BNC targets 17pc production increase

Tinashe Makichi Business Reporter—

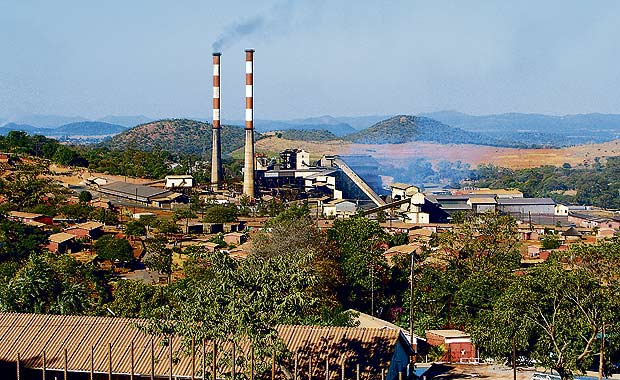

Bindura Nickel Corporation is targeting a 17 percent increase in Nickel concentrate production at its Trojan Mine this year while negotiations are at an advanced stage with a Zambian company over the possibility of treating its nickel concentrate in Zimbabwe. Last year Trojan Mine produced 7 000 tonnes of nickel concentrate and the targeted increase in production comes at a time when BNC has started civil works aimed at reviving its smelter.

Once the smelter is revived Trojan Mine production will only cater for 65 percent of the smelter’s feedstock requirements and that leaves the remaining 35 percent open to other players who may want to partner BNC.

BNC managing director Mr Batirai Manhando said they are in discussion with Munali Nickel Project Zambia, which is going start producing nickel concentrate, over the possibility of treating their concentrate in Zimbabwe.

“This year we are targeting an increase in production of nickel concentrate by 10-17 percent at Trojan Mine. The smelter project will see us processing concentrate into leach alloy which is 80 percent nickel. After having surpassed the first half targets I am quite confident that we are on course to meet our target and expectations,” said Mr Manhando.

“As a company coming from the doldrums, our main focus is to ramp up production and maintain growth.”

The mining company requires about $26,3 million to restart the smelter and the company has been in the market to raise the required capital.

About 50 percent of the capital required to restart the smelter will come from internally generated resources while the other half would be raised through debt hence creating the need for the company to raise production to meet the feedstock requirements of the smelter.

Mr Manhando said production and tonnes milled to September this year were higher than those of last year’s in the same period.

He said BNC has introduced new mining methods, equipment and strategies that have been pivotal in the company’s quest to increase production.

Mr Manhando said BNC continues to be optimistic that nickel prices will continue to firm going forward and the company will continue to pursue initiatives that will achieve value.

“Our continuous exporting of concentrate is costing the company and this however, gives us every reason to revive the smelter. Our main cost currently is on transport and we will work hard towards correcting the situation and currently we have started civil works at the smelter,” he said.

Mr Manhando said after smelting, leach alloy will have been refined to 80 percent nickel compared to the current 9 percent nickel in concentrate.

“To take advantage of economies of scale the company is targeting to bring the Hunters Road project on stream. Restarting the smelter is a focus area for the company and the pursuit of the Hunters Road project is set to increase feed into the smelter,” he said.

Mr Manhando said BNC is negotiating with Government to give the project national status and assist in the raising of capital to fund it through various instruments such as bonds and Treasury Bills.

The project to restart the smelter will take six to eight months to complete and BNC is working with an unnamed South African company in conducting civil works pending the availing of the project finance. He said BNC is at an advanced stage of negotiations with potential funders who include local banks and international financial institutions.

Mr Manhando said with nickel prices hovering at $16 000 per tonne, the forecasted payback period for the debt funding will be 14 to 18 months.

“If nickel prices maintain at the current levels in the long term, the investment in the smelter will be of huge economic value.

“We continue to be optimistic because the demand for stainless steel in the world is growing considering that most countries have now started infrastructural projects on a larger scale, for instance India and China,” said Mr Manhando.

He said Shangani Mine will remain under care and maintenance as it is currently uneconomical to operate the mine. Mr Manhando said the mine has low grade nickel compared to Trojan and hence it is unprofitable to restart it under prevailing nickel prices.

Comments