Covid-19 spawns business for General Beltings unit

Tawanda Musarurwa

Business Reporter

Listed industrial firm General Beltings could look to tap into the extensive opportunities brought about by the novel coronavirus pandemic through its chemicals division, Cernol Chemicals.

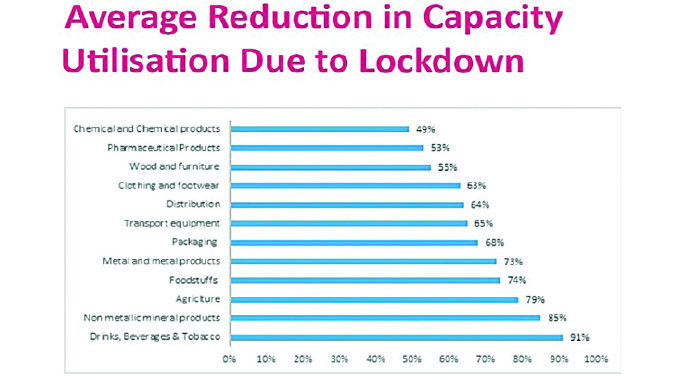

Although the chemicals industry, like most other industries, has been feeling the negative impact of the coronavirus (Covid-19) pandemic in terms of supply chain disruptions and reduced demand for certain products, there is some scope for an upturn in demand for certain hygienic products.

Good hygiene is considered as one of the most important tools to combat the spread of the highly infectious virus.

“The advent of the Covid-19 pandemic and its devastating effects has reignited debate on personal hygiene issues at global and national level.

“It is expected that new measures will be taken to improve institutional hygiene which would create opportunities for the chemicals division,” said General Beltings chairman Godfrey Nhemachena.

“Overall, the business will continue to benefit from the divisional synergies through skills retention and funding models.”

General Beltings will again look to its chemicals division which rescued the group during FY2019.

During the period under review, total volumes were down in the group’s two divisions which were affected by the inflationary operating environment.

“Total volumes declined by 36 percent to 636 tonnes when compared with prior year same period volumes of 995 tonnes due to reduced activity in the first quarter of 2019 as the business remodelled in the wake of multiple statutory promulgations,” reported the group.

“Both chemical and rubber divisions reported reduced volumes when compared with prior year due to depressed downstream demand, although there were significant recoveries in the later part of the year at the rubber division.”

Turnover however, improved largely due to the contribution of the chemicals division.

On an inflation-adjusted basis, turnover at $49 million was 40 percent more compared to prior year’s same period $35 million “due to improved internal efficiencies, a favourable product mix at the chemicals division and benefits from technical partnerships.”

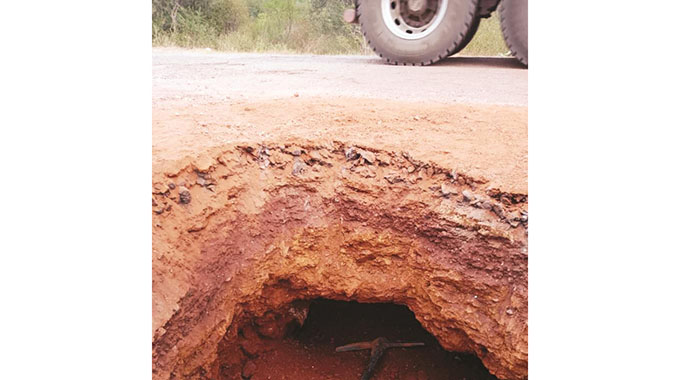

Management said continued monitoring of pricing models in relation to cost volatility enabled the company to gain more ground in the mining sector while at the same time consolidated its market position in the chemicals division.

The main division, the rubber division, saw its volumes decline by 34 percent to 169 tonnes compared with the 257 tonnes recorded in the same period prior year, which management attributed to “shortage of foreign currency and reduced downstream demand.”

Despite the volumes decline, the group reported that the division improved its processes and compared favourably with its regional competitors in terms of pricing and factory turnaround time.

During the period under review, Cernol Chemicals’ volumes at 467 tonnes were 11 percent lower than prior year’s same period volume of 526 tonnes due to the persistent shortages of foreign currency.

But the group said a favourable product mix and pricing opportunities buoyed its turnover to $27 million representing a 132 percent increase on prior year’s $11.6 million on an inflation adjusted basis.

The board decided against declaring a dividend for FY2019.

Comments