Humans have longer life expectancy than their money

Carin Smith

One of the consequences of people increasingly living longer, is that it has changed the number of working years compared to those eventually spent in retirement.

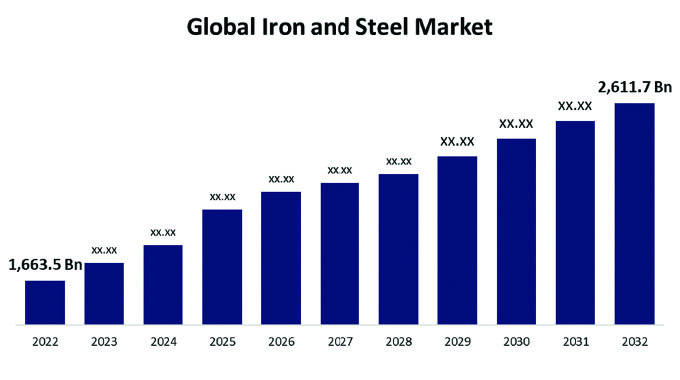

Pension funds today should be investing for a “horizon” of 80 years or more, as technology and medical research advances at a rapid pace, says Petri Greeff, head of investment advisory at RisCura.

“The old model of studying or training for a job and then building a long-term career in that field until retirement may soon be outdated,” he says.

“Increasingly, people may opt to stop and retrain mid-career, possibly even a few times.”

People will likely end up working for longer and spending more time in retirement too.

Recalculate

Increasing longevity will have a significant impact on retirement contributions required, as well as on asset allocation, risk levels, and investment strategies for pension funds, he explains.

This creates the need to reconsider traditional calculations of how much money one would need to ensure you saved enough to support yourself after retirement, says Jan van der Merwe, head of actuarial and product at PSG Wealth.

One challenge is to avoid drawing too much income from your retirement savings, so you won’t “outlive” your capital.

Make smarter choices

“Your financial products should be supported by smart investment choices to ensure you attain growth at the right risk level for your needs,” says Van der Merwe.

He suggests that, before retirement, one should at least have a retirement savings product, supplemented by a tax-free savings plan, as well as discretionary investments and risk cover.

After retirement, it should likely include an annuity product, invested in an appropriate manner, supplemented by longevity guarantees and continued investment in growth assets.

Deane Moore CEO of retirement income specialist Just, recently revealed the 2019 findings from the “Just Retirement Insights” study.

“Our key concern rising from this latest study is the high proportion of people approaching retirement who have not saved enough, yet expect an unrealistically high level of income from their existing retirement pot,” says Moore.

Plan

“Few people realise that they can sustain a 2,5 percent a year higher level of income in retirement, and guarantee this for life, by using a life annuity or a lifetime income option within a living annuity.”

For him the study highlights the important role of careful planning to help make informed decisions.

The study found that around half of respondents lacked the confidence that their money will last and if it runs out, they intend to rely on children to support them.

It also highlighted a large gap between the expectation and reality of how much retirement money is enough to last.

When asked if they had done any retirement budgeting, over half (53 percent) of the respondents admitted that they had not calculated how much they would need per year and just under half (48 percent) lacked confidence that their money would last.

The study also showed what it calls “a misplaced optimism” among respondents about the amount of retirement savings required to cover their expected lifetime.

About 80 percent indicated that they have less than R2 million in retirement savings and more than half of these respondents expect a monthly income in retirement that is significantly higher than the sustainable income that can be purchased in the market. — Fin24.com.

Comments