It’s time to pay climate debt to countries like Zim, Mozambique

Ben Ehrenreich Correspondent

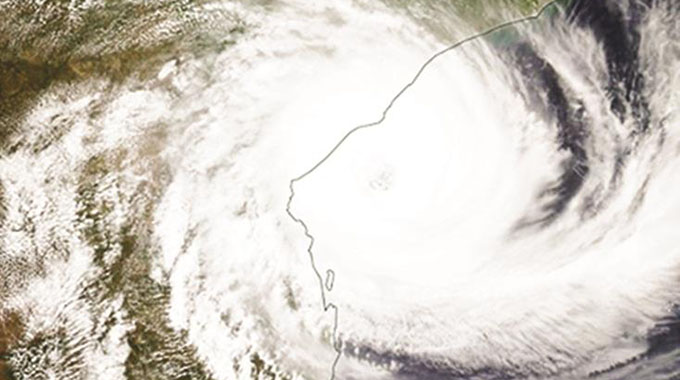

More than a month has passed since Cyclone Idai made landfall on the coast of Mozambique.

Rivers swollen with rainwater overflowed, submerging whole villages.

An entire city — the port town of Beira, with a population of half a million — was all but erased.

Including the casualties incurred in neigh-boring Zimbabwe and Malawi, Idai took more than 1 000 lives and rendered hundreds of thousands homeless.

The floodwaters have receded. Now cholera is spreading.

Bad things happen all the time in places with unfamiliar names. Disaster piles upon disaster: Last month a cyclone, somewhere else a flood.

The newscasters don their most solemn expressions, frown for a quick, respectful pause, and move on.

With Idai, it was a city larger than Oakland or Atlanta, simply washed off the map.

And it will almost certainly happen again. More heat in the oceans means extra energy for storms.

Idai was the seventh of nine cyclones in the southern Indian Ocean this season, more than twice the usual average.

More severe hurricanes are hitting the Atlantic — remember Maria, and the nearly 3 000 killed in Puerto Rico? — and more severe cyclones are forming in the Indian Ocean.

Many more people will die. Others will profit.

The latter, insists Dipti Bhatnagar, a climate activist in the Mozambican capital of Maputo, have a bill to pay.

For years, Bhatnagar, who works for the environmental NGO Friends of the Earth International, has been talking and writing about climate change in terms of debt arrears owed by the planet’s rich to its poor.

It is, as she puts it, elementary “climate finance”.

Profits flow swiftly in one direction while costs pool up somewhere else.

The balance is long overdue, because climate change is not just weather: It is systems, markets, financial networks, deals struck between government ministers and corporate executives or bankers, inequities that have the same contours now that they had centuries ago, when it was European gunships, not storms, that brought death from the sea to the shores of Africa.

From where Bhatnagar sits, the balance sheet is easier to read than it is elsewhere on the globe.

Mozambique is, by the IMF’s reckoning, the sixth-poorest country in the world.

Most people earn about $1,30 a day. Less than 30 percent of the population has access to electricity.

Carbon emissions are low: The average citizen of Mozambique is responsible for 55 times less carbon emissions than the average American.

Seen from another angle, though, Mozambique is filthy rich.

Earlier this decade, the Italian multinational Eni discovered enormous quantities of liquid natural gas (LNG) — 85 trillion cubic feet — off Mozambique’s northwest coast.

If money has a smell, it smells like LNG, which is mainly methane and smells like something you would be ashamed to release in close quarters.

Every major oil company you can think of has jumped in to get its fingers on Mozambique’s gas: ExxonMobil, British Petroleum, Shell, Chevron, plus major energy companies from Norway, Japan, India, China, Thailand, France, Portugal, and Brazil, to name just a few.

Big projects involve big financing, so big banks — from Switzerland, France, the United Kingdom, Russia, China, and Korea — are making sure to take a cut as wealth flows malodorously out from beneath Mozambican waters.

All for the noble cause of shipping fuel to much, much richer countries, where its combustion will further endanger and impoverish the people of Mozambique.

It really does smell awful: In 2013, shortly after the LNG fields were discovered, the London offices of Credit Suisse and the Russian-owned bank VTB extended secret loans of more than $2 billion, guaranteed by the Mozambican government, to companies controlled by military officials.

They soon defaulted. The banks couldn’t be expected to absorb the loss, so the people of Mozambique would have to. The IMF and other foreign donors cut off aid payments, causing the currency to plummet and food prices to soar, while the government imposed austerity measures and slashed public funding.

It’s an old story: Corrupt local elites collude with plundering foreign elites, enriching themselves and their distant collaborators, while leaving their countries in an apparently endless cycle of debt.

The real debt, Bhatnagar argues, goes the other way. For more than a century, the United States and Europe have built wealthy, industrialised societies based on the burning of fossil fuels.

Their wealthiest citizens and corporations have used their riches — and all kinds of clever accounting tricks, backed always by military might — to eat through the resources of the rest of the world, in the process creating a crisis from which they continue to profit, and that has so far been suffered by almost everyone but them.

Did I mention that, by Thomas Picketty and Lucas Chancell’s calculations, the richest 1 percent of the planet’s population are responsible for 2 000 times more carbon emissions than Mozambique’s poor?

Or that one of the less visible effects of climate change in southern Africa is drought punctuated by erratic and extreme rains, which, as LNG flowed in the north, caused a rubbish dump in Maputo to collapse last year, burying 17 people in a tsunami of trash?

If any equitable solution is possible, Bhatnagar contends, it cannot stop at ending the extraction and consumption of oil, coal, and gas.

The countries and the corporations that have profited have accrued a debt, and they must pay.

Bhatnagar means that very literally. An estimated 90 percent of Beira’s infrastructure was destroyed.

It will cost billions to rebuild, to find housing and employment for the more than half a million people who have been displaced, to create a healthcare infrastructure adequate to the population’s needs.

In the long run, Bhatnagar is imagining major, systemic change and a shift to a world in which communities control their own resources, but the immediate policies she is suggesting are hardly revolutionary: direct financial and technological assistance to the countries and communities that are currently footing the bill for the comforts of the wealthy, rigorous taxation on corporate profits and financial transactions.

Proposals like the Green New Deal, she argues, will be neither equitable nor effective unless they look beyond national borders to include the rest of the world.

This includes not only Mozambique, but Bangladesh, Haiti, Honduras, everywhere in the world where people are suffering unimaginable losses so that others, far away, can enjoy unconscionable luxuries.

“We don’t all have the same responsibility,” Bhatnagar says, “and we don’t all have the same capability.

Those who created this crisis must now support those of us who do not have the capacity to deal with it while it’s coming at us fast and hard.”

Tackling climate debt does not mean, she cautions, a struggle of poor countries against rich ones. Neither profits nor losses are evenly distributed.

In California’s Camp Fire last fall, private fire fighters saved billionaires’ estates, while the poorest pensioners in Paradise died.

In Mozambique, high officials stash money offshore while the poor, literally suffocated by garbage, die.

“It’s about targeting elites,” Bhatnagar says, about searching out new forms of global solidarity and overturning a system in which most human beings, and the planet itself, count as externalities on a ledger of profit and loss.

“We are challenging our leaders right here in our countries, and we need people in the Global North to challenge the leaders in your countries and to make the connections between our movements.”

The zeitgeist, she admits, is running in the opposite direction, to walls and blinders; panicked xenophobia paired with climate denialism; the rise of governments in the United States, Brazil, India, and elsewhere that are, as she puts it, “anti-people and anti-environment.”

In much of the world, these connections are getting harder to see.

In Mozambique, they are nearly impossible to ignore. —The Nation.

Comments