Mwana Africa valuation upgraded

Better production at Bindura Nickel Corporation and Freda Rebecca in the fourth quarter has resulted in the upgrading of Mwana’s valuation by Edison Independent Investment Research

Golden Sibanda Senior Business Reporter

Investment intelligence company, Edison Independent Investment Research, has upgraded its valuation of Mwana Africa on the back of better production at units Freda Rebecca and Bindura Nickel Corporation in the fourth quarter. The investment research company said while the now historic numbers were low, its valuation has increased to 12,1c for Freda Rebecca and Bindura Nickel Corporation from 11,7c previously.

The prior valuation was based on long-term metal prices and a 10 percent discount rate, owing to the passage of time, discounting from financial year 2014 and not the current financial year.

“We have adjusted our forecasts for financial year 2014 to reflect the fourth quarter’s operational performance,” Edison said recently.

Edison has projected the multi-commodity miner to rake in $122,6 million revenue for the year to March compared to $109,2 million and profit before tax to come it at $6,9 million against $11,5 last year.

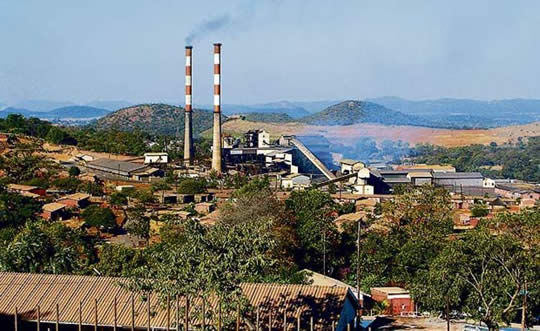

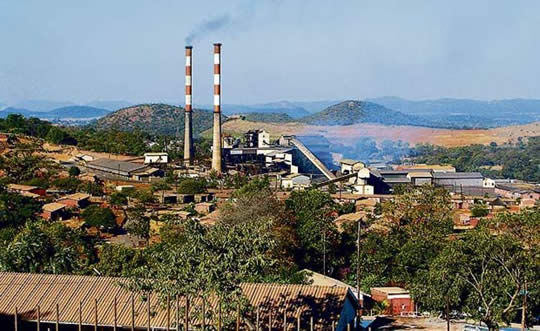

Mwana Africa has is listed on the London’s junior market, the Alternative Investment Market, and has two producing assets in Zimbabwe and significant exploration projects in DRC and South Africa.

Mwana’s operational update for the quarter to March 2014 revealed record throughput at Freda Rebecca and a 15,2 percent increase in tonnes milled at Trojan on the back of a record tonnage mined.

Quarterly tonnes milled of 279 879t equated to an average monthly throughput of 93 293t, within 7 percent of Freda’s target rate of 300 000t per quarter, or an average of 100 000 tonnes per month.

Performance at Trojan also improved with a 15,2 percent increase in tonnes milled quarter-on-quarter. This included a 9,5 percent increase in nickel concentrate production.

Of note was an implied 25,4 percent decline in unit C1 cash costs for the quarter, from $125 88/t milled in third quarter to $93 95/t.

Trojan has milled 589,6 000t at an average grade of 1 395 percent to produce 7,084t nickel in concentrate at C1 cash costs of $11 694/t nickel for the first full 12-months since resuming operations.

Edison said at current spot prices the valuation improved markedly, from 5,8c to 9,1c, owing to the increase in nickel price, from $15 550/t to $18 580/t.

Including SEMHKAT and Zani-Kodo (Democratic Republic of Congo), the London listed mining group’s valuation increased to 15,1c compared 14,7c at long-term prices and 12,1c versus 8,8c at current spot prices.

“A resource conversion drilling programme is underway at Zani-Kodo as part of a feasibility study at Kodo Main to upgrade ‘inferred’ ounces to ‘indicated’ and ‘measured’ status, which should add value to both the project and the company.”

Mwana’s Zimbabwe operations at Freda and BNC have kicked into high gear since the resuming production in 2009 and 2012, respectively.

Comments