Chinamasa hails use of plastic money

Nyemudzai Kakore Herald Correspondent—

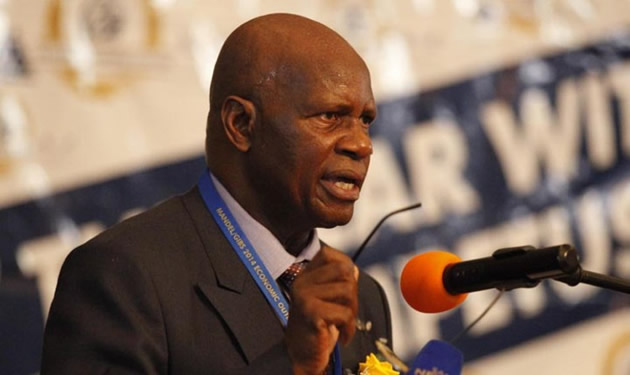

The financial services sector now holds $6,1 billion in deposits owing to the upturn in the use of plastic and electronic money platforms, Finance and Economic Development Minister Patrick Chinamasa has said. Minister Chinamasa said this was facilitated by the move from a cash-based economy and payment system where the public has shifted to use plastic money and Real Time Gross Settlement transfers.

As such, Government was in the process of installing and activating point of sale (POS) machines in all Government and quasi-Government departments, Parliament heard last Thursday.

Read more:

- Businesses embrace plastic money

- EDITORIAL COMMENT: Encourage farmers to use plastic money

- Retail sector embraces bond notes, plastic money

- Going plastic

“There is no way that you can have cash to represent the bank deposits. Currently, we have something like $6,1 billion in bank deposits. There is no way you can have physical cash of that amount. Even in the United States, it is only 10 percent of virtual money and that is money in bank deposits,” said Minister Chinamasa.

“While you are talking about a cash crisis, the cash is actually easing because of the corresponding increase in use of plastic money. I am pleased of that crisis because it has given us an opportunity to come up with solutions to that problem. We need, of course, to secure the point-of-sale machines and it is a process. Already, the uptake of point-of-sale machines has been phenomenal.”

He was responding to Glen Norah legislator Mr Webster Maondera (MDC-T) on Government policy regarding the payments done to Government departments as most departments want service seekers to pay cash upfront instead of using point-of-sale machines.

On the progress involved in printing bond notes and their introduction, Minister Chinamasa said the Reserve Bank of Zimbabwe was finalising the signing of a tripartite agreement with the African Export/Import Bank (Afreximbank) and bond notes printers ahead of the introduction of bond notes in October this year.

He assured the nation that the guarantee facility of bond notes would not exceed the $200 million guaranteed by Afreximbank since the regional bank had a reputation to protect.

“The $200 million is a guarantee facility. The bond notes are coming to play a two-fold purpose, as an export bonus scheme, but more importantly to stop leakages of the US dollar. The way things are, if we brought in $2 billion today, tomorrow it will be gone.”

“That is what I think we need to understand. Because of its appreciation and everybody is looking for United States dollars. They will find ways to come and mop up, siphon and fish out our US dollar(s). That is the reason also why we are coming in with the bond notes.

Measures such as boosting exports as the major foreign exchange earner through various production and export incentives, such as the 5 percent export incentive scheme and other support to gold producers are in place to boost the economy.

The minister said other measures included implementing the international financial institutions (International Monetary Fund, World Bank and African Development Bank) Arrears Clearance Programme, to unlock more external funding and lowering bank lending rates from as high as 35 percent to current levels of 6-15 percent.

He said these measures and incentives to boost exports were primarily aimed at top export earners of gold (particularly the small scale producers) and tobacco growers.

Comments