BNC seeks national project status nod

Golden Sibanda Senior Business Reporter

Golden Sibanda Senior Business Reporter

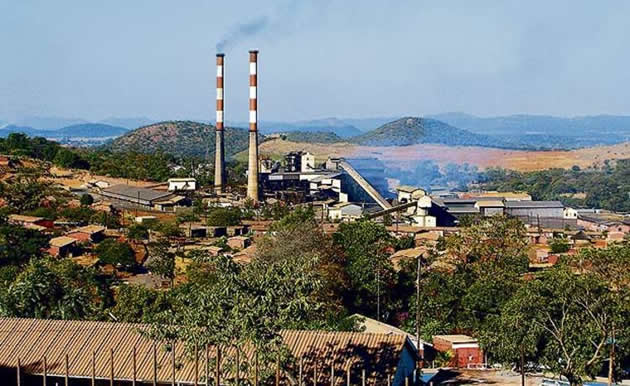

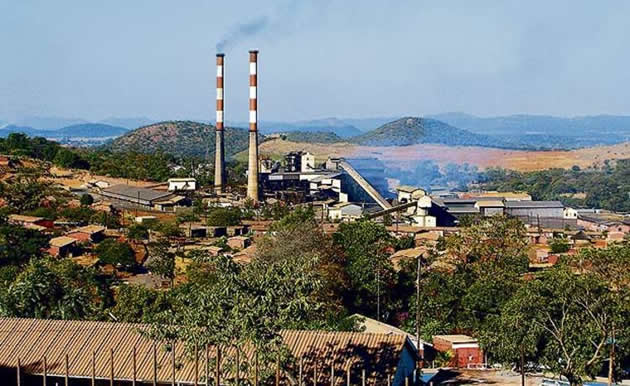

Bindura Nickel Corporation has approached Government with a request for its smelter restart project to be granted national project status.

The restart will save the firm over $12 million in transport costs.

Bindura will invest $26 million for the restart, to be funded through debt and internal resources. The smelter was mothballed in 2008 due to hyperinflation and a plunge in global nickel prices.

Chairman Mr Kalaa Mpinga told the company’s annual general meeting in Harare yesterday that a decision on the request was imminent. He said the same approach was used for the restart of Trojan Mine.

BNC’s return to full production helped parent firm Mwana Africa to achieve record revenue and profit of $65 million and $26 million, respectively, for the full year period to March 31, 2014, Mr Mpinga said at the AGM.

“There is a Government regulation to encourage new investment. You can request for national project status, which basically gives a number of incentives to facilitate and expedite new investment,” Mr Mpinga said.

Mr Mpinga said that national project status would give BNC access to a number of incentives, including duty-free import of capital equipment and value added tax rebates on certain equipment.

“So, there is a letter that you have to write to the Government in which you explain the economic and strategic importance of the project. We did that when we did the restart of BNC’s Trojan Mine,” he said

Mr Mpinga said that there were two main benefits from restarting the smelter, one of which is the restoration of BNC’s capacity to refine concentrate, which is an imperative to cut on cost of transport.

The other benefit to be derived from the smelter would be compliance with Government’s value addition and beneficiation policy.

Mr Mpinga said BNC was in discussions with local and foreign banks for half of the $26 million it requires to fund the restart of the smelter.

BNC managing director Mr Batirai Manhando said after completion of the smelter, BNC would save about $1 million from transport costs, which should add at least $12 million to the bottom line.

“Nickel in concentrate contains 9 percent nickel and after smelting the value increases to 75 percent and the rest of the waste is thrown away. It saves about $1 million, which goes to the bottom line,” he said.

Mr Manhando said that the company was also in the process of removing ageing equipment to enhance its efficiencies and a total of $7 million had been set aside for new equipment and mine deepening.

Giving an operations update for the quarter to June, Mr Mpinga said nickel in concentrate production was 14 percent lower at 1,902t, as underground mobile equipment was taken out of commission for refurbishment and also due to mining of lower grade areas.

He said that head grade was 6 percent lower at 1,5 percent, compared to the last quarter of 2014 when 1,6 percent grade was achieved.

Recovery was also down by 4,7 percent to 84,1 percent against the 2014 last quarter performance when recovery topped 88,8 percent.

Nickel sales went down 17 percent at 1 871t against 2014 last quarter volumes of 2 250t. Cash costs rise 21 percent to US$13 750/t (Q4 2014, US$11 333/t) and all-in sustaining costs up 29 percent to $15 750/t (against Q4 2014, US$12 220/t) as a result of lower production and refurbishment of BNC mining equipment.

Tonnes mined were 4 percent lower at 155,610t due to the impact of underground mobile equipment taken out of commission for refurbishing.

Tonnes milled were 3 percent down due to the equipment refurbishment programme. Head grade declined by 6 percent to 1,519 percent resulting from scheduled mining of lower-grade areas.

Comments