CBZ leverages on digitalisation

Tawanda Musarurwa

Senior Business Reporter

Zimbabwe’s biggest bank, CBZ Holdings, says it is looking at how it could leverage on cryptocurrencies and other emerging digital innovations.

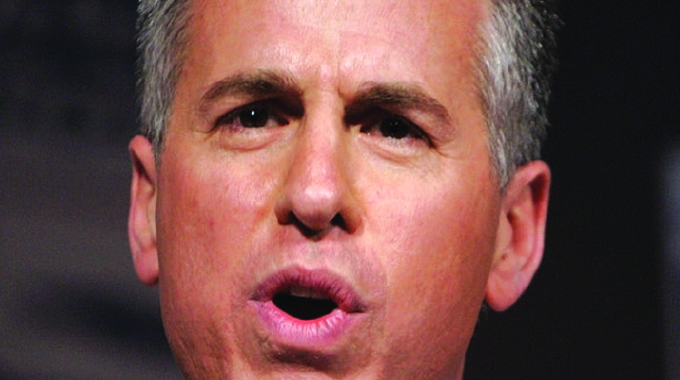

In an interview on Friday, CBZ chairman Marc Holtzman, said the lender is open-minded about new innovations, as these could open up new opportunities going forward.

“Cryptocurrencies, or rather blockchain more broadly, fintechs, bigtechs, and techfins are all exciting innovations, which are being introduced to serve specific gaps that have been exposed by the ever evolving customer needs and wants.

“Our view is that these innovations have the potential to strengthen the way we do business, the way we serve our customers, as well as open up new market opportunities.

“Such opportunities can be pursued through collaboration and cooperation with the same fintechs, hence our deliberate drive towards an open innovation strategy in which we work with and through these fintechs in areas such as mobile money, mobile wallets, and the like,” said Mr Holtzman.

“Obviously, there are risks that come with these innovations, but fortunately, in the Zimbabwean case, the regulator — the Reserve Bank of Zimbabwe — has already published a Fintech Regulatory Sandbox to guide banks participation in these innovations and advanced technologies.

“This allows for prior testing of solutions, detection of potential risks and crafting of risks mitigants before solutions are launched to the wider market.”

Meanwhile, the group posted a good set of numbers for the year to December 31, 2020, with total income jumping 628 percent to $14 billion, from $1,92 billion in the prior comparable period, largely underpinned by the bank’s digitalisation programme.

Mr Mudavanhu

Explained chief executive Blessing Mudavanhu during the same interview: “A key area that made a huge difference for our FY2020 performance was digitisation. At least half of 2020 was marked by complete shutdown. We were able to quickly transition to working from home, but we had put in place products that worked, because people could transact from home.

“That digitalisation drive is something that is just before Covid-19. We capitalised on it because business continued, and now as we go forward we try to polish it and expand it to other business such as agriculture.”

The group’s profit after tax followed a similar trajectory to total income, increasing by 564 percent to $6,15 billion from $920 million in FY2019.

In other key metrics, the group’s total assets rose 421 percent to $88,3 billion from $16,9 billion in 2019.

Total advances jumped 876 percent to $29,4 billion from $3 billion, with the bank becoming one of the major agriculture financiers.

Total deposits were up 398 percent to $65,1 billion from $13 billion in the prior comparable period, with management indicating that around half of these deposits are currently in United States dollars. The chairman said the FY2020 numbers are sustainable going forward.

“This is not a once-off. We can see even going into our first quarter numbers that this is sustainable, and it reflects the great work that Blessing and the team have done to digitise going into Covid-19.

“So we had our digital channels open, and we are improving them even more now, and this puts us in a great position to assert our position as the dominant bank on the market,” said Mr Holtzman.

Comments