EDelivers: Forward-looking policies prop rise in horticulture earnings

Edgar Vhera-Agriculture Specialist Writer

PROGRESSIVE policies under the new dispensation have given birth to the current revival wave in the horticulture sector that is credited with the colossal 86 percent leap in citrus, flower, fruit and vegetable export earnings from US$19 million in 2017 to US$35 million in 2018.

Statistics from the Reserve Bank of Zimbabwe (RBZ) show that citrus, flower, fruit and vegetable exports were US$18,9 million in 2017 before surging to US$35,2 million in 2018 following the coming in of the Second Republic.

Below are the key economic forces credited with turning around the horticulture sector’s fortunes:

1) In his inaugural speech on November 17 in 2017, President Mnangagwa pledged that his Government would kick start the country’s economic revival through:

Addressing land compensation and tenure issues, national stability and sustained economic recovery, placing agriculture at centre of the country’s economic policies, exports, foreign currency generation, relaxation of export procedures, proclamation that foreign investments are safe and respect of Bilateral Investment Promotion and Protection Agreements (BIPPA).

2) The 2018 financial budget buttressed the President’s call by indicating that the fiscal policy would be aimed at the removal of policy uncertainty and inconsistency, lowering cost of doing business, re-engaging with the international community, security of land tenure, introduction of bankable land leases, enhancing foreign exchange generation, enhancing exporters’ competitiveness, strengthen Offer Letters and 99 Year Leases, support the Anchor Farm Initiative and cancelled export order fee down from US$50 to US$10.

3) The Transitional Stabilisation Programme (TSP) further buttressed this by saying that horticulture revival would be achieved through removal of all regulatory impediments, promotion of private sector financing mechanisms, development of efficient co-ordinated fresh produce markets, standardisation of quality practices, provision of technical expertise and extension services, development of an incentive structure for anchor farmers.

4) The National Development Strategy 1 (NDS1 2021-2025), which is being operationalised has among other things, the following key strategies to restructure and re-invigorate the horticulture sector — improving security of land tenure systems for horticulture producers, a legal framework to curb side marketing of produce under contract schemes, developing a unique competitive brand for Zimbabwe’s horticultural products, promoting the export of value-added horticulture products, reduce post-harvest losses and raise export earnings, diversifying and scaling up production of blueberries, raspberry and macadamia nuts, to formalise the domestic horticultural markets and improving ease of doing business.

Citrus, flower, fruit and vegetable exports could not extend their growth in 2019 due to the Covid-19 pandemic that hit hard on horticulture exports worldwide, as markets were closed due to restrictions on movements, resulting in flights cancellation as a way of managing the spread of the coronavirus.

The Government has classified the horticulture sector as a low hanging fruit capable of turning around the country’s fortunes in terms of increased foreign currency earnings, employment creation and economic development in a short period of time.

It has put among others the following incentives that exporters are benefiting from — suspension of duty on agriculture capital equipment (SI 6 of 2016), anchor farmer incentive, value added tax (VAT) zero rating of farm inputs and Foreign Currency Account (FCA) retention on incremental export receipts of 100 percent.

It also crafted the Horticulture Recovery and Growth Plan (HRGP) in 2020 that outlined plans to ensure that the country’s horticulture exports are upwards of US$ 1, 469 billion annually from 2025 onwards.

The HRGP encompasses the entire horticulture value chain including domestic production, processing and value addition as well as export market promotion.

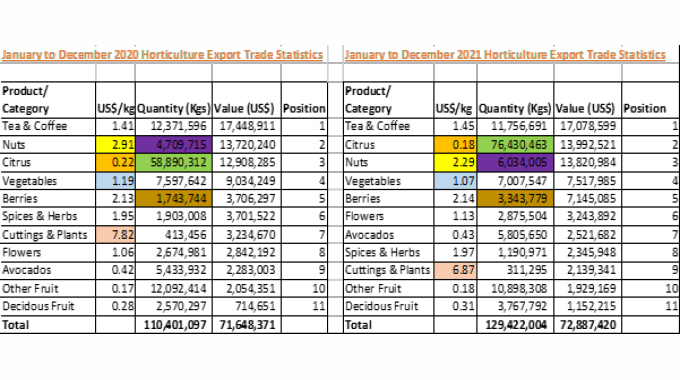

In 2020 the horticulture sector earned the country US$72 million after 110 million kilogrammes of products were exported.

To give credence to the resurgence of the horticulture sector the volume of horticulture exports rose from 110 million kilogrammes achieved in 2020 to 129 million kilogrammes in 2021 representing a 17 percent growth.

Tea and coffee maintained their pole position as the largest foreign currency contributors within the horticulture sub-sector for both 2020 and 2021 period with earnings of over US$17 million in each year.

