Ignore farmers at your own peril, Chinamasa warns banks

Golden Sibanda Senior Business Reporter

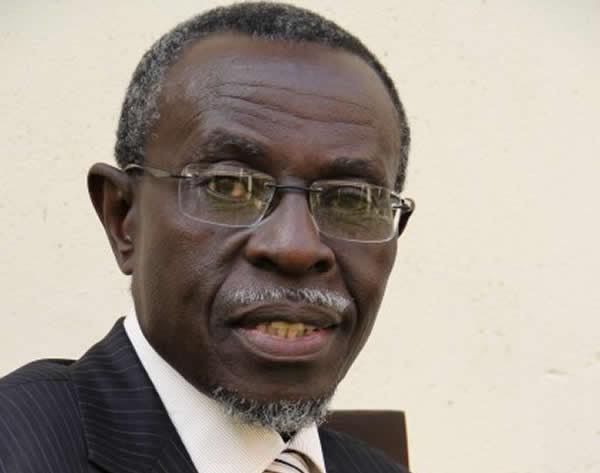

FINANCE Minister Patrick Chinamasa has rapped banks for failing to adjust to the new domestic economic order requiring financial products tailor- made for small farmers.

Minister Chinamasa, however, warned that banks that fail to realign with the structural shift in the economy risk meeting the fate of the proverbial dinosaur – demise despite past success.

The finance minister said the financial services sector has been caught ill-prepared and was vexed by the changes after failing “to adjust to the structural shift in terms of financing agriculture”.

“In my conversations with them I have been urging them to come to terms with reality and come up with innovative financing for the small farmer,” Minister Chinamasa said.

This, he said, comes against a background where three-quarters of the country’s population eked out their livelihoods from agriculture through commercial or subsistence farming.

“In Zimbabwe, 75 percent of the population earns their livelihoods from agriculture such that commercial banks only ignore them at their own peril,” the finance minister said.

Further, Government’s fast track land reform programme resulted in more than 350 000 farmers from the previously landless black majority getting productive land for farming.

The programme also saw between 90 000 and 105 000 indigenous black farmers taking up tobacco farming, previously the exclusive domain of only about 2000 white farmers.

“The land reform programme benefitted many small-scale farmers. Through the land reform programme, we made land accessible to more than 350 000 farmers,” he said. This translated to about 11 million hectares of productive or prime land for farming. To leave out 11 million hectares of productive land is basically to curse our economy,” the minister said in his official opening speech of the Regional Rural and Agricultural Finance Thematic Conference that started yesterday in Harare and ends tomorrow.

The ongoing three-day conference was organised by the African Rural and Agricultural Credit Association and the Rural Finance Knowledge Management Partnership.

In Zimbabwe agriculture is central to economic growth, accounting for 18 percent of gross national product and about 30 percent of the country’s annual foreign exchange earnings. The sector is also one of the single biggest employment industries. Yet only 16 percent of total loans disbursements for the year to March 2015 was allocated to the sector, amounting to $660 million out of a cumulative $4 billion loans extended.

Reserve Bank of Zimbabwe Deputy Governor Dr Kupukile Mlambo said the bank was aware of the central role of agriculture to the domestic economy and part of its intervention was addressing the issue of non-performing loans to enable banks to extend credit.

Minister Chinamasa said credit finance was critical for rural and agricultural development in Africa; hence the need for financial institutions to come up with innovative funding schemes.

“The majority of our people live in these areas and are excluded from the mainstream economic activities. The financial sector must not be like the proverbial dinosaur, because they are failing to adjust to the existing reality,” the finance minister said.

The minister said because of their diverse business portfolios, financial institutions played an important role in linking up farmers with markets and other strategic stakeholders.

Speaking at the same event, Bankers Association of Zimbabwe president Mr Sam Malaba admitted that local banks were not lending to agriculture as much as they should.

But he cited the short and transitional nature of deposits as binding constraint to banks’ ability to provide medium- to long-term funding requirements of the agriculture sector.

Mr Malaba also attributed the cautious credit extension to agriculture, especially small farmers, to the absence of acceptable collateral such as title deeds to their land.

Further, Mr Malaba said banks, which he said use depositors’ funds, cannot freely extend financial support to the farmers in the absence of an effective value chain, such as in tobacco, which enables them to recover the funds when farmers sell their produce.

Comments