Editorial Comment: We all need to pay our taxes

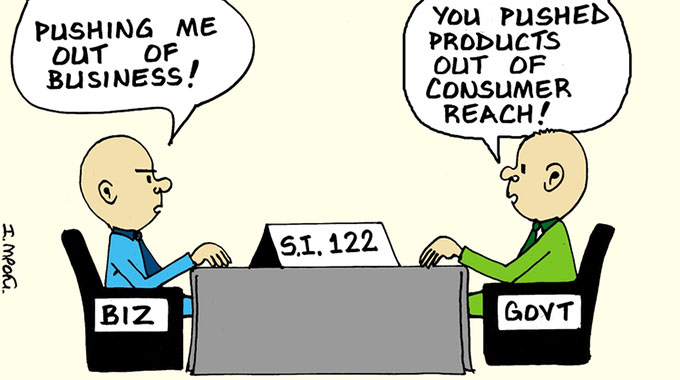

TAXES are lowest and most fair when everyone pays according to income or consumption with no special favours or exemptions. But in recent days the public and through these statements Finance and Economic Development Minister Professor Mthuli Ncube, have been inundated with pleas for special treatment.

The tourism industry sees the point of the 2 percent transaction tax, except when they have to pay it and so want it dumped for them.

The Confederation of Zimbabwe Industries (CZI) understands the need for the Government to levy taxes, but not on manufacturing. The Chamber of Mines complains bitterly about the modest royalties that constitute just about the only tax miners pay.

And farmers throughout history have always been startled that anyone could tax such fine fellows as the sons and daughters of the soil.

So who do all these people think should pay taxes? Everyone else except them is apparently the answer.

But someone has to pay and for every taxpayer let off the hook it means that either the remainder have to be taxed into their graves or the Government prints money and wrecks the economy. Either way, Zimbabwe is destroyed.

Zimbabwe’s tax system is not perfect, but it is reasonably fair with a simple tax code.

There are a few exemptions. A zero-rate band on income tax covers the income every family, rich or poor, needs to buy basic food and pay for essentials like electricity. A handful of basic foods are exempt from VAT. Transactions below $10 do not attract the new 2c tax. Payments into pension funds are not taxed and a chunk of medical bills and medical aid payments are exempt.

There are smart rules that encourage businesses, large and small, to invest. But that is about it.

It is possible to avoid taxes legally. Simply grow your own food and buy nothing and sell nothing. But that is not a lifestyle that appeals to anyone. So we are all in the tax system, either as producers or consumers and usually as both.

The new 2c tax has generated a lot of nonsense and considering the financial acumen and intelligence of some complainers, some deliberate lying. For most businesses, the tax means a 1 percent rise in costs, since salary and tax payments are exempt. Even if a business is the third in a supply chain, and few even get that far, that means a 3 percent rise in total costs.

The tax is so low because the professor set it up so everyone pays, including criminals and because it costs nothing to collect and cannot be avoided.

Our VAT level of 15 percent is hardly exceptional by world or regional standards. Our income tax is progressive, that is each band of income attracts a higher rate; the main problem that a dispassionate observer might note is that the bands are too narrow, so quite modest incomes climb into the upper bands. But, oddly, that is not brought up in tax pleas.

The mining royalties are low, and avoid all the old arguments about transfer pricing and the like and allow external mining companies to make their own arrangements over how costs are shared across a global group without having platoons of taxmen arguing about every decision. In any case most miners get back more in export incentives than they pay in taxes.

Admittedly the royalties are a tax engraved in stone by Parliament as a fiscal measure while the incentives are an administrative decision subject to instant change made by the monetary authorities as a measure to improve the balance of payments.

But still, miners look at the bottom line in their income accounts. There has been cheating on taxes, but now Zimra and the police are swooping and jail sentences loom for offenders. And those who have been deducting PAYE from employees and VAT from customers, but forgetting to forward this to Zimra are coming under ever greater pressure.

Big shots at the top of major private companies might feel they get little for their taxes, since they send their children to private schools, go to private hospitals when sick and even have a private security guard looking after their home. Education, health and the police are about the biggest items on the Government spending bill.

But they must realise that more than 99 percent of the people need these services from the State, unless of course top CEOs are ready to pay the guy who makes their tea US$10 000 a month once all allowances are in place.

But that leads to where a legitimate chorus of views should and must be made. The money the Government spends is not the Government’s money: it is our money and now, thanks to VAT and the 2c tax, even the old lady selling bananas on the pavement is a taxpayer.

So she, and the rest of us, have every right to have input into how the Government spends our money and to demand that it is spent properly, that it is accounted for and that we get value for money.

So let us look at the spending plans and get ready to shout.

Comments