Trump may trash a strong dollar but he’s a boon for bulls

For all of Donald Trump’s complaints about the dollar’s strength, he may have himself to blame.

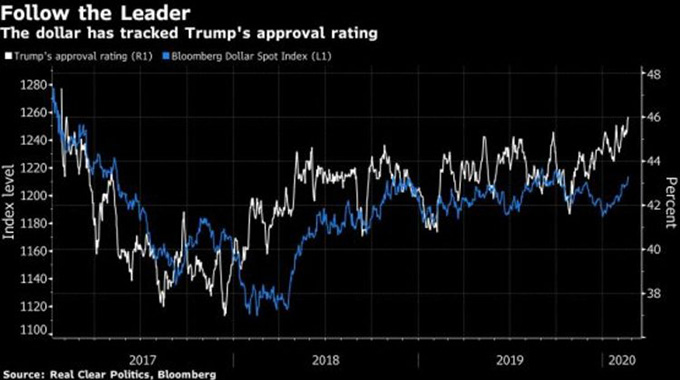

One theory behind the greenback’s 2,5 percent climb so far this year has to do with the US president’s soaring approval rating.

While concerns about the coronavirus have certainly increased the demand for so-called safe haven assets like the dollar, there has also been a 70 percent correlation between Trump’s popularity and the US dollar since his election, according to calculations from TD Securities.

That relationship has come into sharper focus as Trump’s approval rating has shot to 46 percent, the highest in three years, according to Real Clear Politics.

It mirrors a similar relationship noted by Wall Street analysts as well between equities and Trump’s rising odds of re-election, as measured by prediction markets.

The US currency has been more closely tracking stocks rather than falling Treasury yields, which would typically drag down the dollar, said Mark McCormick, global head of FX strategy at TD Securities.

“Regardless of how Trump feels about the dollar, he’s been good for the buck,” he wrote in a report. “It’s likely the case that US risk assets, and by extension the US$, prefer the status quo to a progressive shift in the White House.”

The Bloomberg Dollar Index rose 0,1 percent to the highest in more than four months during Asian trading yesterday.

2020 Election Is Playing Out Well for Stocks: Wall Street Votes

The Trump campaign has floated the idea of another round of tax cuts and, if re-elected, he would likely pursue a sizable infrastructure package, McCormick said.

Similarly, a more centralist candidate such as Michael Bloomberg, who has been rising in the polls, would be “unlikely to upset the apple cart.” A progressive like Bernie Sanders, on the other hand, could pose a significant risk, the strategist said.

“Expect more two-way risks ahead,” McCormick said. — Bloomberg.

Comments