BNC bond issue raises $15m to date

BNC was granted liquid asset status by the Reserve Bank of Zimbabwe, which requires local banks and other financial institutions to invest a minimum percentage of their assets in the bond.

Golden Sibanda and Godfrey Gavure

BINDURA Nickel Corporation has so far raised $15 million from its $20 million bond issue amid indications that subscriptions will far exceed the targeted amount due to strong investor interest.

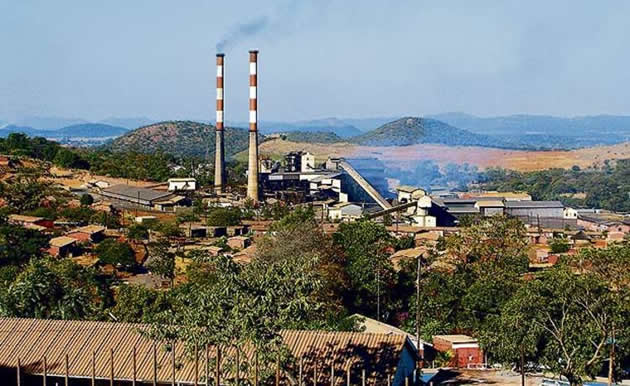

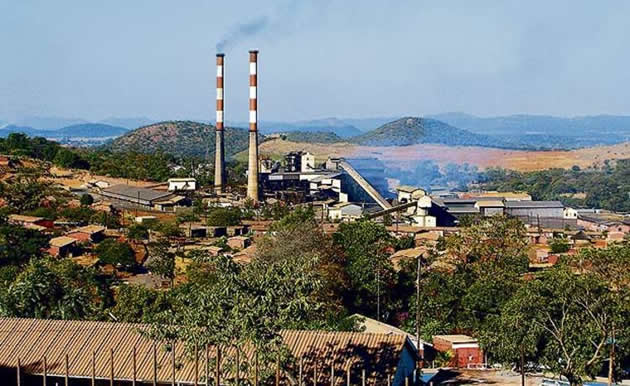

The listed integrated nickel miner is in the process of raising $20 million through private placement to fund the restart of its Trojan Mine smelter, an exercise expected to cost $26,5 million.

The bond opened for subscription in November last year and was initially set to close in January, but was extended to end of this month as investors needed more after the festive holidays.

Advisors to the fund-raising process, Invictus Capital chief executive Mr Ritesh Anand said investment commitments had reached $15 million with strong interest from investors that are still to make offers.

“We have raised, in commitments, around $15 million and we are still speaking to three other institutions; more have expressed interest in the bond, banks are also interested in participating,” he said.

Mr Anand said with commitments already at $15 million with the three big institutions still to come in, it was evident that the targeted amount of $20 million would be exceeded quite easily.

Chief executive Mr Batirai Manhando shared the same sentiments in an interview after BNC’s analyst briefing yesterday saying road shows done so far showed strong interest in the facility.

“From the road shows we have been doing, there is a lot of interest from pension funds, etcetra. We have confidence that we should be able to get the $20 million that we want,” he said.

Benefits of restarting the smelter include improved playability, profitability, less penalties on content impurities, lower transport costs and compliance with Government’s beneficiation thrust.

As such, the $20 million redeemable bond with prescribed and liquid was asset status was issued and a five-year facility is fully amortised over three years with a $16 500 tonne nickel price.

BNC was granted liquid asset status by the Reserve Bank of Zimbabwe, which requires local banks and other financial institutions to invest a minimum percentage of their assets in the bond.

The prescribed asset status for the facility, which was granted by Finance and Economic Development Minister Patrick Chinamasa also compels Zimbabwean asset managers to invest a certain minimum percentage of their assets under management into prescribed assets.

Meanwhile, BNC’s nickel in concentrate production was 30 percent lower at 1 383 tonnes for the third quarter to December 2014 due to fewer tonnes milled, lower head grade and reduced recoveries. Mr Manhando said the once off decline was partly due to ongoing refurbishment.

He said the quarter under review was the only odd one out for over the past 20 months when nickel production fell below 1 800 tonnes with other quarters always averaging 2 000 tonnes.

“Equipment taken out for refurbishment exercise alongside maintenance reduced resources available for mining development, which in turn restricted access to massives,” Mr Manhando said.

As such, Mr Manhando said, this prompted a 23 percent decline in mill head grade while recoveries eased by 2 percent in the quarter to September as a result of the lower milled head grade.

Nickel sales were 31 percent lower quarter on quarter from 2 008 tonnes due to lower production volumes. Cash costs and all-in sustaining costs rose 17 percent due to lower volumes.

The refurbishment exercise on mobile equipment continued in the third quarter, but the costs of that are expected to start declining in the last quarter when the programme is completed.

Comments