Treasury cuts fuel levy to support price freeze

Tapiwanashe Mangwiro and Panashe Nyamudeza

Treasury has cut the fuel levy on fuel imports by between 34 and 63 percent per litre, as it moved to prevent any further cost driven price increases in the country, which may have negative impact on slowing inflation.

Finance and Economic Development Professor Mthuli Ncube effected the cut after amending section 22H of the Finance Act provisions on the NOCZIM Debt Redemption and Strategic Reserve Levy.

The existing legal provision was amended through Statutory Instrument 254A of 2021.

Motorists have often bemoaned what they termed “inflated prices” due to the many taxes levied on fuel imports. To support his announced fuel price freeze in November, Minister Ncube has cut the fuel imports levy substantially.

As such, he said with effect from November 11, 2021 up to December 10, 2021, and in terms of section 22H (“NOCZIM debt redemption and strategic reserve levy) of the Finance Act, as amended by SI254A of 2021, the levy would be calculated at 0,047 per US dollars per litre of diesel or 0,057 US dollars per litre of petrol.

In terms of the SI254A of 2021, published in the Government gazette of November 11, 2021, the provisions apply to any person licensed by the minister responsible for energy to import the petroleum product in bulk.

Minister Ncube told delegates at the Zimbabwe Investment Conference in Glasgow, Scotland, recently that fuel prices in Zimbabwe would remain unchanged for the remainder of 2021.

“With oil hovering at US$85/barrel it affects us as fuel net importers and it affects the costs of doing business, we are aware of those problems.

“For those of us going back to Zimbabwe, I can say we are likely to see the price of fuel unchanged this month (November) and next month (December),” Minister Ncube said.

In October, Zimbabwe Energy Regulatory Authority (ZERA) hiked the price of diesel from US$1,34 to US$1,38, while that of petrol went to US$1,40 up from US$1,38.

Duty contributed US$0,30 to the cost of every litre of fuel imported via pipeline and US$0,35 per litre for fuel imported through road haulage.

Other costs, ZINARA road levy (US$0,06), carbon tax (US$0,04) and other taxes; including the NOCZIM debt redemption tax are then added to take the total taxation to US$0,49 per litre consumed locally.

Businesses in the petroleum value chain, especially the thriving retailers, will then pay ZERA licence fees and additional taxes levied on operating income.

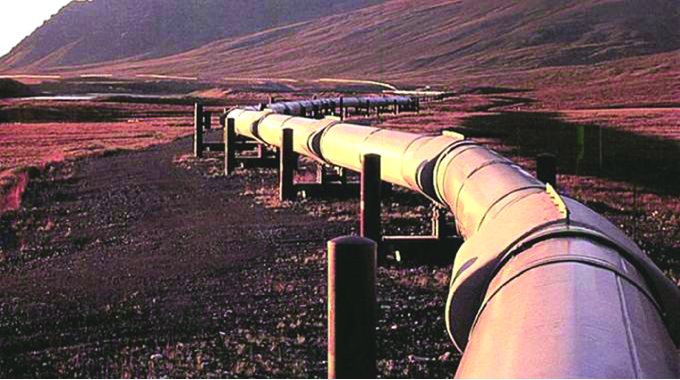

Close to 90 percent of the fuel imported in Zimbabwe is transported via the Beira to Harare pipeline while 10 percent is imported by independent petroleum companies by road.

Comments