SECZ launches C-Trade

Tawanda Musarurwa

C-Trade, the online and mobile shares trading platform was launched yesterday effectively opening up Zimbabwe’s capital markets to all and sundry.

It’s the first of its kind in the Sub Saharan African region. The platform will enable investors, both local and foreign to purchase securities from anywhere in the world anytime, using mobile devices.

The initiative is being led by capital markets regulator, Securities Exchange Commission of Zimbabwe (SECZ) and seeks to promote financial inclusion by encouraging participation by the smallest retail investor. Prior to the launch of C-Trade, only around 7 000 individuals were active on the local capital markets.

Zimbabwe has a population of over 14 million. SECZ chief executive Tafadzwa Chinamo said C-Trade will open the markets to “virtually everyone”.

“C-Trade is significant; it’s a game-changer set to alter how we perceive and interact with stock markets. For today it becomes a reality for millions of Zimbabweans who for so long thought it unimaginable to the stock market literary at their fingertips with the option to partake in and enjoy the benefits of deploying their money with unprecedented simplicity as investors,” said Mr Chinamo.

“All one needs to access this hitherto select market is an ID number, bank account or cell phone number for those who opt not to use their bank accounts. This makes our market reachable by virtually every adult on the planet. How many more potential investors can one wish for?”

The platform allows one to place an order to buy or sell shares listed on the stock exchange; view the shares that one owns on one’s Internet-enabled device, access to real-time market data such as prices of shares, volume traded, bids, offers and integrates or links the investor, the broker, the ZSE and the Central Securities Depository (CSD).

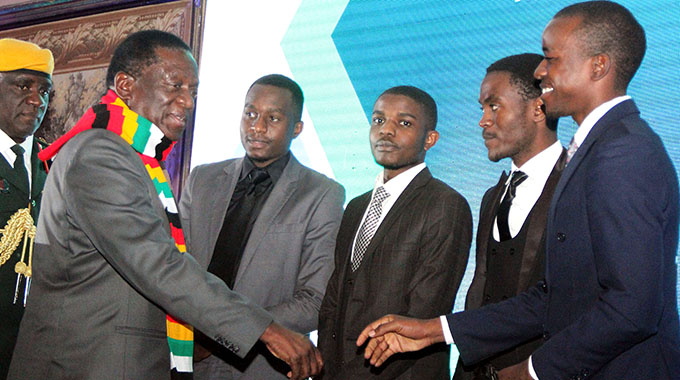

Officiating at the launch, President Mnangagwa said the C-Trade initiative will both widen and deepen the country’s capital markets.

“This is indeed another milestone achievement in the financial services sector as this platform will allow a broader spectrum of our society to directly trade and invest on the Zimbabwe Stock Exchange.

“The adoption of mobile and online trading will result in a larger volume of traffic to the stock market due to the added convenience in transacting. The mobile trading, because of its wide reach will encourage participation at grassroots level as well as among the small retail investor, thus widening and deepening the scope of capital markets,” said President Mnangagwa.

“This development is further set to deepen financial inclusion in the capital markets through the use of the C-Trade platform and its attendant online and mobile application, which can be utilised by mobile network subscribers.

“The C-Trade platform resonates well with our mantra that ‘Zimbabwe is open for business,’ as it aims at harnessing, promoting and opening up financial markets for broader participation with increased convenience and ease.

“The C-Trade platform is coming against the backdrop of the recent commissioning of two banks meant to financially empower women and the youths — the Zimbabwe Women Microfinance Bank and Empowerment Bank.

“These initiatives are in line with the four-year financial inclusion strategy, which my Government launched aimed at improving access to financial services and the achievement of inclusive economic growth to benefit the majority of our people.”

The technical partner for the mobile share trading platform is Escrow Systems, a unit of the Escrow Group that provided the technical solution for the mobile traded retail bond in Kenya last year.

The system will allow for mobile trading of both bonds and shares. C-TRADE is an end to end innovation that harnesses and promotes participation of every type of investor on the Zimbabwean stock markets, through mobile and Internet-based platforms while linking all capital markets participation.

Through the new initiative, small retail investors, right up to the largest institutions, can have direct access to the equities markets.

The ZSE and the Financial Securities Exchange (Private) Limited (FINSEC) already have systems in place that list and trade bonds. Debt listing rules have since been gazetted and paved way for the listing of bonds.

Comments