8 firms in court over EcoCash deals

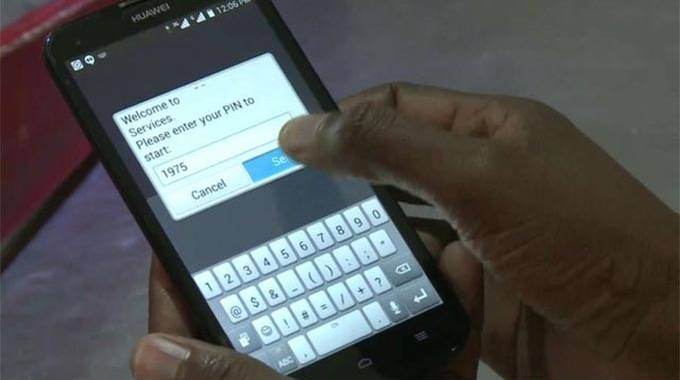

EIGHT financial institutions that were allegedly involved in foreign currency dealings in Harare through EcoCash bulk payer lines, yesterday appeared in court for violating some sections of the Exchange Control Regulations.

Titanium Capital (Pvt) Limited, Dream High Investments (Pvt) Limited, Access Finance (Private) Limited, Tererati (Private) Limited, Vision Credit Source (Private) Limited, Capital Profit Financial Services, Raymond Mudonhi Investment (Private) Limited, Justice Mahuni, Kudzai Mudonhi, and Juso Global Limited, separately appeared at the Harare Magistrates Court charged with illegally dealing in foreign currency.

They were not asked to plead to the charges.

Titanium Capital, which is represented by Tatenda Patrick Musonza, is alleged to have dealt in $210 475 688.

Dream High Investments, represented by Tinasahe Paradise Magada, is alleged to have transferred $143 669 348 while Access Finance (Private) Limited allegedly transacted $185 420 444.

Tererati (Private) Limited owned by Samuel Tererai Chiodze is said to have transacted $125 722 079 while Vision Credit Source (Private) Limited, represented by Takudzwa Godwin Rafamoyo, allegedly traded $192 207 880.

Capital Profit Financial Services represented by Taitus Tapiwa Madzara, allegedly transacted $59 237 733.

Raymond Mudonhi Investment (Private) Limited, Justice Mahuni, Kudzai Mudonhi and Juso Global Limited Justice Mahuni allegedly illegally traded $150 128 765.

According to the State, Titanium Capital (Pvt) Limited traded with 429 agents between January and June 2020 and the institution was allegedly still trading using the EcoCash bulk payer line.

Dream High Investments, is a registered company dealing in buying and selling of groceries, according to the State.

It is said that sometime in February 2019, it opened a corporate banking account with Steward Bank. The court heard that between January and June 2020, Dream High Investments received $143 669 348 from different companies and individuals, which it then transferred using the EcoCash bulk payer line to agents who would buy forex on their behalf from the streets.

Access Finance, which is registered as a bureau de change, is alleged to have bought various Econet lines which it would give to various agents, who in turn used them to buy forex on the streets.

It is alleged that its conduct was against the Reserve Bank of Zimbabwe financial regulations that do not allow it to employ or trade outside its premises.

Between January and June 30 last year, Tererati (Private) Limited is alleged to have bought forex using agents from the streets.

Vision Credit Source, which is a registered company, is also alleged to have used the same modus operandi to buy forex from the parallel market through its agents.

It is alleged that between January and June last year the company transferred $2 520 535 from its bank account into various EcoCash accounts before transferring it to various agents.

The agents would then allegedly buy forex on the streets.

All the suspected dealers are expected back in court tomorrow for bail applications. Regional magistrates Mrs Vongai Guwuriro, Mr Ngoni Nduna and Mr Turai Manwere, separately presided over the matters.

Comments