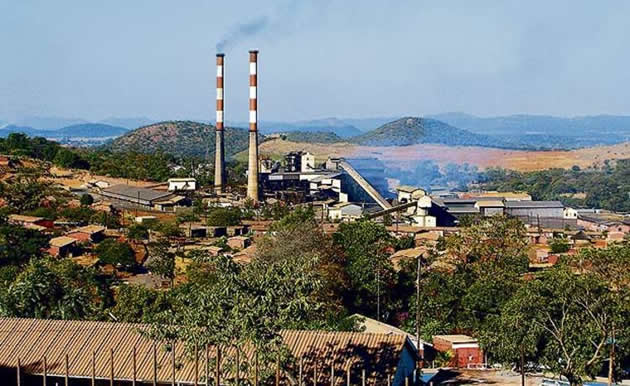

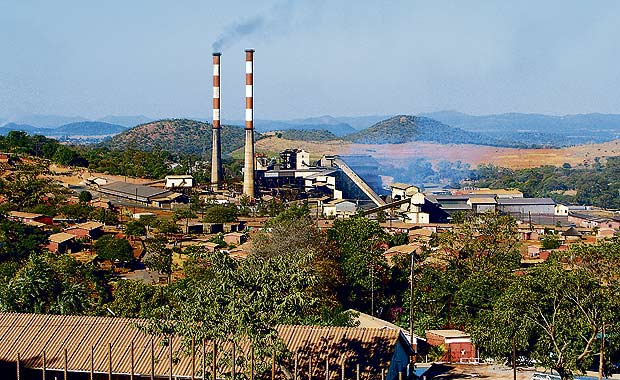

BNC smelter 71pc complete

Business Reporter—

ALTERNATIVE Investment Market-listed mining group, ASA Resources says the $26,5 million refurbishment of Bindura Nickel Corporation’s Trojan Mine smelter is now 71 percent complete with nearly $20 million spent on the project.

BNC earlier said the rationale for the smelter was the need to get higher prices of nickel in leach alloy than nickel concentrate and potential for an increase in revenue by 15-20 percent per tonne.

Africa’s only integrated mining and smelting company will embark on phase 2 of Trojan Mine re-deepening programme to ensure adequate feedstock in the absence of third party supply.

“Upgrade and refurbishment of the smelter project is on course (above 71% complete),” ASA said in a group financial update for the 2017 interim to September 2016.

The AIM listed commodities group, whose main producing assets are BNC and gold miner, Freda Rebecca, said with the smelter nearing completion the group would need to increase production to match the new capacity of the smelter.

ASA said with the price outlook for nickel more encouraging and the smelter taking shape, management is revisiting phase 2 of the shaft re-deepening project.

On completion, it would extend the life of mine by about 5 years and give Trojan increased access to known ore reserves and higher grades in advance of the smelter restart.

“As reported previously, Trojan’s concentrate can only provide sufficient output to meet 50-55 percent of the smelter’s total capacity and, without third party feed, it would not be running at optimum levels on present production,” ASA said.

The re-deepening project could provide increased feed for the smelter and, equally important; allow exploration drilling to continue to evaluate resources below 45/0 level.

It will cost approximately $5 million to complete this project and extend the shaft system from 43/0 to 45/0 level.

To assist with bringing both of these projects to fruition in 2017, bondholders have agreed to place a 12-month moratorium on the principal bond debt; in the meantime Bindura said it will continue to make interest payments as normal.

When the previous executive originally negotiated the $20m bond, in 2014, it was assumed nickel prices would be higher and this moratorium gives BNC time to complete the smelter project while hopping nickel prices increase further.

Meanwhile, BNC’s revenue increased by 9 percent to $22,5 million (H1 FY2016 $20,6 million). Profit after tax of $1,184 million (H1 FY2016: loss of $3,3 million).

The nickel miner recorded a 19 percent reduction in realised average nickel-in-concentrate price to $6,198/t in first six months of the previous financial year.

BNC’s Trojan Mine sales increased 25 percent to 3 464t nickel-in-concentrate (H1 FY2016: 2 762t) while the head grade increased to 1,89 percent following the adoption of the new mine plan to blend massives with disseminated nickel ore

Tonnes of nickel mined and milled decreased by 11 percent to 201 707t in the 2017 the interim from 226,294t) 2016 first half and 11 percent to 205,290t from 231 224t, respectively compared to the first half period in 2016 financial year.

Comments