Gold Trade Act unpacked

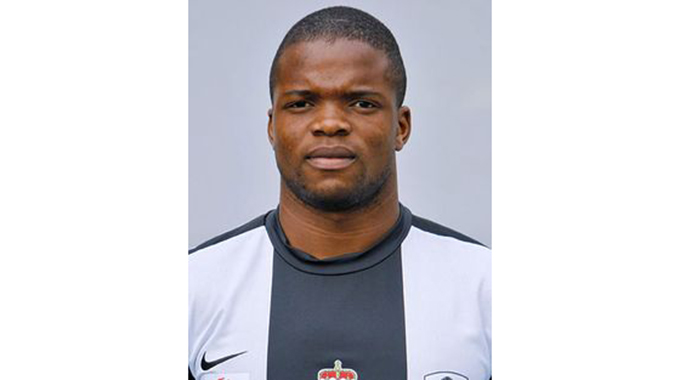

Godknows Hofisi

Introduction

In my article of July 8, 2021 titled “An overview of key mining laws in Zimbabwe” I explained that the Mines and Minerals Act (Chapter 21:05) is the principal Act.

I also listed the Gold Trade Act (Chapter 21:03) as one of the main sources of mining laws. This article acknowledges Government’s clear efforts to increase gold production and export earnings.

Gold Trade Act (Chapter 21:03)

This article seeks to unpack the Gold Trade Act (the Act) for the business of readers. The Act is arranged into four parts, namely:

Preliminary, in Part 1

Dealing in and possession of gold, in Part II

Licences and permits, in Part III

General, in Part IV.

Preliminary

Part 1 is made up of sections 1 and 2. Section is the interpretation section and defines key words used in the Act.

Dealing in and possession of gold

This is covered in Part II of the Act, being sections 3-12. According to section 3(1) no person shall, either as principal or agent, deal in or possess gold, unless:

- a) He is the holder of a licence or permit, or

- b) He is a holder (of a registered mining location) or tributor (lessee or assignee of the rights of a holder), or

- c) He is the holder of an authority, grant or permit issued under the Mines and Minerals Act (Chapter 21:05) authorising him to work on alluvial gold deposits, or

- d) He is an employee or agent of any of the persons mentioned in (a), (b) or (c) above.

An authorised person may only deal with another authorised person. A miner (holder or tributor) may only deal in and possess gold which has been won by him or her or his or her employee acting on his or her behalf from the mining location upon which he or she has mining rights.

Section 6 deals with the disposal of gold by persons authorised to possess gold. Every holder of a registered mining location and every tributor is required to deliver all gold won by him or her from his or her mining location to the holder of a gold dealing licence.

Every holder of a gold recovery works licence shall deliver to the holder of a gold dealing licence all gold recovered by him or her.

Every holder of a gold dealing licence to whom delivery of gold is tendered shall, without delay, take delivery of such gold and deal with such gold in accordance with directions issued to him or her by the Minister responsible for finance.

It is a requirement in terms of section 8 for licence holders to keep a register of transactions in gold.

Such a register shall keep a true and correct record relating to all gold deposited with or received or dispatched or otherwise disposed of by him or her.

Production and exhibition of such a register may be demanded, in writing, by any mining commissioner, inspector of mines or police officer.

Licences and permits

This is covered in Part III of the Act, being sections 13-22. The main aspects are explained hereunder.

Types of licences and rights

In terms of section 13 licences, in terms of the Act, may be classified into:

- a) A gold dealing licence,

- b) A gold recovery works licence and

- c) A gold assaying licence.

According to section 14 the various types of licences authorise holders thereof to do certain things. For example:

- a) The holder of a gold dealing licence shall be entitled to deal in any manner whatsoever, subject to the Act.

- b) The holder of a gold recovery works licence shall be entitled to buy and receive gold which is not in the form of alluvial, amalgam, retorted, smelted or refined gold, and to sell any gold lawfully in his or her possession only to or through the holder of a gold dealing licence, unless authorised by the Minister to export such gold.

- c) The holder of a gold assaying licence shall be entitled to receive gold for the purpose of analysis or testing thereof, and to sell any gold resulting from his or her operations only to the holder of a gold dealing licence.

Issue of licences

In terms of section 16 no licence shall be issued to any person except upon the written authority of the Minister (of Mines) or the Minister responsible for finance, as the case may be.

The Secretary in the Ministry of Mines or any person authorised by him or her in that behalf, shall issue all licences, other than the gold dealing licence, upon the written authority of the Minister.

The Secretary in the Ministry responsible for finance, or any person authorised by him or her in that behalf, shall issue gold dealing licence upon the written authority of the Minister responsible for finance.

Permits to deal in or possess gold

Section 20 applies. Any mining commissioner may, subject to such conditions he or she may think fit to impose, issue to any person a permit authorising such person to acquire or to be in possession or to dispose of gold in a quantity not exceeding one ounce.

The Minister may, subject to such conditions as he may think fit to impose, issue to any person a permit authorising such a person to acquire or to be in possession or to dispose of such quantity of gold as may be specified in such permit. One may also buy gold as an agent of Fidelity Printers and Refiners.

General

This is covered in Part IV, being sections 23-31.

This part covers areas such as disabilities entailed by a trader on conviction, that a person convicted may not enter a mining location, production of licences and permits, false statements, procedure on confiscation of gold, gold of which ownership is not known, power of entry and search by police, offences and penalties and regulations.

Disclaimer

This simplified article is for general information purposes only and does not constitute the writer’s professional advice. Laws on gold trade are subject to frequent reviews as Government works on well-meaning efforts to increase gold output and export earnings.

Godknows Hofisi, LLB(UNISA), B Acc(UZ), CA(Z), MBA(EBS,UK) is a legal practitioner / conveyancer with a local law firm, chartered accountant, insolvency practitioner, registered tax accountant, consultant in deal structuring, business management and tax and is an experienced director including as chairperson. He writes in his personal capacity. He can be contacted on +263 772 246 900 or [email protected].

Comments