The Horticultural Development Council (HDC) at its inaugural investment summit in 2021 said at the bullish 30 percent annual growth rate (average horticulture growth 1980s – 1990s) a whopping 1,5 million kilogrammes of products valued at US$1 billion can be realised by 2030.

As economies around the world absorbed the shock of Covid-19, another setback came from geo-political developments in eastern Europe that affected air shipments of horticulture products to Europe in 2022.

This led to air freight rates going up due to limited carriers and lack of inbound cargo. This necessitated horticulture stakeholders to make moves to migrate to sea transportation for shipment of Zimbabwe’s perishable horticulture products.

Sea freight or shipping via container ship is by far the cheapest way to move goods internationally though it is the slowest.

As a plus for the maritime shift, the President last year met with a delegation from DP World, one of the largest marine terminal operators in the world, with the hope of setting up logistics projects and dry ports in the country.

The visit was also meant to resuscitate the memorandum of understanding signed between Zimbabwe and United Arab Emirates (UAE) in October 2021.

Government’s policies meant to grow the horticulture sector are now bearing fruit especially through joint venture (JV) arrangements.

Lands, Agriculture, Fisheries, Water and Rural Development permanent secretary Dr John Basera said almost 2 000 JVs covering about 200 000ha had been approved with special interest on the protection of investment, investors and land holders.

One area positively impacted by JVs is the blueberry sector whose exports grew 150 percent from 2 000 tonnes in 2020 to about 5 000 tonnes in 2022.

A beneficiary of a JV arrangement, Mr Robert Bob Henson of Ivanhoe Farm in Goromonzi, said production and earnings from the berries sector had spiked.

“We started the blueberry project in 2020 on 10ha then added 35ha in 2021 and had an additional 15ha in 2022 bringing the total to 60 ha. If suitable land is available, we are planning for 200ha in future,” said Mr Henson during a field day at his farm last year.

He emphasised the profitability and labour intensive nature of blueberry production saying 45ha of the crop were capable of achieving an income greater than that of 4 000ha of irrigated tobacco and employing about 100 times more new people.

The HDC has come up with the hub and spoke model that is meant to incorporate smallholder farmers into main stream export business for sustainability.

HDC chairman Mr Stanley Heri of Nyaragoda Farm in the Macheke area of Murehwa district under Chief Mangwende in Mashonaland East province grew from being an out-grower to contracting out-growers.

“In order to satisfy the insatiable demand for our horticulture products in the EU, I contracted 10 smallholder growers under the Shungu Irrigation Scheme on 0, 4ha each to augment my 2022 supply of sugar snap and mangetout peas,” said Mr Heri at one of the out-grower plots.

Shungu Irrigation Scheme secretary Mr Felix Machando said: “Ten of our members are into this project and each has 0, 4ha under either mangetout or sugar snap peas.

“We have started harvesting our produce and we intend to continue for the next six weeks. We are expecting incomes of between US$2 000 and US$3 000 for each member,” he said.

Mr Machando revealed that they created jobs for the local community and paid between US$5 and US$10 per day depending on one’s speed and efficiency during the reaping process.

“In 2023 our members are expecting to increase their area to at least 0, 8 ha each after noticing this season’s rewards.

Froggy Farm in Chimanimani, Manicaland, has expanded to cover smallholder farmers in the protea flower production business under the hub and spoke model.

Froggy Farm managing director Mr Garth Fowler commented: “Farmers are provided with planting material from the nursery and technical assistance. The material is provided upfront at a reasonable cost and offset against future grower payments.

“Farmers are contractually bound to provide Froggy Farm (The Hub) with cut protea flowers, and are paid per stem according to the flowers’ grades,” said Mr Fowler.

He said Froggy farm sells the flowers either locally or internationally through their partner Zimbabwe Flower Exports (Zimflex). The Hub retains 20 percent of the farm gate price and 80 percent is paid directly to growers for sustainability of the model, said Mr Fowler.

A beneficiary of the protea flower business Mr Joseph Matashura of Manyoli village in Nyanga South district in Manicaland said their livelihoods were derived from the flower production business.

“I have half a hectare plot under protea flowers. After harvesting, we either bunch them or sell as individual stems. For a bunch of 10 stems, we get US$0,55 while the most paying stems fetch US$0,68.

“Froggy Farm collects the flowers to determine the price on the basis of our packing, handling and presentation. We sell weekly and get paid fortnightly,” said Mr Matashura.

The Government has also launched the US$30 million horticulture export revolving fund (HERF) meant to close the funding gap and spearhead increased productivity, as well as finance bankable projects with a focus on value addition to give impetus to horticulture investment and growth.

Comments