Buy physical gold: Central banks are on its side, expert says

NEW YORK. – Gold prices can go nowhere but up as central banks around the world try their utmost to spur inflation, author and gold market expert Jim Rickards said yesterday.

“Every central bank in the world says they want inflation . . . they’ve come nowhere close . . . but that just means they are going to keep on trying; central banks cannot allow deflation because it increases the real value of debt . . . they are not going to rest until they get it,” The James Rickards Project director told CNBC’s “Squawk Box” on yesterday.

Central banks from the European Central Bank to the Bank of Japan have pumped billions into financial markets and slashed interest rates to record lows in a bid to stimulate growth.

While inflation has so far failed to materialise to levels that policymakers want, when prices do rise, gold, which is traditionally seen as a hedge against inflation, should benefit.

Low interest rates also reduce the opportunity cost of holding gold, which doesn’t offer a yield.

Rickards, who is recommending investors to hold 10 percent of their portfolios in gold, did not give a price forecast. Prices have already gained about 26 percent year-to-date.

Spot gold prices were flat yesterday morning at around $1,337 an ounce.

Storied investors such as Bill Gross and George Soros have advocated buying gold in recent weeks, a sign that the metal has promise, added Rickards.

So what should investors buy?

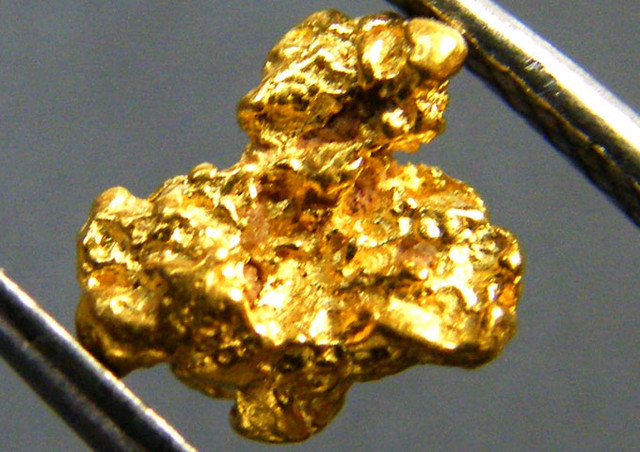

“Physical gold is very scarce; when the price really does break upwards, you’re not going to be able to get it. The time to get it is now,” he said.

ETFs and Comex futures, while good for short-term trades, will not be able to perform when gold prices skyrocket as there’s just $100 worth of paper gold for $1 of physical gold.

“When everyone wants to convert their paper to physical (gold) . . . there’s not going to be enough to go around,” Rickards said. – CNBC.

Comments