President calls for demonetisation

News Editor

News Editor

President Mugabe yesterday officially invited those holding on to Zimdollar notes to take them to banks, starting Monday, in exchange for US dollars as Government moves to remove the legal status of the local currency.

The President made the notice in Statutory Instrument 70 of 2015 titled: “Reserve Bank of Zimbabwe (Demonetisation of Notes and Coins) Notice 2015”, that was published in the Government Gazette yesterday.

“All notes and coins issued by the bank (Reserve Bank of Zimbabwe) before 2008 are hereby demonetised with effect from the date of publication of this notice,” said President Mugabe.

“The bank shall pay any person who was the holder of a Zimbabwe dollar denominated account at a banking institution on the 31st December 2008 at the following rates —

“(a) five United States dollars for every account that was held with a balance of up to one hundred and seventy-five quadrillion Zimbabwe dollars; and

“(b) for any Zimbabwe dollar balances above the amount stated in paragraph (a), one United States dollar to thirty-five quadrillion Zimbabwe dollars.”

President Mugabe said no banking institution would make any charge or deduction in connection with any payment made in terms of the gazetted notice.

“Payments by the bank in terms of sections 3 and 4 shall be made not sooner than the 15th June and not later than the 30th September, 2015,” he said.

“Provided that the bank may, in its sole discretion and for good cause shown, continue after the 30th September 2015, to make payment for the said notes.”

Government adopted a multi-currency system in February 2009 in response to spiralling inflation which reached 231 percent at the last official count in July 2008 after the decimation of the Zimdollar by ravages of sanctions.

Zimbabwe now uses currencies which include the US dollar, South African Rand, Botswana Pula, British Pound, Euro, Chinese Yuan, Japanese yen and Austrian dollar.

Zimdollar notes holders will exchange them at any bank, building society, POSB and Zimpost.

For walk-in clients, the process is split into two categories involving the last sets of notes issued in 2008 and 2009.

Denominations of between ZW$5 and ZW$ 500 will be paid for at US dollar exchange rates of up to US$2.

The rate for ZW5 will be US$0,02, ZW10 at US$0,08, ZW20 at US0,08, ZW$50 at US$0,20, ZW100 at US$40c and ZW$500 at $2.

During 2009, the RBZ slashed 12 zeros from the local currency as hyperinflation continued to erode its value and the removal of the zero resulted in ZW$1 trillion becoming one Zimdollar.

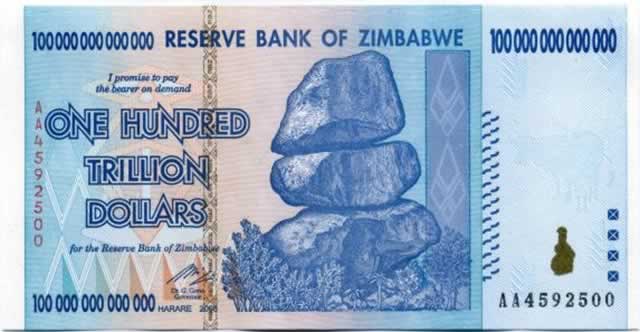

Under the second category, notes issued in 2008 ranging from ZW$10 trillion to ZW$100 trillion to be paid for at the US dollar exchange rate of up to US$0,40, Dr Mangudya said.

The ZW$10 trillion will fetch US$0,04, ZW$20 trillion US$0,08, ZW$50 trillion US$0,20 and ZW$100 trillion will be offset at a rate of US$0,40.

Cash customers will get their exact US$ equivalent of the converted amount, starting from US$0,01c up to $50 and where the US$ equivalence exceeds US$50, payments will be made through banks.

Corporate customers’ US$ equivalents will be credited into their bank accounts.

For account holders, banks will pay the equivalent US dollar amount for each account balance as at December 31 2008.

Customers whose banks were placed under curatorship will deal with curators, while institutions that were placed under liquidation will deal with the Deposit Protection Corporation.

Reserve Bank of Zimbabwe Governor Dr John Mangudya has since reiterated that the return of the Zimbabwe dollar would only be considered when key economic fundamentals such as productivity in key sectors have been achieved.

Comments