Int investor pours $210m into bank

Happiness Zengeni Business Editor—

THE banking sector yesterday witnessed the biggest equity transaction since dollarisation when a high-profile foreign investor, Atlas Mara Co-Nvest, moved to inject US$210 million into ABC Holdings to acquire a majority stake in the banking group. This is a strong sign of confidence in efforts by the Government to turnaround the economy.

The investor immediately pledged to uphold the country’s indigenisation law, proposing to sell part of its equity to ABC chief executive Doug Munatsi and his local partners.

Market watchers say the deal will restore hope and confidence in Government’s bid to attract investors at the same time showing the efforts of the new Government to turn around the economy.

Zimbabwe has for more than a decade been hit by negative perception, which has affected its ability to attract investment.

Under the transaction, Atlas Mara has secured agreements to acquire at least 50.1 percent of the issued shares in ABC at a price per share of 82 cents, which translates to a premium of 90 percent.

At the transaction price, Atlas will acquire ABCH for US$210 million, the biggest equity transaction in the country since dollarisation.

As part of its intended positive impact in the turnaround of the economy, Atlas Mara will assist with the injection of US$100 million in additional capital in ABC, US$40 million of which will be deployed in Zimbabwe.

It will also mobiles credit lines and long term financing in excess of US$500 million in the next five years.

In a statement the group said it believed the proposed combination with BancABC and ADC is consistent with Atlas Mara’s strategic objective of building the premier sub-Saharan financial services group.

Particularly relevant are BancABC’s strong brand and multi-country banking platform, its well-respected management team and exciting growth prospects, and ADC’s pan-African vision and execution expertise.

“Atlas Mara looks forward to empowering the existing management teams of both BancABC and ADC to drive future growth and expand across sub-Saharan Africa.”

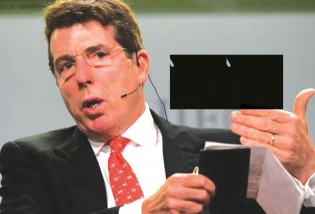

Mr Bob Diamond’s Atlas Mara Co-Nvest will pay a total US$210 million to acquire a majority of ABC Holdings and make a voluntary public takeover offer (by way of an exchange offer) for all outstanding African Development Corporation shares bringing the total value of the deal to US$265 million.

Of the initial amount, Zimbabwean shareholders will be paid US$40 million in cash and US$25 million Atlas Mara shares.

Mr Munatsi, upon completion of the transactions, will join the Atlas Mara Group Executive Committee. Atlas Mara is committed to, following completion of the transactions, provide up to $100 million of equity to BancABC within the first 100 days, to drive its growth going forward, as well as support BancABC’s management in obtaining additional liquidity, including raising capital.

“Atlas Mara’s vision and strategy is to build a leading Pan-African banking platform by partnering with and investing in strong African Banks and African Entrepreneurs,” said the statement.

Atlas Mara was formed by Atlas Merchant Capital led by Mr Bob Diamond who is a former CEO at Barclays plc and Mara Group Holdings founded by Mr Ashish Thakkar, Africa’s youngest billionaire. Atlas Mara listed on the main market of the London Stock Exchange in December 2013 after raising $325 million.

Atlas Mara said it was committed to complying with Zimbabwe’s indigenisation laws and will soon be seeking approval for its indigenous plan. Under the plan, a certain percentage of shares in the local subsidiary will be acquired by Mr Munatsi and his local partners.

“Through this investment, (Atlas Mara) demonstrate that Zimbabwe is a safe and attractive investment destination to the international community and capital markets,” said this firm as it pledged to ease Zimbabwe’s liquidity challenges.

Speaking at the annual results presentation last week, Mr Munatsi said the group would raise tier I capital of $100 million and increase minimum capital in each subsidiary to between $50 million and $100 million by 2015. The group will also arrange credit lines of $200 million to $300 million.

Finance Director Mr Bheki Moyo noted that the banking group was well capitalised with Zambia and Zimbabwe meeting the stringent capital requirements while in Tanzania the capital adequacy ratio at 13,18 percent was within the regulatory threshold of 12 percent.

The transactions are expected to be funded through proceeds of Atlas Mara’s previously completed IPO and the issuance of Atlas Mara shares.

Atlas Mara shares and warrants have been suspended from the London Stock Exchange with immediate effect.

The combination of the three groups will create an entity with a highly scalable growth platform across the SADC region, an important growth region with annual GDP of over $640 billion, ranking it amongst the top 20 GDPs worldwide and a well-positioned banking group capable of offering a broad range of banking products, including corporate banking, treasury services, retail and SME banking, asset management and stock broking.

Mr Diamond, Co-Founder and former CEO of Barclays plc, said: “When we founded Atlas Mara, we did so with the intention of identifying and partnering with exceptional multi-country African financial services companies.

“Our objective is to build Africa’s premier financial services group leveraging the access to capital, liquidity and funding that we at Atlas Mara can provide. I am delighted that we will be merging with such high quality organisations as BancABC and ADC.”

“Our future growth will be based on expanding on Dirk Harbecke’s vision at ADC and on the foundation created by Munatsi and his team at BancABC, who have built a fast-growing, prudently-managed, African banking institution.”

Mr Ashish J. Thakkar, Director and Co-Founder, said: “With this transaction, Atlas Mara is well-positioned to collaborate in a synergistic manner with other partners in sub-Saharan African countries and to expand the combined group’s portfolio of banking products and value added services.

With the combination of BancABC’s regional expertise, ADC’s initial platform and Atlas Mara’s global experience, we are confident we can build a true African financial services institution that addresses the needs of our people across the continent and creates a meaningful and lasting positive impact.”

In the short to medium term ABC will seek to grow market share to 5 percent-10 percent in all banking operations by 2015. Mr Munatsi also said they are targeting cost to income ratio of under 50 percent in all banking operations by 2015.

The group declared a dividend of 2.1cents after posting a 49 percent increase in profit to BWP198 million compared to BWP133 million.

Comments