Mobile money rules the roost

Business Reporter

Mobile money volumes dominated the country’s National Payment Systems (NPS) in the last week of March, latest Reserve Bank of Zimbabwe (RBZ) figures show.

The platform is likely to become the payment mode of choice as Zimbabwe nears the end of lockdown extension.

According to data from the central bank, during the week to March 27, the volume of NPS transactions stood at 40,70 million, a 1,88 percent increase from 39,94 million recorded in the preceding week.

The numbers show that mobile transactions dominated NPS transactions volumes, accounting for 83,42 percent, while Point of Sale (POS )accounted for 15,62 percent; Automated Teller Machine (ATM) for 0,26 percent; RTGS dollars (cash) for 0,69 percent and cheques for a mere 0,01 percent.

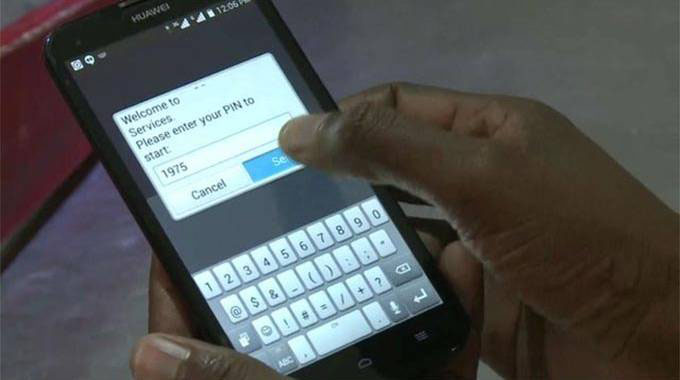

Zimbabwe’s mobile money sphere is dominated by the country’s three mobile telecommunications service providers — Econet Wireless, NetOne and Telecel Zimbabwe.

Econet’s EcoCash platform currently dominates that market. Overall transactions processed through the NPS rose by 14,55 percent to close at $24,78 billion, during the period under review.

RTGS transactions increased from $14,08 billion in the previous week to $16,96 billion, during the week under review.

In value terms, the composition of NPS transactions was as follows: RTGS, 69,68 percent; mobile, 19,62 percent; POS, 10,51 percent; ATM, 0,18 percent and cheque, 0,01 percent.

With the lockdown now in its fifth week, it is largely projected that mobile money usage will increase significantly in terms of both value and volumes, and this should be reflected in upcoming official data from the monetary authorities.

Zimbabwe has been pushing for financial inclusion over the past few years, and the use of mobile money platforms is highly encouraged in this pursuit.

Locally, there are more people with mobile phones than with bank accounts and this provides a good avenue in pushing for financial inclusion.

Latest figures from the Postal and Telecommunications Regulatory Authority of Zimbabwe (Potraz) show that the number of active mobile money subscriptions continued on a growth trajectory, registering a 15 percent growth last year.

According to Potraz data, the total number of active mobile money subscriptions for

the year under review was 7 334 639, representing a growth of 15,5 percent on prior year’s 6 352 552.

Although perhaps not ideal, the Covid-19 response amounts to a significant opportunity for entrenching financial inclusion in the country, largely because of the already widespread use of mobile money.

During the lockdown period, the majority of local banks made sure their systems were always operational to prevent glitches when transacting.

Most banks now have clients’ accounts connected to mobile phone numbers.

Millions of people who did not have access to banking services due to stringent conditions now use their mobile phones for daily transactions.

Comments