Miners seek power tariff cut, tax relief

Martin Kadzere

The Chamber of Mines Zimbabwe is lobbying the Government for a temporary reduction of electricity tariffs and tax relief for platinum miners in response to the plummeting global prices of the metal, which threaten the industry’s survival.

“The industry is calling upon the Government to intervene and assist in reducing costs in specific areas, including electricity tariff and fiscal charges to minimise mine closures and specifically to ensure that mining companies survive this difficult tide,” the Chamber of Mines chief executive Mr Issac Kwesu said last week.

Zimbabwe has three active platinum mining firms, Zimplats, which augments local power supplies with imports from Zambia, Unki Mine and Mimosa Mining company.

The softening of prices has put a strain on the local mining industry, which is a significant contributor to the country’s economy.

Platinum group metals (PGMs) encompass a range of valuable elements including platinum, palladium, and rhodium, primarily used in catalytic converters for automobiles and various industrial applications.

Zimbabwe’s producers of PGMs are now struggling to meet their production and revenue targets leading to a notable decline in profitability across the sector. Zimplats, the country’s largest PGMs producer, reported losses for the first time since 2009.

The downturn is expected to result in the suspension of some capital projects as well as discourage investment in new projects and exploration activities, further dampening prospects for the PGMs sector.

To minimise the impact of low prices, mining companies have taken measures to manage the cost of production, including cutting the head count, improving efficiencies and deferring capital projects.

Mr Kwesu said producers were planning to ramp up production to compensate for revenue losses arising from low commodity prices.

The initiatives, however, have remained insufficient to restore the viability of their operations and some mining companies are now cutting back on the head count to supplement the initiatives.

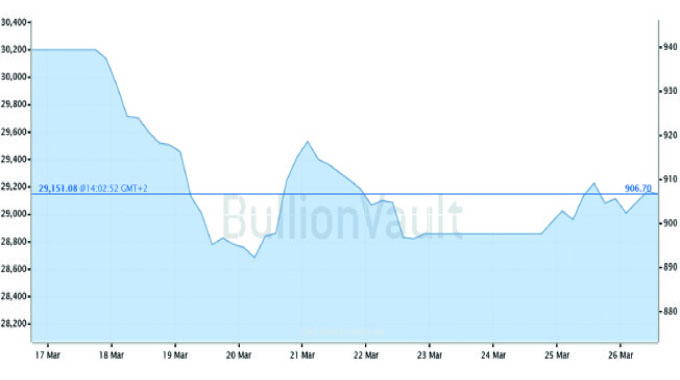

Asked about the Chamber of Mines’ outlook for platinum prices in the near future, Mr Kwesu said: “We anticipate the PGMs market to remain weak in the next 12 months, with PGM prices expected to further soften on sluggish demand for PGMs.

The ripple effects of the price crisis will be far-reaching for Zimbabwe’s economy. Minerals account for a staggering 75 percent of the country’s export earnings, with platinum being the second-largest mineral contributor after gold. The dependence on mineral exports makes Zimbabwe vulnerable to fluctuations in global commodity prices.

The slump in global platinum prices also threatens to exacerbate Zimbabwe’s already negatively skewed balance of payments position.

The decline in export earnings, the country’s lifeblood of foreign currency, comes at a particularly inopportune moment as the country is likely to need more foreign exchange to import food in light of projected severe shortages due to the impacts of the El Niño-induced drought.

Furthermore, the price slump could significantly impact ongoing new platinum projects, potentially stalling them due to a cash squeeze. For instance, Tharisa, a South African mining firm postponed the opening of its Karo Platinum mine in Zimbabwe.

The mine was originally scheduled to start production in July 2024 but the commissioning date has been pushed back to June 2025.

Early this month, Mimosa Mining Company said it was cutting costs by laying off 33 managers and shelving a major expansion project in response to falling global metal prices.

The company said platinum prices fell by at least 35 percent since April last year, hitting its cash flows and profit margins.

Sibanye-Stillwater jointly owns the Mimosa mine with Implats. Anglo American Platinum wholly owns Unki Platinum Mine while Implats controls Zimplats.

Sibanye-Stillwater reduced planned job cuts at its South African platinum mines to 2 600 from the initial figure of 4 000 after intense discussions with stakeholders.

Comments