BNC bullish about future output growth

Enacy Mapakame Business Reporter

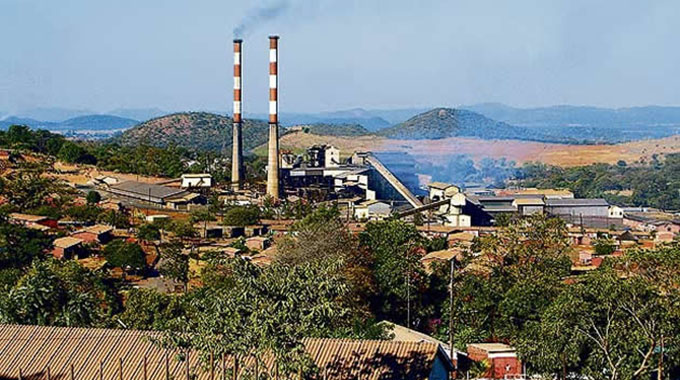

Victoria Falls Stock Exchange (VFEX) listed nickel producer – Bindura Nickel Corporation (BNC) is upbeat about growth in output, which it expects to be driven, going forward, by enhanced production efficiencies due to increased equipment availability.

This also comes as the group has highlighted that maintaining old underground mobile equipment was proving to be costly, worsening operating costs and dragging the group into loss position during the quarter to June 30, 2022.

In a trading update for the quarter to June, Bindura said the acquisition of new underground mining mobile equipment to replace the old and unreliable units was already under way.

While awaiting delivery of new equipment, Bindura is complementing the current fleet by hiring equipment from different service providers.

“Both the new and hired mobile equipment is expected to increase the availability of equipment and ultimately increase production,” said the group in a trading update.

The group is also banking on the anticipated firming nickel prices following easing of lockdowns in China and an anticipated resultant improvement in economic activity, as well as the increasing demand for battery grade nickel in electric vehicles.

Nickel prices are therefore expected to be bullish for the remainder of calendar year 2022.

During the quarter nickel in concentrate sales for the period were 14 percent lower than in the same period last year due to a delay in the renewal of the off-take agreement, which expired in early March 2022. A new two-year contract was signed in early April 2022 and export shipments resumed in the following month.

As a result of the disproportionately high operating costs, the company incurred a loss for the quarter. Meanwhile, tonnes ore mined for the quarter increased by 13 percent in comparison to the tonnes for the same period in the previous year mainly due to the delayed commissioning of the Re-deep Project attributable to unforeseen technical challenges.

According to Bindura, ore head grade was 28 percent lower than the grade achieved in the same period last year, due to the declining massives strike length which led to a reduction in the volume of massives, coupled with constraints on the rate of development due to underground mining mobile equipment challenges.

Tonnes ore milled increased by 16 percent in comparison to the corresponding period last year.

“This marks the transition to the low-grade high volume mining strategy which has been occasioned by declining massives volumes,” said Bindura.

Nickel in concentrate produced was 24 percent lower than for the same period last year, reflecting the lower grade of ore processed.

The high cost of maintaining the aged underground mining mobile equipment fleet as well as the increase in local operating costs, coupled with the lower nickel in concentrate production resulted in an increase in unit costs.

Figures from the group show the cash cost per tonne for the quarter was 58 percent up on the cost for the same period in the prior year, while the all-in-sustaining cost per tonne increased by 55 percent.

During the quarter under review, the average London Metal Exchange (LME) nickel price of $29,029 per tonne was 67 percent higher than the price of $17,343 per tonne which was achieved in the comparative period in the previous year. The price improvement was attributable to the global high demand for Nickel.

Comments