Concern over BNC’s $20m bond . . . as nickel prices plummet

BNC

Golden Sibanda Senior Business Reporter—

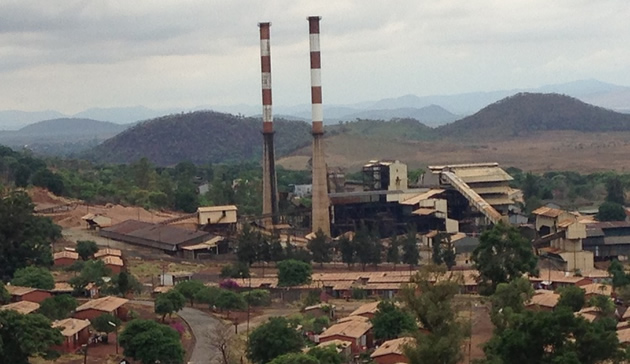

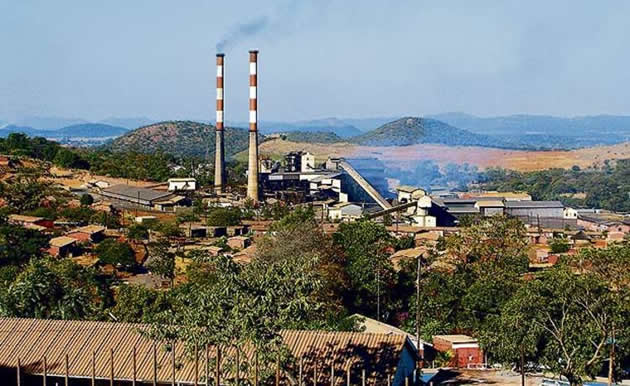

BINDURA Nickel Corporation bond holders have allegedly called on guarantees to its $20 million bond to finance restart of Trojan Mine smelter on concerns it may struggle to repay following the continued weakness in nickel prices. The smelter restart programme, anticipated to significantly whittle down costs and inflate the bottom line, might have to be stopped while BNC is expected to focus on extracting only high ores to make up for the low prices.

BNC’s parent company, Alternative Investment Market listed multi-commodity miner Mwana Africa Plc, guaranteed the bond to raise $20 million required to finance the $26,5 million restart of the Trojan Mine smelter. Mwana Africa and BNC had earlier indicated internally generated financial resources would be used to finance the deficit of the required funds. BNC’s smelter had been under care and maintenance since 2008.

ALSO SEE

Mwana holds a majority stake in BNC and Zimbabwe’s biggest gold miner, Freda Rebecca. The two are its only producing assets but the group is developing other mines in other African countries. Highly placed sources said bond holders are calling on the guarantees (repayment) by Mwana Africa, in view of the plunge in nickel prices, which have fallen to a nerve-wracking $9 000 per tonne.

“It (the smelter restart) may be stopped due to funding and they will focus on high grading. Labour is also restless (at BNC) and uncertain on the back of 25 percent pay cuts,” the source said on condition of anonymity. BNC acting chairman Mr David Murangari referred all questions to managing director Mr Batirai Manhando whose mobile phone rang unanswered. But the source added that with Mwana Africa creating shared services, hundreds of jobs may be lost at its units, including local gold miner Freda Rebecca, which has caused unrest, particularly at the nickel miner.

“When they put the mine on high grade they targeted all the good nickel and once it is exhausted and it becomes unprofitable, they might probably close the mine. If you check BNC’s quarterly results you will note that its all-in costs are about $12 000 per tonne and nickel is on $9 000/t.”

BNC once put all its assets on care and maintenance at the height of hyper-inflation in Zimbabwe in 2008, before restarting in 2012 after a fall in global nickel prices, which plunged to unprofitable prices of $8 000 per tonne. For the bond, BNC offered security, guaranteed by Mwana in the event that the nickel extractor fails to repay, based on an average nickel break-even price of $16 000 per tonne, but nickel has skidded to about $9 000/t.

“Mwana Africa guaranteed $20 million, given as a requirement for the prescribed asset status. This can also be called on if BNC is unable to repay. BNC looks like it has a funding requirement with nickel being at $9 000 and all-in costs at $12 000 per tonne,” the source added.

The call by bond holders on guarantees on the $20 million bond also comes amid concerns by the investors that their money might be directed to financing working capital obligations amid squeezed cash inflows. Due to demand which had earlier continued to outstrip supply, BNC previously anticipated nickel prices to close next year at an average price of between $17 750 per tonne and $19 000 per tonne in 2017.

BNC had also forecast prices of around or below $13 100 per tonne by the end of the year, an annual average price of $15 000 per tonne for 2015. BNC’s nickel production for the year to March 2015 increased by 3 percent to a record 7 306 tonnes for the year to March from 7 129 tonnes last year.

Revenue increased to $79 million a 21 percent increase from $65 million last year, largely due to increase in nickel prices, but the growth is under serious threat in light of unexpected marked decline in global prices.

Comments