EDITORIAL COMMENT : Bottomless pit of Zim business’ greed

German philosopher Erich Fromm was right when he said: “Greed is a bottomless pit which exhausts the person in an endless effort to satisfy the need without ever reaching satisfaction.”

Retailers and manufacturers are exhausting themselves in the bottomless pit of greed. Consumers, who are already struggling to make ends meet, can no longer afford a number of goods which have since become luxuries.

From soft drinks to cooking oil, detergents to bath soap. The consumer is now looking for alternatives instead of feeding the belly of a beast that does not know the meaning of the word “enough”.

Government has exhausted policy, dialogue and statutory instruments in the false belief that retailers and manufacturers will reach satisfaction. One such intervention is the liberalisation of the exchange rate. The “realistic” exchange rate has become an excuse to charge astronomical prices for goods and services in a bid to make super profits.

Retailers and manufacturers only care about themselves. Period. Finance Minister Prof Mthuli Ncube and Reserve Bank of Zimbabwe Governor Dr John Mangudya are now frustrated. The innocent consumer, is frustrated more.

Just last week, Minister Ncube exposed retailers when he explained that price changes should be determined by inflation trends and not the exchange rate. “It is actually bad economics to link price increases to the exchange rate. That’s not how you do it, it is profiteering,” Minister Ncube told the media last week.

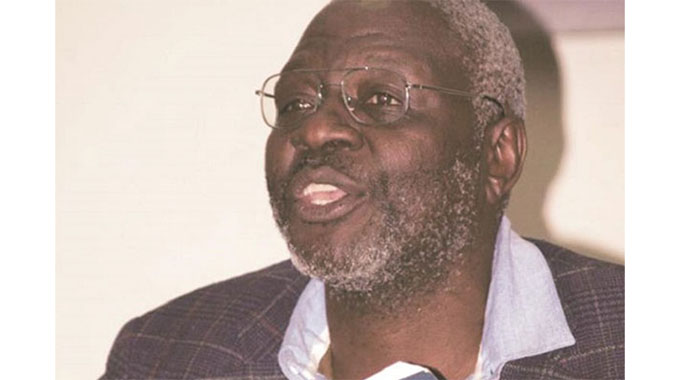

On Monday, Dr Mangudya also slammed businesses for wantonly raising prices of basic commodities based on the movement of the exchange rate, saying it was not a significant factor to determine the value of a product.

Dr Mangudya told a Parliamentary Portfolio Committee on Information Communication Technology and Courier Services that businesses were exaggerating the effect of exchange rate in determining prices of goods and services.

“You do not need to track the exchange rate on a daily basis. If your cost of production is 20 percent foreign currency, I think it would be wrong to use exchange rate as a price determining factor, which I see in Zimbabwe,” said Dr Mangudya.

“In South Africa, you hear that every day, the Rand has moved from 12 to 13, 14 or whatever to the US dollar, but they do not change the price because of movement of exchange rate. If you go to Zambia, the Kwacha moves from 9, 10, they do not change the price. We do not necessarily want this tracking mechanism.

“I think it is a disease that needs to be removed in this country. Yes, we know that Zimbabwe depends on foreign currency, but let us not overemphasise that dependency.”

In a related article we also carried yesterday, retailers said consumer spending had declined considerably in recent months, as Zimbabwean consumers cannot afford to maintain spending with the high prices of goods and services.

Prices of most goods have risen by between 25 and 75 percent over the last few months with the trend notable across leading retailers and wholesalers in the country.

However, consumers have struggled to keep pace with the wave of frequent, and in instances, wanton price hikes, as the majority of employers have not increased salaries.

Like Dr Mangudya said; this disease must be attended to. On the part of consumers, it is important not to fall prey to greedy retailers. If there is no one to buy the expensive product the price will come down eventually. The higher they go the harder they fall.

Why should ordinary Zimbabweans be the ones dealt a bad hand all the time? Retailers and manufacturers must also tighten their belts and trim some weight around their big bellies.

Not everything needs foreign currency. In any case, how much is the foreign currency component on any product, and how does it affect the price? Transparency is needed.

The Consumer Council of Zimbabwe (CCZ) also needs teeth. Monitoring an ever rising bread basket is a meaningless exercise if CCZ has no say in pricing.

Consumers need access to basic necessities such as food, shelter, clothing, health and education.

The Consumer Protection Bill that has been on the cards for nearly a decade and is set to be reactivated in the second quarter of the year is long overdue. The Zimbabwe Consumer Protection Bill is set to replace the Consumer Contracts Act (Chapter 8:03) and will culminate in the establishment of a Consumer Protection Agency that will fight for consumer rights as well as Consumer Advocacy Organisations.

In the meantime, we urge Dr Mangudya and Prof Ncube to take decisive action. This madness must not be allowed to continue.

Comments