Indiscipline rife in forex market

Golden Sibanda

Senior Business Reporter

THERE is worrying level of indiscipline by business in the domestic market, leaving authorities with little option but to intervene to forestall costly market failures if the flagrant disregard of rules continues.

Authorities have already started working on legal provisions to counter the potential risks that may arise out of market indiscipline relating to use or abuse of the auction.

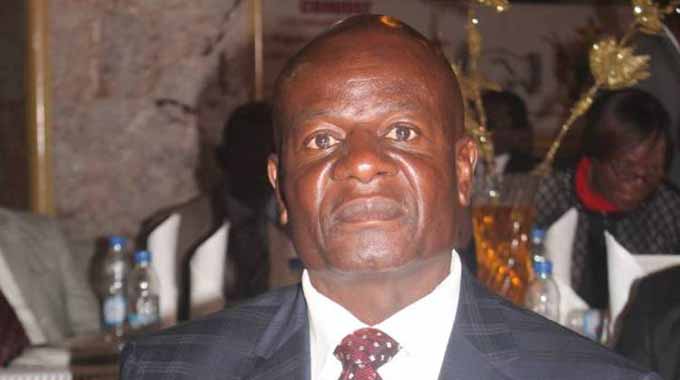

Reserve Bank of Zimbabwe (RBZ) governor John Mangudya and secretary for finance and economic development George Guvamatanga, said this during a 2021 monetary policy review webinar yesterday.

Dr Mangudya said given that there now is discipline in the execution of monetary and fiscal policies, what was lacking to sustain and improve prevailing stability and ensure growth was market discipline.

The indiscipline mostly involves abuse and misuse of forex obtained from the auction market, which has helped bring about exchange rate and inflation stability since its inception in June last year.

“Market discipline is about attitude, is about self-discipline. This attitude, self-discipline is very critical to ensure that we overcome our challenges as a country.

“Under market discipline, we are talking about compliance, we are talking about pricing discipline; including the administrative pricing discipline,” Dr Mangudya said.

“I think we have done very well on monetary discipline and fiscal discipline, but we have not done very well on market discipline, which is compliance, attitude and self-discipline; these are soft skills.

“Why is it difficult to comply with an exchange rate of between $83 and $89 (Zimbabwe dollars) to (US$1), which is a big band?

“Our auction bid band is between $82 and $89-$90, but you find that some people have propensity to always do above that,” the central bank governor said.

He said large number of traders were using an exchange rate from $95 to $110 yet they always obtain funds from the forex auction at much lower ruling exchange rate, including pharmaceutical traders.

Despite bidding around $85, the culprit businesses sell their products at $110 to US$1, a scenario that has been blamed for the contributing to the inflationary pressures that have been observed lately.

“Others want to make money from exchange gains, but you are pushing the buck to the consumers, where at the end of the day they pay higher fees or higher prices,” he said.

Entities involved in such malpractices continue to speculate and seek arbitrage opportunities that see them amass significant local currency and return to the auction for more foreign currency ( US dollars).

Dr Mangudya said this raised questions about the values certain directors stand for (including of banks), but the motive was to attract as much forex from depositors and the auction for sell on the black market.

“As a central bank, the only thing we can do is foster compliance given those circumstances,” he said.

Dr Mangudya railed against banks for facilitating the opening of bank accounts for shelf companies, with no history of business, for purposes of getting funding from the auction.

The central bank chief said some of the companies, with links to high profile people, apply for as much as half a million US dollars, which alert officials turn down.

He said this usually raises dust when certain banks agree to facilitate for the dubious entities even when they do not have the equivalent in local currency for such transactions.

“Banks need to help us so that we nip these kind of transactions in the bud at the bank level,” Dr Mangudya said, adding the first line of defence against such costly malfeasance should be banks.

Secretary for finance, Mr Guvamatanga, said there had been significant improvement in the conduct of the fiscal policy since the coming to power of the new administration. He said when the Government took over, the old dispensation had accessed just over US$3 billion through the RBZ window, which contributed to inflation build up.

Mr Guvamatanga said a strong fiscal policy was critical for monetary authorities to achieve their objectives of inflation, exchange rate and price stability.

“We are very much on course to sustain the current strong fiscal discipline, therefore, there is no major concern that will arise on the fiscal side that would adversely impact on the monetary side,” he said.

He said there now was very clear monetary and very strong fiscal discipline, “what we are lacking is market discipline.” Treasury has not resorted to the RBZ window since the new administration took over in November 2017.

“We are very much worried on the extent of market indiscipline that we are currently witnessing. And sometimes, that market indiscipline translates to what we call market failure. And wherever there is market failure, the Government is then forced to intervene, we actually witnessed widespread market indiscipline with the mobile network operators, especially with electronic money and digital money,” he added.

As demonstrated in dealing with the problem, the secretary for finance said the Government was well capacitated to deal with market failures caused by indiscipline.

Mr Guvamatanga said that the Government very much supported any punitive action the central bank may take against those abusing the auction system.

He said discussions have been held with monetary authorities to put in place adequate legal provisions against such malpractices before the indiscipline turns into market failure.

The remarks also come against the backdrop of wanton prices increases, part of which Treasury says is excessive and not linked to developments on the inflation front. Mr Guvamatanga said he did not agree with the assertion that large retailers were even compliant with foreign exchange regulations in relation to pricing.

He said while they were using exchange rate of $83/US$1, a good number had raised prices by 30-50 percent yet blended inflation had risen by less than 5 percent.

Comments