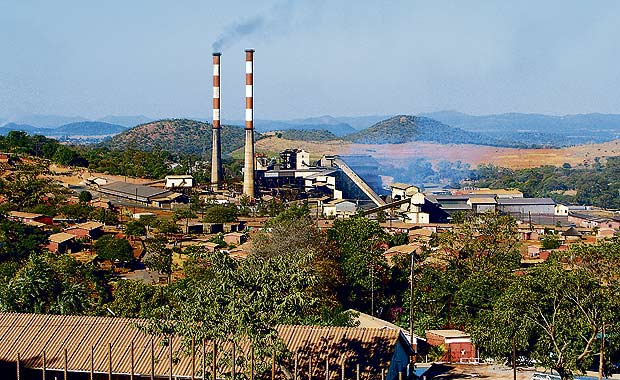

The multi-commodity mining giant has been facing challenges raising funding to support operations. Mwana needed US$15 million for its subsidiary Bindura Nickel Corporation to restart phase two of the Trojan mine, but the funds have been difficult to find in the debt markets as planned resulting in a funding shortfall.

BNC has since revised its mining plan to also target ore massives in an effort to increase revenue, reduce operational costs and hence the funding requirement.

But Mwana contends that the success of the new strategy will depend largely on the company managing to get short-term bridging finance of at least US$5 million.

The company intended to have a phased restart of BNC with the first phase to mine and produce concentrate and restart the smelter and refinery as a second phase.

Mining at the Trojan mine started in September last year with first concentrate completed in April. The company was targeting around 7 200t in 22 months from restart and has an off-take with Glencore for 100 percent of the production.

The funds raised last year took the company through the first year of a restart with further capital required in a year’s time where they will be looking at debt funding options. Mwana owns 75 percent of BNC and 85 percent of Freda Rebecca.

Comments