EcoCash to keep exploring digital space for solutions

Theresa Mhazo

Business Reporter

EcoCash Holdings Limited says it will continue to pursue opportunities for digital solutions to various socio-economic challenges as the fintech group seeks to enhance financial inclusion through technology.

Chairman Sherree Shereni said the group was on a path to empower local communities through reliable and resilient digital solutions that enhance people’s ability to be economically active.

This is in line with the global digitalisation drive that economies are adopting, which has also been accelerated by the Covid-19 pandemic that pushed businesses into hybrid working.

Mrs Shereni said the group was committed to creating transformational solutions that cut across sectors like health, insurance and agriculture among others.

“We are making a lasting difference by empowering people through reliable and resilient digital solutions that enhance people’s ability to be economically active,” she said in a statement accompanying the group’s financial results for the half year to August 2022.

“We look forward to contributing towards sustained innovations in the Fintech, Insurtech, Healthtech, Agritech and On Demand Services space, which we believe we can accelerate, spurred by the gains recorded in the current period,” she said.

She added the group would also build on its past successes to continue delivering value for all its stakeholders despite the environmental headwinds and volatile operating environment.

“Despite the challenging operating environment during the period under review, we have continued to identify and pursue new opportunities, formulating winning strategies to drive business performance and positive socio-economic impact,” she said.

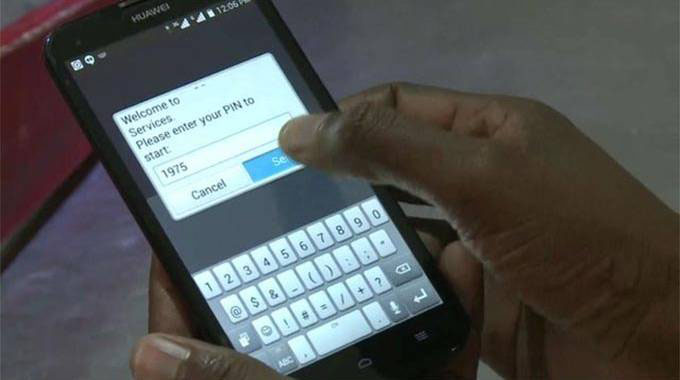

Among other milestones, the company has launched EcoCash bill manager through its mobile money business, bringing to customers a platform that aggregates service providers and allows customers to conveniently pay their bills.

According to the group, the product is transforming the payments space amid indications the group has managed to get over 200 000 customers onboarded to the platform to date.

Additionally, the group also introduced the EcoCash chatbot, an artificial intelligence (AI) driven customer experience solution to improve efficiencies in query resolution as well as improve the overall mobile money experience.

Through this innovation, they have started to record positive gains on their customer effort scores from the 250 000 registered customers.

EcoCash has also continued to build around the core life and short-term insurance products for the Insurance technology business focusing on expanding its channel network to enhance service delivery and experience across all our insurance products.

In terms of financial performance, the group recorded revenue of $45,4 billion for the half-year period compared to $42,5 billion in the same period in 2021. Most of the revenue was driven by the fintech business followed by insurtech and digital platforms.

The fintech business, anchored by EcoCash and Steward Bank, remains the largest contributor to the group’s financial performance driven by new product innovations, and growth in the banks’ foreign currency revenue, a result of the deliberate growth in the US dollar loan book and foreign currency accounts.

A profit before tax of $911,1 million was achieved, an improvement from the prior period’s loss before tax position of $106,2 million.

Comments