Hwange pins hope on Zisco deal

Africa Moyo Business Reporter

TROUBLED coal-mining firm, Hwange Colliery Company Limited, says the plans by Government to resuscitate operations at Ziscosteel – a former top steel producer – would help turnaround its fortunes.

Hwange has woven a turnaround plan anchored on ramping up underground mining to boost production, especially of coking coal, which can also be exported.

Ziscosteel used to be the biggest consumer of Hwange’s coking coal and it is envisaged that the proposed $2 billion investment into the Redcliff-based steel miner by a Chinese investor – R and F Company – would bring back the glory days to Hwange.

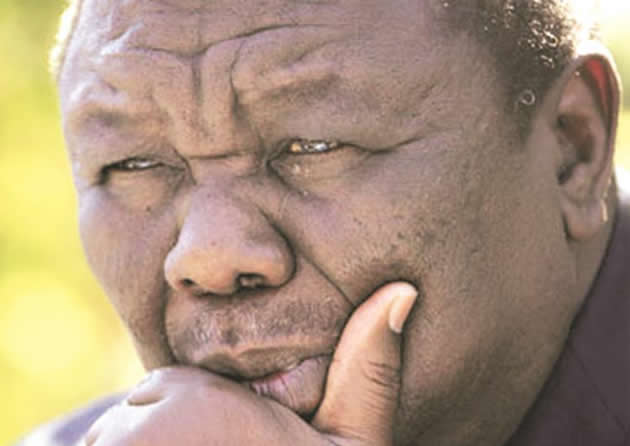

Hwange managing director Mr Thomas Makore told The Herald Business yesterday that reports suggesting a new investor had been found for Zisco is “very welcome news” for the 115 year old coalminer.

“Ziscosteel was a big off-taker of our coking coal so it gives us a very significant off-take for our coking coal. It (revival of Zisco) will only support the turnaround plans that we are implementing at the moment.

“Right now we are producing thermal and industrial coal and for Zisco we will need to supply coking coal; that is why we are resuscitating our underground operations. “We will also have to mine coking coal at our dragline operations; that is how we will respond to this demand,” said Mr Makore.

The approval of the Scheme of Arrangement by creditors in which Hwange made arrangements to settle its obligations amounting to $352 million, is also seen as a milestone that would help Hwange turnaround its operations.

As part of plans to transform its operations, Hwange took delivery of its continuous miner that was being repaired in South Africa on August 13. The continuous miner is a critical tool used in underground mining, accounting for 45 percent of underground mining activities. It had broken down over two years ago.

Other key pieces of equipment that are crucial in underground mining – which has been tentatively set for the last quarter of the year – would be delivered around mid-September.

Said Engineer Makore: “Underground mining is where we produce high value coking coal, so it will be a good addition to our product mix. It will improve our profitability and add to our volumes.”

A continuous miner processes about five tonnes of coal per minute when operating optimally. Underground mining operations are primed to enhance the product mix offering of Hwange, thereby improving the overall profitability and quality of its revenue.

Recently, Hwange selected an European company to conduct exploration and drilling at its new concession in the western areas of Hwange. Preliminary exploration results show that the new concessions have an estimated underground resource of about one billion tonnes.

Underground operations, together with the return of Zisco, is expected transform Hwange’s operations, particularly on profitability.

For the full year to 2015, Hwange reported a net loss of $115 million

Comments