Zim economy will shine again

Benny Tsododo Correspondent

With several critics and economic commentaries depicting Zimbabwe as a country with an inauspicious investment climate and insipid policies, the increasing number of substantive investment deals that have been inked lately, together with others currently under serious negotiation, indicate a commendable turn of events that point to a promising economic future for the country.

Reports indicate that the country recently signed a number of favourable business deals, some of which will see some long-struggling companies being revived and more employment opportunities created for the people.

Among the business deals recorded, a reputable French yeast and fermentation products manufacturer, Lessaffre Group, is reported to have acquired 60 percent shareholding in local yeast manufacturer, Anchor Yeast Holdings, in a deal worth $8,4 million.

Another highlight is the takeover of the local paint manufacturer, Astra Holdings, by a Tokyo-listed Japanese firm Kansai Plascom. Kansai Plascom reportedly acquired 63,25 percent shares of Astra Holdings.

Also of note is the 100 percent acquisition of Blue Ribbon Industries by a Tanzanian conglomerate, Bakhresa Group, in a multi-million deal that will see the milling and confectionery company getting a new lease of life.

These are big business deals cutting across all sectors of the economy.

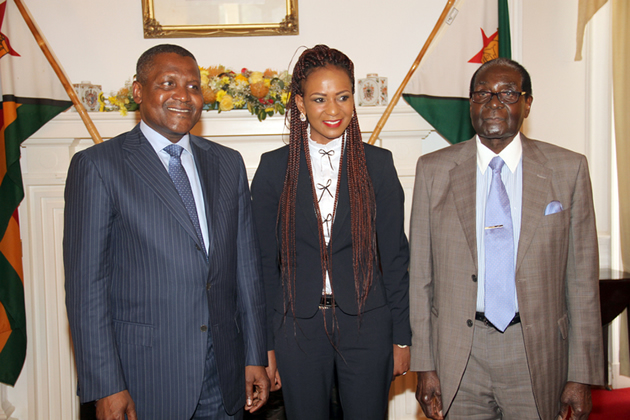

More investment deals are in the pipeline, including the highly publicised cement manufacturing, thermal power generation and coal mining business proposals by the Dangote Group fronted by the Nigerian business mogul, Aliko Dangote.

What is of interest to this writer is not only the huge inflow of foreign investors into Zimbabwe but the percentage of shareholding granted to foreign investors and Government’s commitment to address concerns of investors.

It should be noted from the aforementioned deals that the equity acquired by foreigners breached the 51-49 percent indigenisation threshold. This speaks volumes of the flexibility and investor friendliness of the indigenisation plan.

By allowing foreign investors to acquire majority shares in the said deals, Government has demonstrated beyond doubt that the indigenisation programme is not a one-size-fits-all policy but, depending on negotiations, could be tailor-made to suit any given investment plan.

The deals also reflect Government’s commitment to mutually engage investors as highlighted by President Mugabe during his Heroes’ Day speech. President Mugabe said: “Being a country that observes and respects the rights of investors, as Government, we are prepared to listen to all investor concerns and address them”.

He reiterated this position during his State of the Nation Address, when he said: “In order to buttress the positive economic gains recorded to date, government will implement policies that will improve the business environment, and promote, and attract both domestic and foreign investment”.

This found expression in the 10-Point Plan, with its fifth point talking about “encouraging private sector investment”.

To any fair-minded person, it is clear that Government has made significant strides to address concerns of private investors and the trajectory is paying dividends as vouched for by the recently concluded business deals.

Private investors had raised concerns about the indigenisation programme’s 51-49 percent threshold and judging by the indigenisation matrices of the recently concluded deals, Government understands their concerns and remains committed to improving the country’s investment climate.

However, there seems to be worries over the country’s ease of doing business as pointed out by potential investors such as Dangote. Dangote told journalists that: “You know there are so many permits and whatever, but the Government promised to accelerate (the process) and promised as soon as we get things right, we will move.”

The judicial manager of Blue Ribbons Industries, Reggie Saruchera decried the same, saying bureaucracy had delayed the conclusion of the Bakhresa deal by two years. The deal was initiated in 2013 but was only approved in May this year.

President Mugabe made reference to the red tape worry during his State of the Nation Address, saying; “Instead, we expect a clear and robust legislative and regulatory framework to be urgently put in place in order to create a One-Stop-Investment Centre that streamlines processes and procedures. This is now a very urgent and high priority matter for which those responsible will be held to account.”

It is encouraging that, the Ministry of Economic Planning and Investment Promotion has indicated that it is seized with the matter and is putting in place measures to urgently establish a One-Stop Investment Centre.

The ministry is urged to expedite the process so as to allay and address the fears of potential investors. Government should be applauded for demonstrating to sceptical investors that it is ready to engage and address their fears.

With this progressive spirit, the country is set to host more investors and is likely to record more foreign investment deals that should spur economic growth.

Comments