SADC develops regional mobile money platform

Tawanda Musarurwa Senior Reporter

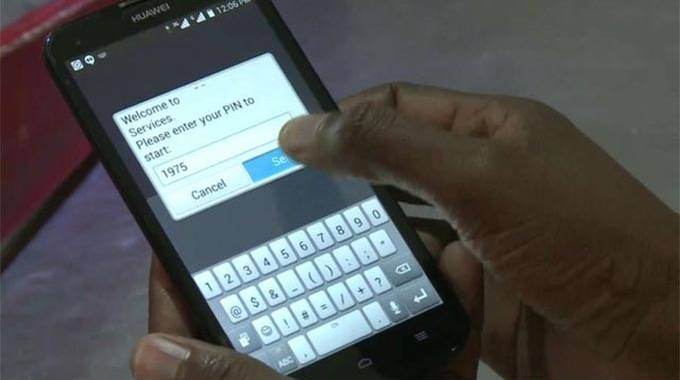

The Southern African Development Community (Sadc) region is working to introduce a mobile money transfer system for the bloc.

Mobile money has evolved as a utility to provide financial services largely to the unbanked population.

According to Zimbabwean banker and chairman of the Sadc Payments Scheme Management Body Andrew Mugari:

“We are running a pilot to enable customers to transfer funds to any SADC country using mobile phones which will bring further convenience to the customers in the SADC region.

“Two banks, ZB Bank in Zimbabwe and Zanaco in Zambia as well as Mobile Network Operators (MNOs), Mukuru and Terrapay in South Africa as well as Airtel in Malawi are involved in the pilot tests.

“Once successful, we will roll-out to all member regional banks and MNOs and this is part of a financial inclusion strategy in the region.”

Financial services market analysis firm FinMark Trust, has since developed Mobile Money Guidelines to assist SADC Member States with principles to facilitate the harmonisation of their legal and regulatory frameworks for mobile money, in support of greater financial inclusion and market development in the SADC region.

Currently customers are able to transfer funds real time to any SADC country using the SADC Real Time Gross Settlement (RTGS) system.

Zimbabwe has 14 banks on the SADC RTGS system, previously called SIRESS and it has the highest number of banks on the platform followed by South Africa with 11 banks.

The current settlement currency is the rand but the system is open to other regional currencies.

The region is also working towards including the US dollar on the platform.

In total there are 83 banks on the SADC RTGS platform and more banks are joining.

“The major benefit to customers is that they get same day value and therefore we urge customers in Zimbabwe to make use of this system.

“When they approach banks, they should request that their payments go through the SADC RTGS system.

“We are also working towards making the platform very cheap for customers when they make cross border transactions,” said Mr Mugari.

SADC commercial banks met in Angola earlier this month to discuss issues on how to enhance the regional RTGS platform.

The SADC Payments Scheme Management Body derives its mandate from the Finance and Investment Protocol which was signed by SADC Heads of States in Maseru, Lesotho, in August 2006.

The SADC payments project seeks to promote payments regional integration and harmonisation.

Comments