Wall Street slips as geopolitical risks gather, earnings loom

NEW YORK. – US stocks edged lower yesterday as investors assessed uncertainty stemming from rising geopolitical tensions and the upcoming corporate earnings season.

The United States launched missiles at a Syrian airfield last week to retaliate a deadly chemical attack on civilians.

The strikes pushed President Donald Trump, who came to power in January calling for warmer ties with Syria’s ally Russia, and his administration into confrontation with Moscow.

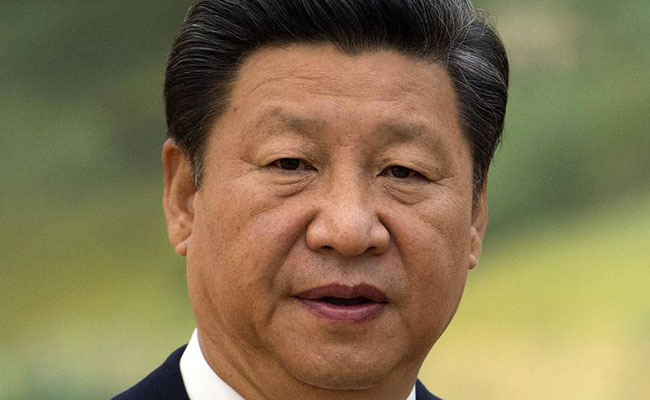

Also, Chinese President Xi Jinping called on the US for a peaceful resolution with North Korea, which has warned it would launch a nuclear attack if provoked by the United States, as a US Navy strike group headed toward the western Pacific.

The S&P 500 fell below its 50-day moving average, while the price of gold and VIX, Wall Street’s fear gauge, rose to their highest levels since November.

At 10:57 am ET, the Dow Jones Industrial Average was down 52.9 points, or 0,26 percent, at 20,598.4, the S&P 500 was down 7.27 points, or 0,31 percent, at 2,346.51 and the Nasdaq Composite was down 19.45 points, or 0,33 percent, at 5,847.32.

Earnings are likely to be the next catalyst for the market. The big banks, which have outperformed in a post-election rally since November, are of particular interest as investors fret over valuations amid a lack of clarity on Trump’s ability to deliver on his pro-growth policies of tax and regulatory cuts.

Financials were the worst hit yesterday. The S&P 500 financial index .SPSY tumbled 0,91 percent, setting it up to post the fourth straight day of decline.

“Technically, we are due for a breather and if the earnings season disappoints, it could provide the correction that we need,” said Josh Jalinski, president of Jalinski Advisory Group.

JPMorgan, Citigroup and Wells Fargo are scheduled to report results today, which will be the last trading day of the week on Wall Street ahead of the Good Friday holiday. Seven of the 11 major S&P sectors were lower.

Utilities .SPLRCU, real estate .SPLRCR and consumer staples .SPLRCS, defensive sectors with slow but predictable growth, rose. Chipmaker Qualcomm dropped 2,8 percent to $53.81 after it was asked to refund Canada’s BlackBerry $814,9 million in an arbitration settlement.

Delta Air Lines was up 3,5 percent at $46,90, boosted by a quarterly profit beat. Declining issues outnumbered advancers on the NYSE by 1,869 to 846. On the Nasdaq, 1,832 issues fell and 776 advanced.

The S&P 500 index showed nine 52-week highs and no new lows, while the Nasdaq recorded 40 highs and 24 lows. –Reuters.

Comments