Proplastics seeks removal of import duty

Business Reporter

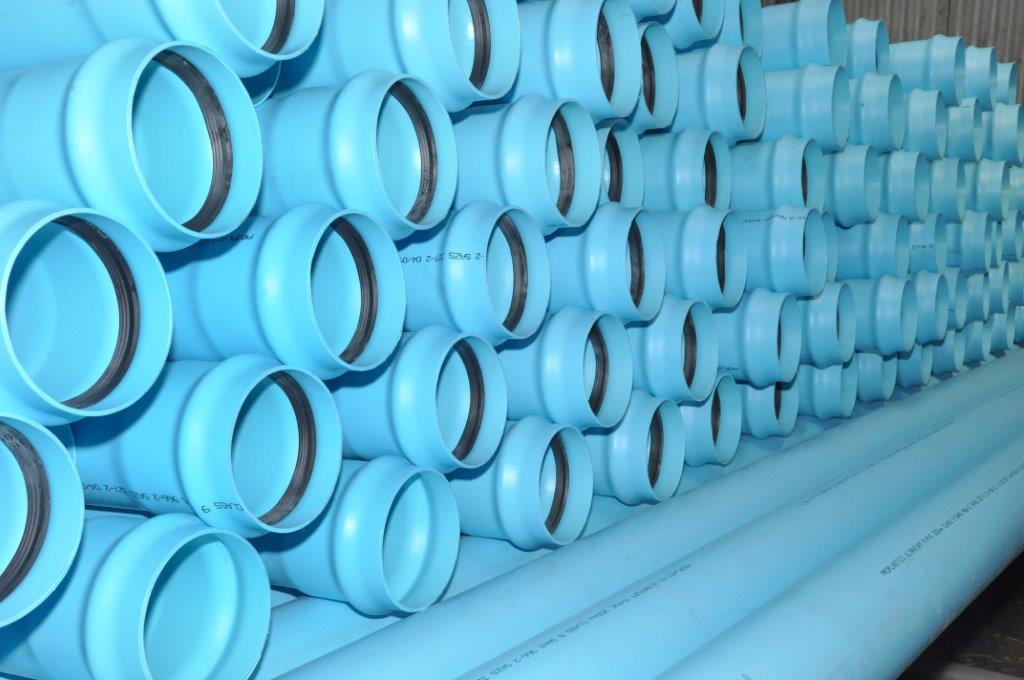

Plastic pipe manufacturer, Proplastics is lobbying Government to remove duty on imported raw materials used in plastic pipe manufacturing in order to create a level playing field with regional competitors. Proplastics managing director Kudakwashe Chigiya told analysts that paying duty on raw materials has rendered locally produced products uncompetitive compared to regional counterparts.He said the company welcomes the recently introduced import restriction under Statutory Instrument 64 of 2016 and sees it as a temporary measure aimed at keeping the industry wheels turning.

“We have lobbied Government to consider scrapping duty on our raw materials considering that almost 80 percent of our raw materials are imported.

“We also welcome the recently introduced SI 64 but we will not focus much on that because we see it as a temporary measure and all we need to do is to improve our production for us to be able to compete with our regional competitors,” said Mr Chigiya.

Proplastics’ revenue for the six months to June 2016 dropped 11 percent to $5,8 million from $6,6 million of the same period last year on the back of reduced selling prices as the group adopted a strategy to trim margins and drive volumes.

The drop in revenue for the period saw the company posting a 65 percent decrease in profit at$91 200 from $262 800 of the comparative period last year.

Proplastics’ gross profit margins eased to 21 percent from 22 percent in the prior year, as the drop in selling prices was largely offset by improved factory efficiencies.

Despite all the negative challenges experienced during the period under review, volumes were maintained at last year’s levels.

“Gross profit for the period was down 15 percent to $1,2 million largely driven by the drop in sales. We anticipate that the introduction of new machinery will increase production efficiencies thus lowering unit costs further,” said Proplastics finance director Paschal Changunda.

Overheads for the period grew 11 percent as the group incurred some staff rationalization expenses in order to align staff levels to current business volumes.

Finance costs were 15 percent below prior year on the back of favourable rates on borrowings. EBITDA dropped 33 percent to $529 097. The statement of financial position for the company remains strong with total assets amounting to $11,9 million.

Mr Changunda said improved credit control procedures and stringent working capital management resulted in improved cash flow generation by the business. Cash and cash equivalents at the end of the period amounted to $984 454, which is a sound position is given the plant replacement programme over the last two years largely funded from internal resources.

Mr Chigiya said new efficient moulds (seven of them) were commissioned in the first quarter while a new PVC plant acquired in the second half of this year is being commissioned.

“The two investments will significantly improve efficiencies in the factory and ultimately overall equipment effectiveness and pricing.

“This marks the beginning of a slowdown in capital investment as we reach the tail end of our modernization programme. The new equipment will also support our drive for exports,” said Mr Chigiya.

Despite the persisting economic challenges, Mr Chigiya said demand for the Group’s products has started to pick up again and is still under pinned by housing development projects and the rehabilitation of the old piping infrastructure.

“As reported in prior year, these projects are being carried out through private public partnerships and non-governmental organisations. In addition, recent orders for mining projects have been very encouraging and will bolster the performance in the second half of the year,” he said.

Comments