IDBZ approves $269m worth of projects

Enacy Mapakame Business Reporter

The infrastructure Development Bank of Zimbabwe (IDBZ) says it approved $269 million worth of projects under the Public Sector Investment Programme during the half year to June 30, 2019.

Inadequate economic and social infrastructure have remained an impediment to the country’s growth aspirations as industry fails to reach full capacity on infrastructure gaps.

According to the African Development Bank (AfDB) Zimbabwe requires an estimated US$33,8 billion between now and 2030 to close the infrastructure funding gap.

Infrastructure is one of the key enablers to economic turnaround strategies and takes centre stage in Zimbabwe’s development agenda.

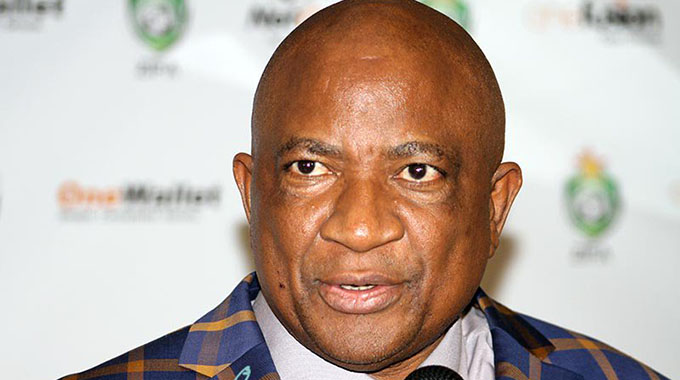

IDBZ chief executive officer Thomas Sakala, said the bank’s initiatives were in support of Government’s thrust on infrastructure development, as the country targets an upper middle income economy by 2030.

“In support of Government’s increased focus on infrastructure development, the bank is providing advisory services through monitoring and implementation of PSIP projects and approved certificates reached ZWL$269,24 million for the period under review,” said Mr Sakala in statement accompanying the bank’s financial statements for the half year under review.

Mr Sakala added the bank also seeks to capacitate other players in the infrastructure value chain through availing funding for their working capital and capital expenditure needs.

In this regard, the bank’s infrastructure value chain loan book was at $16,1 million by end of the reporting period.

On ongoing projects, IDBZ raised $2,98 million during the period under review, for financing some infrastructure projects, as the bank forges ahead with meeting its mandate.

The bank achieved this despite the challenging macro-economic environment characterised by foreign currency shortages as well as inflationary pressures.

But the bank forged ahead in delivering its mandate with projects such as the Kariba and Hwange housing projects as well as the Bulawayo student accommodation expected to reach 80 percent completion by year end.

“During the period under review, the bank made significant progress towards execution of its mandate, in spite of the harsh macro-economic environment.

“The bank raised $2,98 million towards financing some of the ongoing projects over the reporting period,” he said.

IBDZ is also working on project preparation activities for projects in its pipeline and expect them to reach bankability by year end.

These are student accommodation projects for Chinhoyi University of Technology and Catholic University of Zimbabwe as well as Harare public ablution facilities and the Christmas Pass Mixed Development.

Meanwhile, IDBZ widened loss for the period to $3,4 million from $1,2 million recorded in the comparable prior year period while a total comprehensive income of $26 million was achieved.

Revenue for the half year rose 67 percent to $7 million driven by interest earned from treasury placements and coupon interest from treasury bills the bank received as capitalisation in 2018.

Additionally, there were increases in fees, commission and recoveries from advisory and monitoring services provided on Government projects.

Following the change in functional currency, the bank’s foreign domiciled development finance institution worth US$4,5 million was remeasured using the spot exchange rate ruling at June 30, 2019.

According to IDBZ, the interest is held at fair value through other comprehensive income and exchange gains of $30 million were recorded in other comprehensive income.

Comments