SECZ tightens disclosure rules

Golden Sibanda Senior Business Reporter

Golden Sibanda Senior Business Reporter

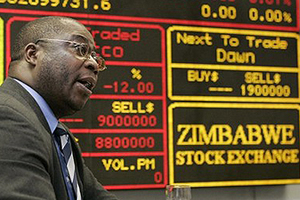

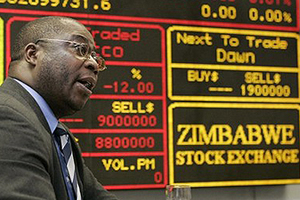

THE Securities Commission of Zimbabwe says it is in the process of tightening disclosure rules for public listed companies to protect the interests of vulnerable shareholders. While it has made great strides in improving disclosure of material information by listed companies, SECZ remains worried by the passiveness of most shareholders in protecting their interests.

Already, SECZ has revamped and enhanced regulations and frameworks governing licensed entities such as the Zimbabwe Stock Exchange and stockbrokers to monitor compliance.

The securities and exchanges supreme authority has also facilitated the expedited installation of an electronic trading platform and establishment of a central securities depository.

Listing rules are also being reviewed to improve disclosure of material information to help investors to make informed decisions about their investments in virtually all public listed companies.

When completed, the financial disclosure framework will compel directors to immediately and adequately disclose to the market important material information once a board has made a decision.

SECZ chairperson Mrs Willia Bonyongwe in an interview yesterday said they were looking at a whole spectrum of issues to put Zimbabwe’s capital markets at par with other standard global exchanges.

“The disclosure framework will have been enhanced when all other rules have been gazetted. Listing rules are being reviewed and will be completed by the first quarter of next year,” she said.

The regulator said cautionary statements should provide adequate information about material developments in a company for shareholders to make informed decisions about their investment.

She also pointed out that material information should be announced as soon as directors have made a decision as there is the danger they may reveal it some parties at the expense of others.

SECZ has already directed the ZSE to set up a review committee in partnership with the Public Accountancy Board to look at financial statements and order republication where deficiencies are noted.

It contends that while tightening the disclosure and regulatory framework is meant to protect all investors, often, it is the fragmented and powerless minorities who suffer from abuse of systems.

In most cases, related party transactions between major and influential shareholders take place in companies in front of minorities who are made to ratify the deals or are simply rolled over.

Companies that have already borne witness to the disclosure framework SECZ is working on include Masimba, African Sun and Lifestyle Holdings which had their results reviewed by a review panel.

As part of the continuous and extensive measures to raise Zimbabwe’s capital markets regulatory systems to global standards, SECZ also wants directors to understand their duties.

And besides full appreciation of board of directors fiduciary duties, SECZ says measures should be taken to ensure that directors have the skills to effectively discharge their fiduciary duties.

Mrs Bonyongwe expressed strong reservations about the lack of desire among investors or shareholders such as insurance firms and pension funds in making directors accountable for their actions.

She said most investors go to extraordinary general meetings and annual general meetings but never question the conduct of directors or simply endorse majority shareholders agendas and proposals.

“When shareholders go to AGMs and EGMs nobody questions directors even when (as SECZ) say majority shareholders should not vote, the people we are trying to protect do not do anything. People need to follow their money by taking board members to account,” she said.

Comments