ZAMCO repays $1,2bn debt to acquire NPLs

Business Reporter

The Zimbabwe Asset Management Company (ZAMCO) has fully repaid the $1,2 billion loan it received from Government to acquire non-performing loans (NPLs) from banks to deal with the threat of systemic risk and enhance the institutions’ role of financial intermediation.

The role of ZAMCO in dealing with NPLs has helped improve and enhance the capital adequacy and earnings of banks through removal of toxic assets.

ZAMCO acquired the NPLs at a discount and restructured the loans, including by giving the debtors flexible and more time to repay, which gave the entities some breathing space, time to recover and also prevented total default on the bad loans.

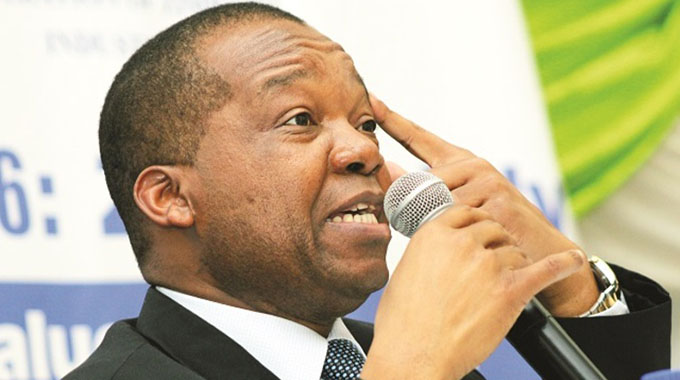

Presenting the Monetary Policy Statement on last week Reserve Bank of Zimbabwe (RBZ) governor Dr John Mangudya said the improvement in banks’ asset quality had been phenomenal.

Dr Mangudya said the acquisition of NPLs and their replacement with risk free assets (treasury bonds) had provided banks with earning assets that could be used by the institutions to unlock liquidity as security.

“ZAMCO has managed to pay off its obligations of $1,2 billion to Government ahead of the sunset time of 2025 and plans to wind off its operations in line with section 57A of the Reserve Bank of Zimbabwe Act are underway,” Dr Mangudya said.

ZAMCO was established by the RBZ in July 2014 to deal with systemic risk that was posed by rising NPLs in the local financial services sector, which had also resulted in banks reducing lending to productive sectors of the economy to avoid accruing more bad loans.

The company acquired most of the NPLs held by banks, which belonged to companies that were strategically important to the economy and demonstrated potential to be turned around if the constraints of costly debt were removed.

At the time, NPL levels had peaked at around 20 percent, way above the global benchmark of 5 percent and below, which makes it possible for banks to operate with the risk of lending to clients that eventually do not honour their debt obligations .

Latest central bank data shows that the average non-performing loans (NPLs) to total loans ratio has remained low at 0,55 percent as at June 30, 2021, against the international benchmark of 5 percent, which showed “sound credit risk management systems and internal controls,” said the RBZ governor.

Dr Mangudya also indicated in the MPS that the local banking appears to be in a sound state.

Zimbabwe’s banking sector has largely remained adequately capitalised, with an aggregate core capital of $57,54 billion as at June 30, 2021, an increase of 8,09 percent, from $53,18 billion as at the close of 2020.

And banking sector average capital adequacy and tier one ratios of 35,32 percent and 25,05 percent respectively, were above the regulatory minima of 12 percent and 8 percent, respectively.

The banking sector’s solid position is also reflected by total banking sector loans and advances, which increased by 73,27 percent from $82,41 billion as at the end of last year to $142,79 billion as at the end of the first half of 2021.

Dr Mangudya said financial intermediation remained stable as shown by a loans-to-deposits ratio of 45,84 percent.

“This position reflects that there is scope for banking institutions to enhance their financial intermediation role. The banking sector continued to support the productive sectors of the economy, as reflected by the ratio of loans to productive sectors to total loans 80,89 percent as at 30 June 2021,” he said.

Comments