Manufacturing woes persist

Rumbidzayi Zinyuke Business Reporter

Rumbidzayi Zinyuke Business Reporter

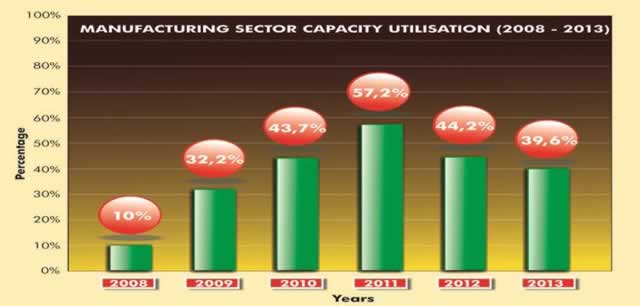

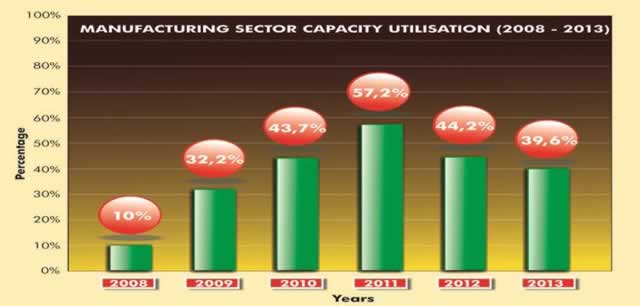

Capacity utilisation in Zimbabwe’s ailing manufacturing sector has continued on a downward trend dropping 5,3 percentage points from last year’s average of 44,9 percent to 39,6 percent in 2013, the Confederation of Zimbabwe Industries Manufacturing Sector Survey has revealed.

The survey, which was released in the Harare yesterday, indicated that factors affecting the sector remained largely unchanged while there was a noted increase in the percentage of respondents facing challenges due to working capital constraints.

Capacity utilisation in the sector decreased to 44,2 percent last year from 57,2 percent in 2011 for the first time since the country adopted the multi-currency system in 2009. The top five performers from last year all dropped in terms of capacity utilisation from last year with the pharmaceuticals industry recording the most significant decline from 58,3 percent in 2012 to 20 percent this year. Bakers were the best performing sub-sector recording the highest increase from 40 percent capacity utilisation in 2012 to 82 percent in 2013.

Grain millers improved from 30 percent to 50 percent while the textile industry recorded a slight improvement from 34,4 percent to 35 percent this year.

Car assemblers dropped from 30 percent capacity utilisation from 58,2 percent last year. Leather and allied sector remained the worst performing operating sub-sector from last year at 11,3 down from 27 percent last year.

According to the survey, only 35,7 percent of the respondents recorded capacity utilisation of above 50 percent, with only two firms recording capacity utilisation of 100 percent.

CZI said among the top five constraints to industry, the issue of funding remained the major problem being faced by companies while a significant number of companies pointed to low domestic demand.

Following a decade of economic challenges characterised by hyperinflation and the adoption of multi-currency system, the country has faced problems in reviving the industry as no capital inflows or external lines of credit have been coming in. The situation has been compounded by the exponential growth in imports due to the depressed industrial activity which drains most of the liquidity in the economy.

In line with the drop in capacity utilisation, 45 percent have reported no change in the business viability.

Only 7 percent of the respondents recorded a significant improvement in business viability in the past year, while 48 percent indicated that business had actually been declining and 16 percent recorded a slight increase. In terms of capital investment, the survey revealed that 60 percent of the respondents did not carry out any new investment in 2013. The major reason for investment was to replace worn out machinery and equipment while 43 percent indicated that they wanted to expand their operations.

Of the respondents who carried out capital investment, 90 percent invested in machinery and equipment, while 10 percent invested in land and buildings.

CZI said the majority of capital investment was done through profit plough back with 36 percent of respondents having accessed bank loans and only 5 percent using FDI funds. Results of the survey showed that on average, production for local consumption was at 80 percent compared to 85 percent last year, while the remainder is for the foreign market indicating a slight improvement in exports by the manufacturing sector.

The survey showed that the main challenge faced by companies who want to export was that local products remained uncompetitive in regional and international markets while companies that have orders were failing to meet them due to shortage of working capital.

Companies also said competition from imports was affecting business. Eighty five percent of the imports came from South Africa and China contributed 67 percent, 31 percent was from India and 15 percent from Brazil.

The survey also showed that there was no significant change in terms of export destinations and their respective market shares, with the exception of South Africa which increased its market share from 12 percent in 2012 to 18 percent this year.

CZI said the companies that had not exported in the past two years had cited the uncompetitiveness of local products on the international markets as shortage of working capital and high cost of production had rendered their products expensive. Government has indicated that industry needs about US$2 billion to resolve the issues around capacity utilization, old equipment and efficiency.

The Ministry of Agriculture, Mechanisation and Irrigation Development has also said a vibrant agro-industry would be the basis for driving economic growth, employment and wealth creation.

About 60 percent of raw materials used in the manufacturing industry come from agriculture, which underlines the need to strategic importance of the sector to industry.

Comments