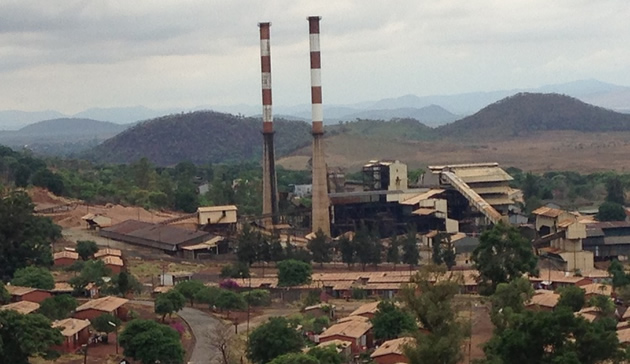

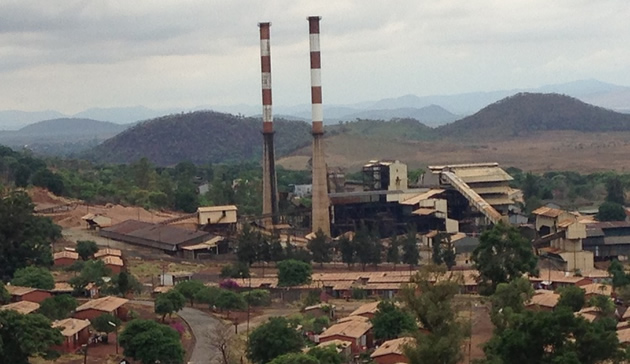

HATCH Global to lead Trojan restart

Funds for the restart of the Trojan smelter would come from proceeds of a $20 million bond and $6,5 million mobilised from internal resources

Golden Sibanda Senior Business Reporter

BINDURA Nickel Corporation has engaged Canadian international engineering giant HATCH Global as the main contractor for the $26,5 million restart of its Trojan smelter.

Technical director Mr Thomas Mashungupa told analysts during BNC’s interim results presentation yesterday that HATCH would assist with modifications, redesigning and process improvements, with some of the work already underway.

Mr Mashungupa said funds for the restart of the Trojan smelter would come from proceeds of a $20 million bond and $6,5 million mobilised from internal resources.

Smelting of the nickel would add value to the concentrate being exported by BNC, as only 10 percent nickel is contained in volumes exported with the rest discarded as waste.

“HATCH is the largest furnace group in the world; it is domiciled in Canada, but has got offices dotted around the whole world. The office that we are going to be dealing with for proximity purposes is the South African office,” Mr Mashungupa said.

“We have gone through feed system design; we have completed that. We have gone through instrumentation and control system design, we have concluded that.

“We have placed contracts for the precipitator. We mentioned, I think last year, that one of the largest tasks that we have got to do is the complete refurbishment of the precipitator, which cleans the dust from the furnace,” he said.

Other works happening around the smelter plant include maintenance works on other facilities that work together with the smelter, including sealing around the furnace and furnace refractory while a number of key project personnel were now on site.

Earlier this year, executive chairman Mr Kalaa Mpinga said national project status would be sought for the restart of the smelter, which will save BNC on transport costs.

Mr Mashungupa said engineers were already on site as well as other key process specialists, such as the artisans from the various disciplines and these included boilermakers, feeders and instrumentation technicians who are already working on site.

He said various experts were dismantling hardware that will not be required, selecting portions requiring refurbishment, clearing way for material that will come and doing certain installations among some engineering and technical work underway.

Mr Mashungupa said at the current rate of the programme implementation, the company would be able complete refurbishments and commission the plant by June 2015.

Group managing director Mr Batirai Manhando said the group had gone a step further in its quest for value addition by embarking on the restart of the Trojan smelter.

“To that effect, we are looking to raise some money for the smelter restart, which is the $20 billion bond, we have highlighted here,” Mr Manhando told the briefing.

Commenting on the financial performance of the group, he said BNC had continued to register growth; with half-year turnover more than doubling to $46 million from $21 million in the comparative half-year period to September 2013.

Corporate costs totalled $33,9 million, giving rise to an operating profit of $12,5 million and net cash from operations of $5,5 million and significant reduction of liabilities.

Tonnage milled in the interim was 310 000 tonnes from 267 000t last year. Mr Manhando said head grade had gone down slightly to about 1,05 percent from over 1,5 percent as the group ramps up volumes with everything produced being sold.

Unit production cost have increased to be about $14 000 per tonne from about $12 000/t as BNC has resumed development and other projects that had been suspended to cushion the business when global nickel prices dipped to very low levels.

Total equity has increased from $28 million in March 2014 to $36 million, long term liabilities have decreased to $12 million from $32 million, current liabilities were slightly unchanged while total assets jumped to $75 million from $64 million.

Comments