$200m raised as demand for TBs soar

Tawanda Musarurwa Senior Business Reporter

Government this week successfully raised $200 million through the first Treasury Bills (TBs) auction of the year.

TBs are short-term financial instruments issued by the Government Treasury to be paid at par-value after a particular maturity period, often a maximum of a year.

At the end of last year, TBs auctions were largely underwhelming.

A $300 million float last October received an uptake of just 27 percent ($81 million), pointing either to investor fatigue in the Government-issued debt instrument or market concerns over returns in an inflationary environment.

A $200 million float of 272-day paper the next month yielded a 52,5 percent uptake. But there seems to be a mindset shift in the winds.

The Reserve Bank of Zimbabwe (RBZ) yesterday announced that its float of 272-day TBs to the tune of $200 million had been oversubscribed by $70 million.

Total bids amounted to $270 million, with the highest rate on offer at 30 percent per annum, while the lowest was 14 percent.

Out of the total bids, $200 million was allotted.

The TBs were targeted exclusively at commercial banks, the Post Office Savings Bank and the Infrastructure Development Bank of Zimbabwe.

It means if typical players such as insurance firms and pension funds had participated, the demand could even have been higher.

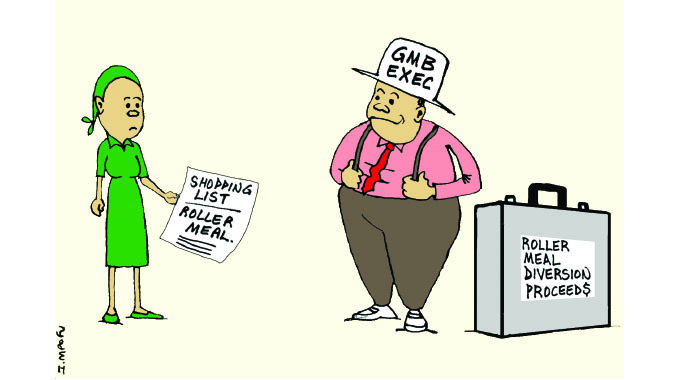

Monies raised through TBs can increase money supply, especially to the extent that it is spent on subsidies.

Official figures from the RBZ show that subsidies on fuel, electricity, grain and other essentials, particularly in the first half of 2019, caused an increase in reserve money, which rose from $3,3 billion at the

end of December 2018 to an estimated $8,8 billion as at December 2019.

TBs are used to raise funds for Government programmes.

The country’s monetary authorities have, however, maintained that they will maintain a “strict reserve money programme”.

“The bank is committed to the implementation of the Monetary Targeting Framework, and going forward, the bank is targeting reserve money growth of 10 – 15 percent by end of 2020, which is consistent with end of year inflation target of around 50 percent,” said the RBZ governor Dr John Mangudya while announcing the 2020 Monetary Policy Statement (MPS) on Monday.

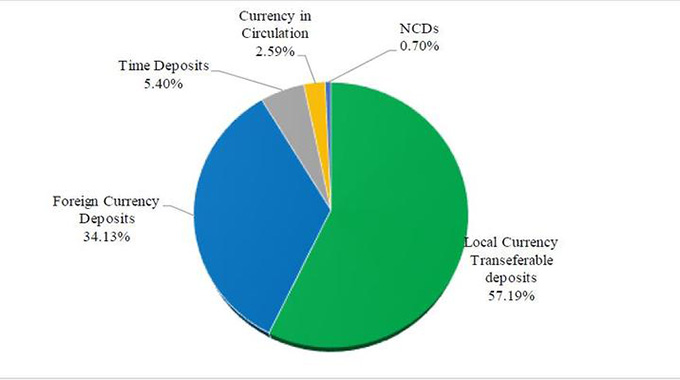

Last year, Zimbabwe’s broad money (M3) grew by around 250 percent to $35 billion, from $10 billion as at December 2018.

Government resumed TBs auctions last August, and one of the reason for the renewed demand could be excess cash from TBs that have since come into maturity.

The latest issue came with an open tender on a yield basis interest rate and other special features, which included prescribed asset status, liquid asset status, tax exemption as well as acceptability as overnight accommodation by the RBZ.

TBs are used by Government to raise budgetary support for critical public programmes, in view of limited external support.

Recently, the central bank governor lamented the lack of external support as contributing to some of the major prevailing economic challenges.

“We used shock therapy approach to rebalance the economy, we are therefore going through cost of adjustment as a country, in our case we plunged into this (economic transformation) by our self as we relied on our own resources as compared to some countries that received bailouts,” he said last week.

And in the absence of large-scale re-engagement with international donors and lenders, the authorities will remain highly dependent on monies raised through TBs to finance fiscal stimulus.

Comments