Prospects of VFEX bright

Enacy Mapakame Business Reporter

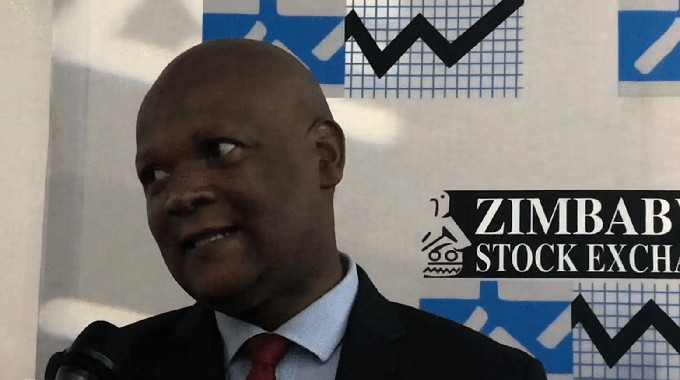

Zimbabwe Stock Exchange (ZSE) chief executive officer Mr Justin Bgoni has commended progress made by the Victoria Falls Stock Exchange (VFEX), saying prospects were bright as more listings were in the pipeline.

The US dollar denominated exchange was launched in October last year to enable companies to raise capital in foreign currency for their expansion projects as well as for importation of raw materials and equipment.

Speaking at the recently held Capital Markets Awards hosted by Financial Markets Indaba (FMI) and The Herald’s sister paper Business Weekly, Mr Bgoni said the exchange, which is a subsidiary of ZSE, had made commendable progress and was upbeat of more listings given the tremendous number of enquiries from counters and investors.

“The whole process for a company to list takes a long time. So far we are happy with progress made and more importantly, we are happy about the enquiries we are getting from the market. There is heightened interest from the market,” he said.

Currently, the exchange has two listings – Seed Co International and Padenga Holdings – but enquiries have reportedly grown, including from the mining sector, to join the bourse.

The exchange was introduced to address some of the glaring challenges that businesses and investors faced on the ZSE, which also deterred investment.

“There are very few new listings on the ZSE. Stock exchanges allow companies to raise capital.

“If you look at the companies on other exchanges especially during the Covid-19 period, there was a lot of capital raising but not on ZSE, and there are a number of reasons for that and one of them is currency issues.

“That is why we launched VFEX to allow companies to raise capital for their expansion projects.

“Normally, when companies in Zimbabwe raise capital, they are looking at importing or expanding their businesses and therefore want hard currency.

“The other issue is the ability to take money out of the country if you are a foreign investor, this has been very difficult on the ZSE although it has slightly improved following the introduction of the (RBZ) auction system. But traditionally it has been very difficult, so it is easier when you settle shares in hard currency on the VFEX.

Capital markets regulator — Securities and Exchange Commission of Zimbabwe (SecZim) chief executive officer Tafadzwa Chinamo weighed in saying the move to have another exchange that trades in hard currency was meant to address the challenges on the ZSE as well as building a competitive capital markets.

Trading on the VFEX commenced on October 26, last year with one counter Seed Co International, before Padenga joined this year. By year end, more listings are expected with resources group — Caledonia expected to debut on the exchange by December 1, this year.

Experts in the capital markets and mining sector say the exchange has potential to become a game changer in a country endowed with vast mineral resources as it trades in hard currency and therefore a good funding mechanism for the mining sector, which is seen as an enabler for economic growth.

As such various incentives have been put in place to increase its allure among other African exchanges.

For instance, withholding tax for companies that list on the VFEX will be less than others at 5 percent, while those on the ZSE is 10 percent. For non listed companies, withholding tax is pegged at 15 percent.

Comments