Mobile money transfers up 16,3pc

Business Reporter

Business Reporter

Mobile money transfers rose 16,3 percent from $458 million in the third quarter to reach $533 million in the last quarter of 2015, latest official statistics show.

Since the adoption of multiple foreign currencies in 2009, Zimbabwe has witnessed a proliferation of mobile banking facilities modelled on the one used in Kenya called M-PESA.

A growth in mobile phone usage in the country has also seen other independent service providers joining the sector, offering a wide variety of services.

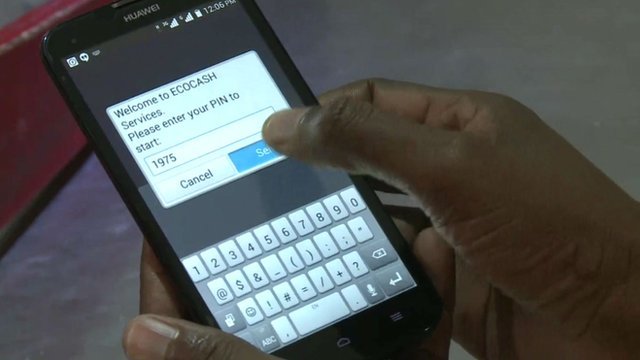

Names such as EcoCash, TeleCash, One Wallet and NettCash, mobile money payment platforms are now household names.

In a fourth quarter industry review, the Postal and Telecommunications Regulatory Authority of Zimbabwe (Potraz) said Econet remained the dominant operator in three aspects that is subscriptions, agent network as well as value of transactions.

“The total value of transactions on mobile money platforms increased by 16,3 percent to record $533 067 245 from $458 412 196 recorded in the previous quarter,” it said.

“The number of mobile money subscribers also increased by 9,9 percent to reach 7,3 million subscriptions from 6,7 million subscribers recorded in the previous quarter.”

Potraz said the number of mobile money agents also increased to 33 259 from 29 775 recorded in the previous quarter.

It said cross network transfers were also implemented in the fourth quarter of 2015.

“Mobile money subscribers are now able to send money across all the three networks. A total of $2 256 390 was transferred across the three mobile networks representing 0,4 percent of total transactions.”

The Reserve Bank of Zimbabwe has said at least $61 billion has been moved via mobile money transfers between 2009 and 2014 through 299 million transactions.

Comments