Rhodium the new PGM king

Looking at the share price charts of Implats and Amplats, you’d imagine the lockdown had no impact on production whatsoever.

That’s not true: Amplats suffered a 25 percent drop in production in the first half to June, and reported a 585 000 ounce Covid-related loss of output. The impact on Implats was less severe, with tonnage and refined output down 14 percent due to Covid-19 for the full year to June.

The results announced last week by Implats were stunning. Buried in the detail is the impact of a formerly insignificant metal called rhodium, which accounts for just 6.5 percent of Implats’s output but 25 percent of revenue. It’s a similar story at Amplats, where rhodium accounts for 7.5 percent of platinum group metal (PGM) output but 34 percent of revenue.

The rise of rhodium

In January rhodium prices were already considered absurdly high at over $8 000/oz, with many analysts expecting a correction. That has not happened.

Not by a long shot. This week rhodium traded at $13 300/oz, a 10-fold rise over the last decade.

Platinum, on the other hand, is down nearly half since 2010. The palladium price is up eight-fold over the same period.

Platinum has been steadily eclipsed by what were previously considered by-product metals — rhodium and palladium. Ironically, platinum fell victim to its own success, having traded at a high of over $2 200/oz in 2008 during the commodity super-surge.

Manufacturers started switching to palladium, used in the manufacture of autocatalysts for petrol-driven vehicles, which traded at a substantial discount to platinum a decade ago.

This brought Russia firmly into the PGM driving seat as it had stockpiled palladium for years as a by-product of its nickel mining. Those stockpiles were unwound over the next few years, and as demand started to outstrip supply, the palladium price shot up more than four-fold.

Huge impact

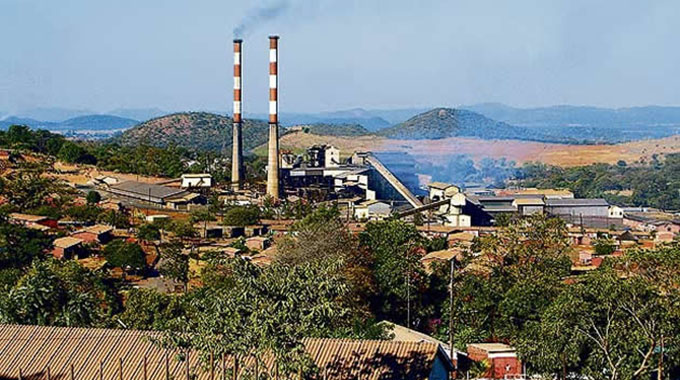

SA producers account for more than 80 percent of global rhodium supply, a result of the relatively unique PGM geology in the sub-continent.

This is reflected in the latest results from Implats, which reported a four-fold increase in free cash flow for the year to June – with palladium accounting for 37 percent of its revenue, rhodium 25 percent and platinum 27 percent.

Johan Theron, Implats group executive for corporate relations, explains how a little bit of rhodium goes a long way.

“The importance of rhodium has exploded since the VW emissions scandal (where VW was found to be fiddling emissions from its vehicles) Rhodium used to be a relatively insignificant part of our total business mix, but now it is substantial, because it is used as autocatalyst element for both diesel and gasoline vehicles to reduce nitrous oxide emissions. Stricter emission standards on both diesel and petrol vehicles have pushed the rhodium price to where it is today.”

Historically, platinum accounted for about 75 percent of Implats’s revenue. It now accounts for slightly less than half of all PGM ounces produced but just 27 percent of revenue. The changing dynamics of the PGM market, and a steady shift away from diesel, are reflected in the financial performance of producers.

At the PGM Industry Day in Johannesburg this week, Minerals Council of SA chief executive Roger Baxter outlined the devastation caused by the lockdown to PGM production – by June, it was down about half since the start of the year, though producers say production has ramped up substantially since then.

Baxter also highlighted the risks facing PGM producers who face unrelenting inflation pressures while changes in rand PGM prices are subject to wild swings.

For now, the inflationary pressures are overwhelmed by lofty commodity prices. PGM producers will be hoping rhodium and palladium’s crazy run is far from over. – Reuters

Comments